Stripe: the name that’s synonymous with online payment processing. But does it truly meet the diverse needs of every business?

As the digital landscape evolves, so do the demands of merchants seeking a reliable payment solution.

While Stripe holds its ground in payment gateways, it’s not the only player in the game. A plethora of payment platforms have emerged, each offering its own set of advantages.

From flexible fees to superior support, these competitors are reshaping online transactions for businesses.

Join us as we navigate through the best Stripe alternatives for 2025. We’ll delve into how they stack up against Stripe, highlighting their unique features and potential benefits.

It’s time to rethink your payment strategy and find the perfect fit for your business needs.

But, first, let’s understand Stripe better. Let’s dive in.

What is Stripe?

Stripe is a leading online payment processing platform that allows businesses to accept payments over the Internet.

Founded in 2010, Stripe has quickly become one of the most popular choices for businesses of all sizes due to its ease of use, reliability, and robust set of features.

Also, Stripe offers a seamless integration process, making it easy for businesses to start accepting payments on their website or mobile app.

Overall, Stripe is known for its simplicity, reliability, and scalability, making it a popular choice for businesses looking to accept payments online.

But, why do businesses rely so much on Stripe? Let’s dig deeper into it.

How does Stripe help deal with business payments?

With Stripe payment gateway, businesses can securely accept payments from customers worldwide, whether for products, services, subscriptions, or donations.

This opens up new markets and opportunities for growth and expansion.

But, Stripe is not just limited to that. Along with seamless integrations, it also provides businesses with a suite of tools to simplify and streamline the payment process.

Check these out –

- Flexibility: Stripe supports a wide range of payment methods, including credit and debit cards, digital wallets like Apple Pay and Google Pay, bank transfers, and more.

- Advanced Features: From subscription billing to recurring payments and fraud prevention tools, Stripe provides businesses with the security features they need to manage payments efficiently and securely.

- Reliability: Known for its reliability and uptime, Stripe ensures that businesses can process payments smoothly without any interruptions.

In essence, Stripe empowers businesses to focus on what they do best while handling the complexities of payment processing seamlessly in the background.

Now, you might be wondering, if Stripe is so capable, why would you need an alternative?

Let’s find that out.

Why do you need Stripe alternatives?

While Stripe offers a range of features and benefits, there are several reasons why businesses may seek alternatives:

- Cost Considerations: Depending on your business model and transaction volume, alternative payment processors may offer more competitive pricing or fee structures compared to Stripe fees.

- Specific Needs: Your business may have unique requirements – high-risk industries, offline payments, specific geographic locations, etc. – that Stripe doesn’t fully address. Alternative solutions might offer specialized features or integrations better suited to your needs.

- Geographical Restrictions: While Stripe offers global reach, it may not support certain regions or currencies as effectively as alternative platforms.

- Customer Support: In some cases, businesses may seek alternatives with better customer support or more responsive service.

- Risk Diversification: Relying solely on one payment processor like Stripe can pose a risk. Exploring alternatives can help diversify this risk and ensure continuity of service.

Now, let’s explore some of the top alternatives to Stripe and how they address these considerations.

Best Stripe alternatives for eCommerce

When it comes to eCommerce, having a reliable payment processing solution is crucial.

While Stripe is a popular choice, several alternatives offer unique features and benefits tailored to the needs of online businesses.

Let’s explore some of the top Stripe alternatives and how they address key concerns –

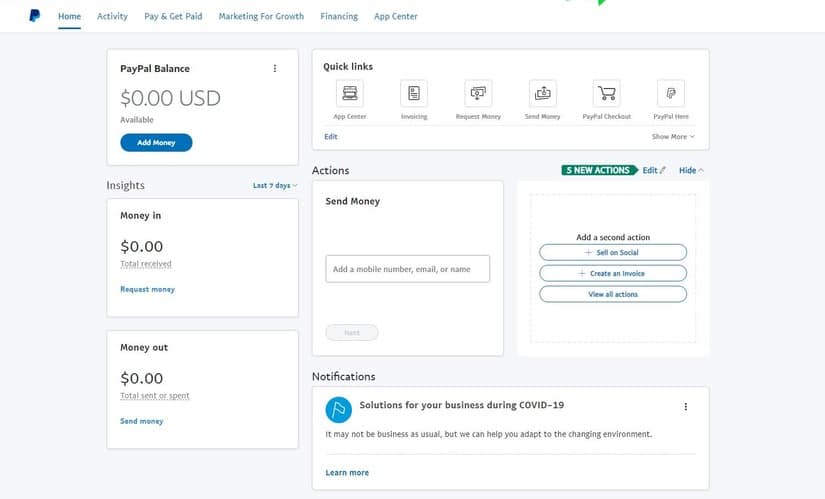

PayPal

PayPal is a widely recognized and trusted payment platform and Stripe alternative that offers seamless integration with eCommerce websites.

It supports various payment methods, including credit/debit cards and PayPal Wallet, providing flexibility for customers.

Pros

- Cost: Competitive transaction fees, particularly for high transaction volumes.

- Flexibility: Wide range of supported payment methods, offering customers multiple options.

- Security: Robust security measures, including buyer and seller protection.

- Geographical Reach: Global operation allows businesses to accept payments worldwide.

Cons

- Higher Fees: Transaction fees may be comparatively higher, for lesser volumes.

- Limited Customization: Checkout experience customization options are limited.

- Strict Policies: Some industries face restrictions due to PayPal’s policies.

Pricing

Transaction fees vary based on type, volume, and currency. Check detailed pricing here.

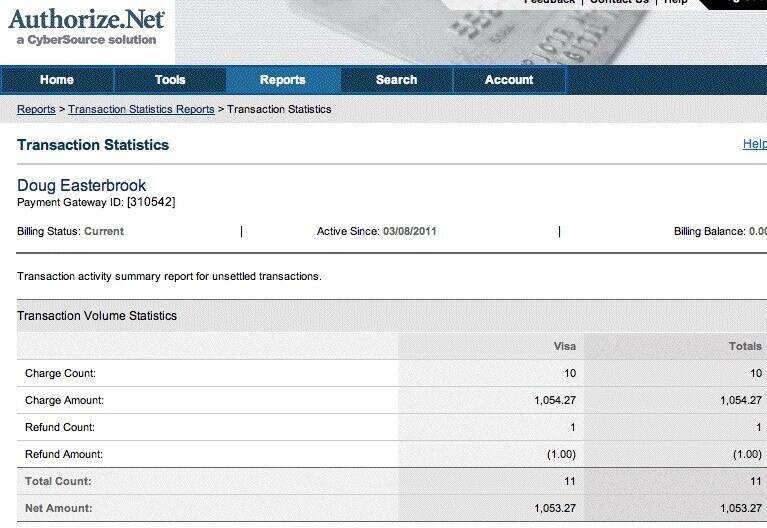

Authorize.net

Authorize.net is another established payment gateway and Stripe alternative known for its robust security features and support for multiple payment methods.

It integrates with numerous eCommerce platforms and offers advanced fraud detection tools to safeguard transactions.

Pros

- Cost: Competitive pricing with transparent transaction fees and no setup or cancellation fees.

- Flexibility: Supports various payment methods and integrates with numerous eCommerce platforms.

- Security: Advanced security features such as tokenization and fraud detection.

- Geographical Reach: Operates globally, enabling international payments.

Cons

- Separate Merchant Account: Requires a separate merchant account, adding complexity.

- Complex Setup: Initial setup is a bit more complex, requiring technical expertise.

- Higher Fees for Smaller Businesses: Transaction fees are on the higher end for smaller businesses.

Pricing

Price includes setup fee, monthly gateway fee, and transaction fees. Check detailed pricing here.

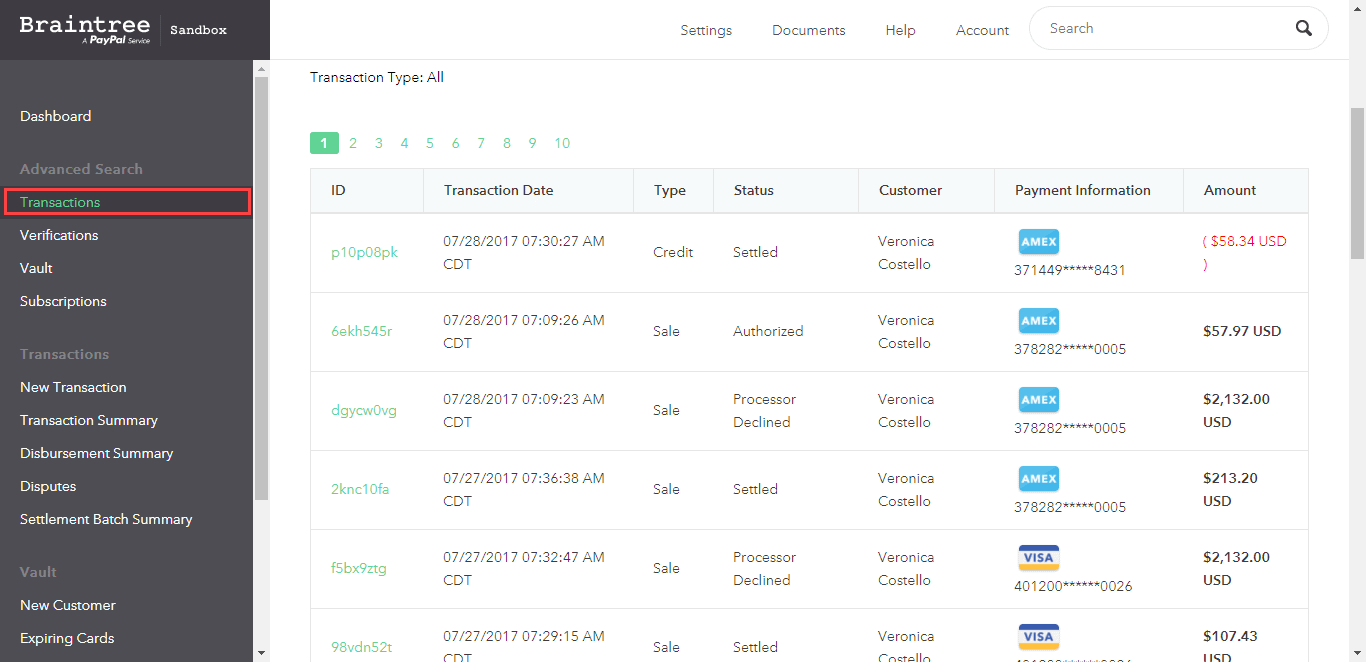

Braintree

Owned by PayPal, Braintree provides similar trust and recognition while offering advanced features such as customizable checkout experiences.

This Stripe alternative supports various payment methods and prioritizes security with advanced fraud detection tools.

Pros

- Cost: Competitive transaction fees, particularly for high transaction volumes.

- Flexibility: Supports various payment methods and offers customizable checkout experiences.

- Security: Robust security measures, including advanced fraud detection.

- Geographical Reach: Global operation enables businesses to accept payments worldwide.

Cons

- International Transaction Fees: Higher fees for international transactions.

- Limited Support for Some Platforms: Integration options are limited for certain eCommerce platforms.

- Additional Setup or Customization: Some advanced features require additional setup or customization.

Pricing

Transaction fees apply based on volume and currency. Check detailed pricing here.

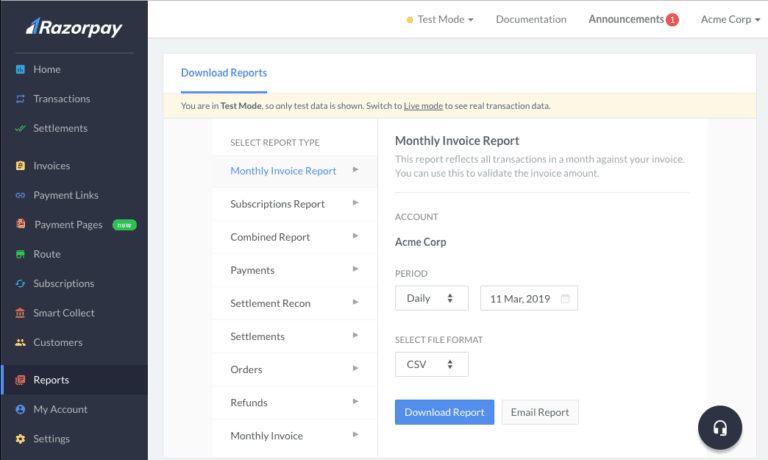

Razorpay

Although not among direct Stripe alternatives on a global scale, Razorpay is tailored for businesses operating in India and Southeast Asia.

This platform offers support for local payment methods such as UPI and wallets.

It provides advanced features like smart route optimization for improved success rates.

Pros

- Cost: Competitive transaction fees and customizable pricing plans.

- Flexibility: Supports various payment methods and offers advanced features.

- Security: Prioritizes security with robust encryption and fraud prevention measures.

- Geographical Reach: Primarily focused on India and Southeast Asia, with support for local payment methods.

Cons

- Limited Geographic Coverage: Limited support for businesses outside India and Southeast Asia.

- Transaction Fees: Fees vary based on payment method and volume.

- Technical Expertise Required: Integration requires technical expertise, particularly for customizations.

Pricing

Transaction fees apply based on volume and payment method. Check detailed pricing here.

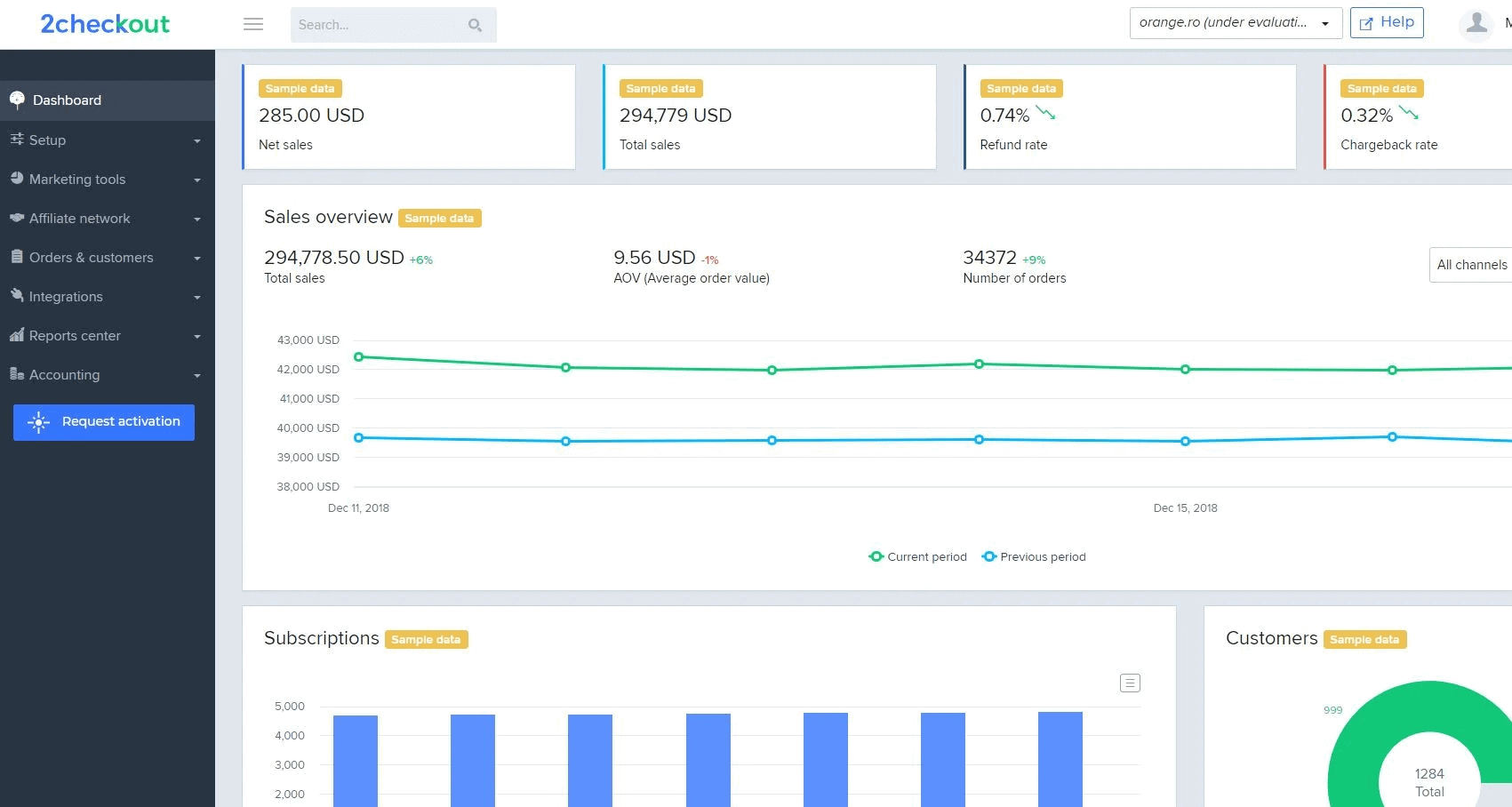

2Checkout

2Checkout is a global payment processing solution supporting multiple currencies and payment methods.

It offers features such as recurring billing and subscription management, making it suitable Stripe alternative for eCommerce businesses of all sizes.

Pros

- Cost: Transparent pricing with competitive transaction fees and no setup fees.

- Flexibility: Supports multiple currencies and payment methods, providing flexibility for international transactions.

- Security: Implements advanced security measures such as tokenization and PCI compliance.

- Geographical Reach: Global operation enables businesses to accept payments worldwide.

Cons

- Transaction Fees: Fees vary based on sales volume and payment method.

- Limited Customization: Checkout experience customization options are limited.

- Regulatory Requirements: Compliance with strict regulatory requirements is necessary.

Pricing

Transaction fees apply based on volume and currency. Check detailed pricing here.

What’s the best Stripe alternative?

As we’ve seen so far, each alternative has its own strengths and weaknesses.

Businesses often need to consider multiple options to meet their requirements.

For example, having two payment gateways can provide redundancy and ensure uninterrupted payment processing in case one gateway experiences downtime or technical issues.

Additionally, some businesses may use different payment gateways for different aspects of their operations – one gateway for domestic transactions and another for international payments.

Similarly, businesses operating multiple online stores or managing different business models may opt for multiple instances of Stripe or multiple payment gateways to accommodate varying needs and preferences.

But juggling between multiple platforms can be overwhelming.

That’s where Putler steps in.

Let’s understand how Putler can help you in such scenarios.

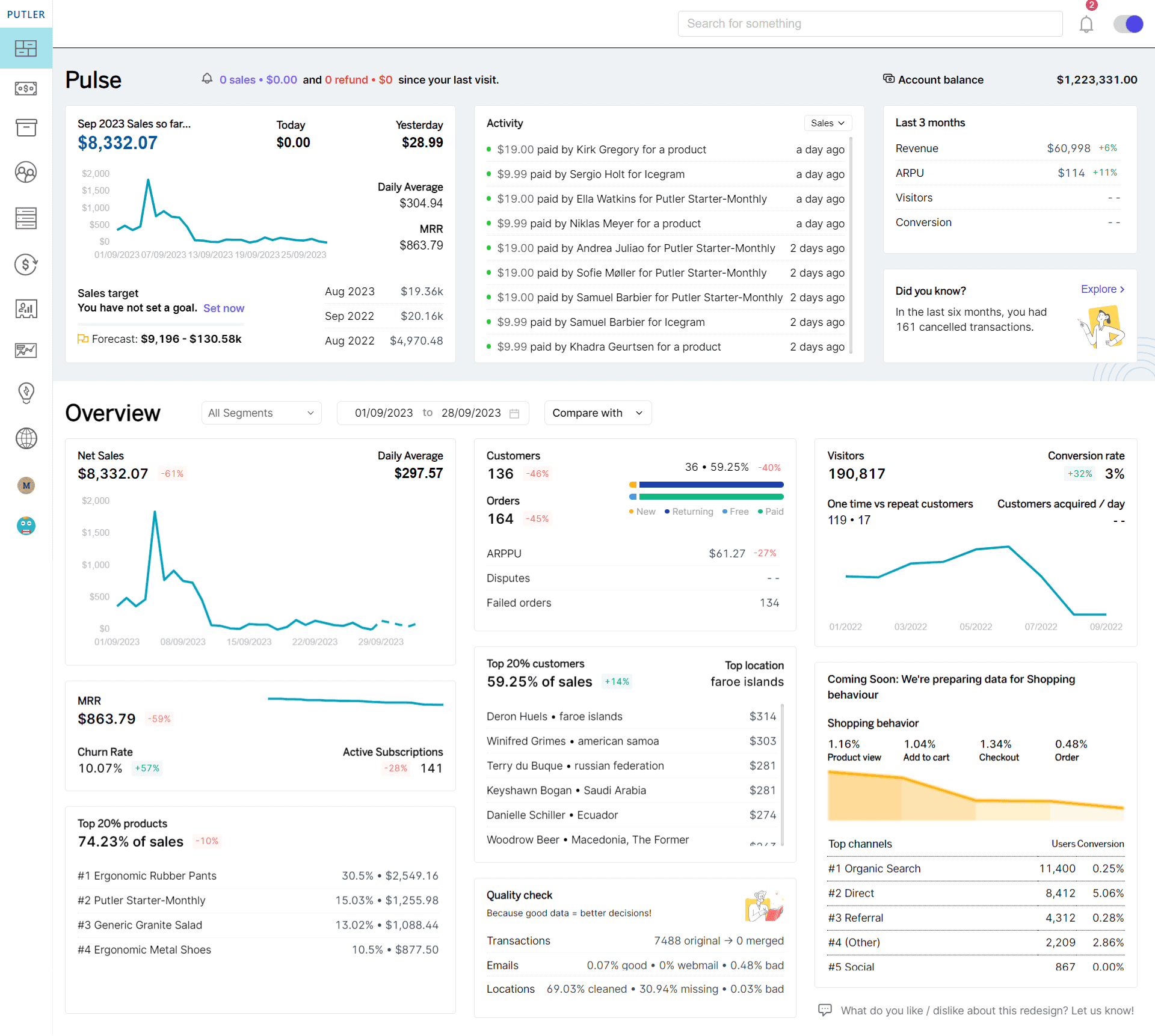

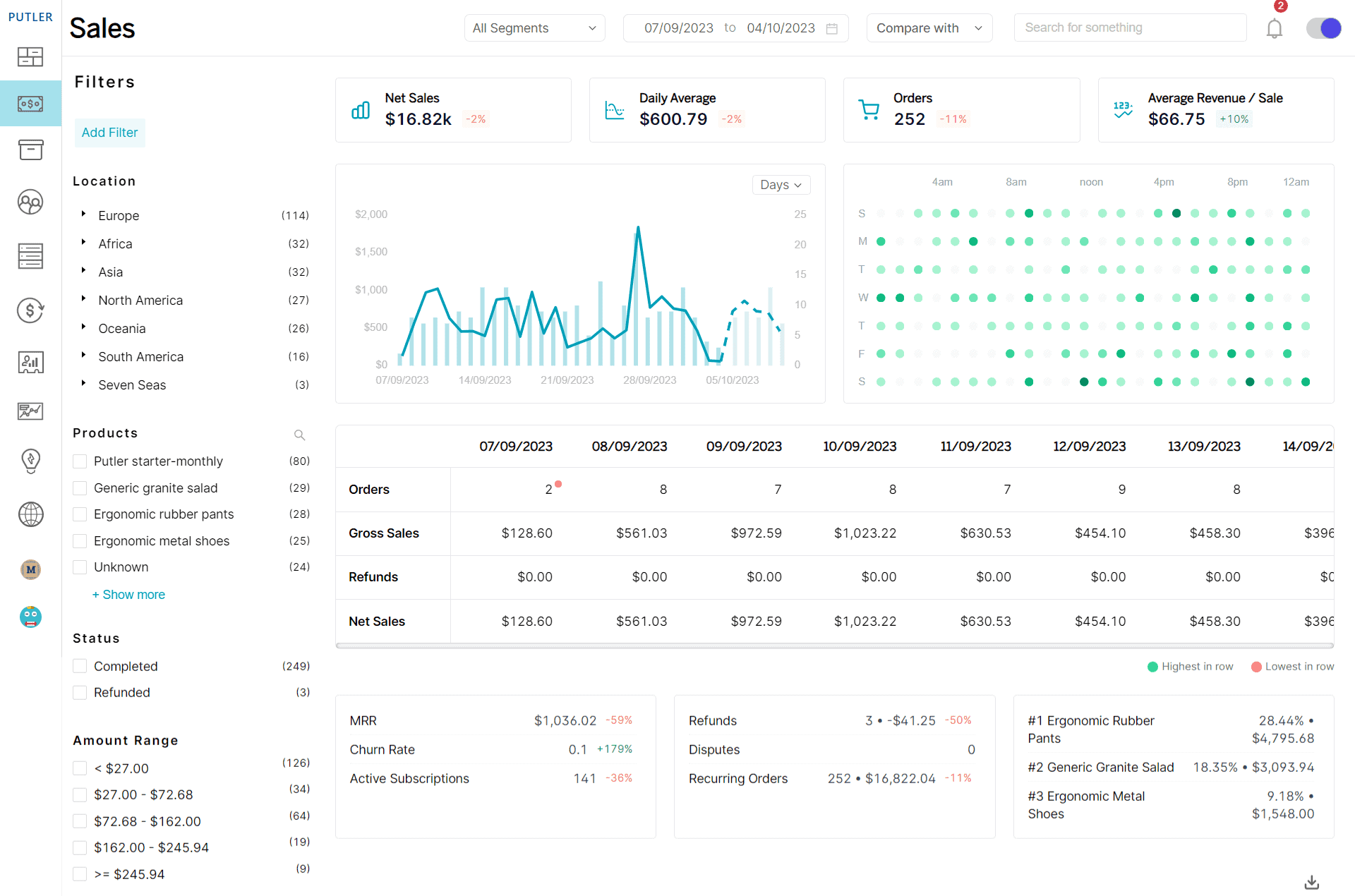

Putler – All payment gateways reporting in a single dashboard

Although not a payment processing platform or one of the Stripe payment alternatives itself, Putler brings all the platforms we discussed before under one roof, making payment management a breeze.

So, if you are tired of sifting through several payment platforms for vital business insights, Putler might be the right choice for you.

See why –

All-in-one Dashboard

Putler consolidates data from various payment gateways into one easy-to-use dashboard.

With Putler, you no longer need to log into multiple (7+) payment platforms to access your payment data.

It aggregates information from different payment gateways, and cleans and enriches them before presenting it in a unified dashboard for seamless monitoring and analysis.

This eliminates the need for manual data consolidation, saving you time and effort.

Seamless Integration

Putler works with over 7 payment platforms, including PayPal, Stripe, Authorize.net, 2Checkout, Razorpay, Braintree, and more.

Its seamless integration extends to all popular payment gateways, ensuring smooth data consolidation.

Whether you utilize multiple platforms or maintain multiple accounts within a single platform, Putler ensures complete compatibility.

This means you can effortlessly consolidate all your payment data, regardless of the platform, for comprehensive insights and analysis.

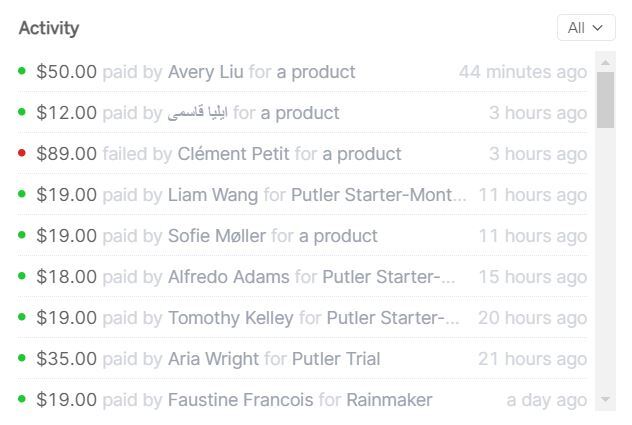

Real-time Insights

Get instant access to real-time insights into your sales performance, refund rates, and customer behavior with Putler.

Also, it provides up-to-the-minute data, unlike most Stripe alternatives.

This enables you to monitor transactions as they happen and respond promptly to changes in your business environment.

Advanced Analytics

Gain deep insights into sales performance and customer behavior with Putler.

Yes, it offers advanced analytics capabilities that go beyond basic reporting.

Dive deep into your sales data to identify trends, patterns, and correlations.

Understand your customers better by analyzing their purchasing habits, preferences, and lifetime value.

These insights empower you to make informed decisions and drive business growth.

Optimization Tools

Make data-driven decisions that maximize revenue and enhance profitability with Putler’s optimization tools.

Leverage Putler’s optimization tools to identify key trends and opportunities for revenue growth.

By analyzing historical data and predicting future trends, Putler helps you optimize your pricing strategies, marketing campaigns, and product offerings.

Simplify Your Workflow

No more tab-switching or data exporting when you have Putler.

Putler simplifies your workflow by eliminating the need for manual data entry, tab-switching, and data exporting.

With everything consolidated in one platform, you can streamline your payment reporting process and focus on more important tasks.

Direct Refunds

Putler simplifies the refund process by reducing it to just two steps.

This helps eliminate the hassles of the multiple steps that business owners face while executing a refund.

However, it’s important to note that Putler currently supports direct refunds for Stripe, PayPal, Braintree, and Shopify.

So, let Putler handle the complexities while you focus on growing your business.

Conclusion

Ready to take your payment management to the next level?

Say goodbye to payment processing headaches and hello to streamlined efficiency with the right Stripe alternative.

Whether it’s flexibility, cost-effectiveness, or advanced features you’re after, there’s a solution out there tailored to your business needs.

Embrace innovation, simplify your tasks with Putler’s consolidated insights and streamlined workflows, and watch your business thrive.

Make the switch today and pave the way for a brighter, more efficient future in online transactions.

FAQs

Is Stripe the best option for selling SaaS?

Stripe is a popular choice for selling Software as a Service (SaaS) due to its developer-friendly APIs and flexible features. However, the best option depends on your specific business needs. Stripe alternatives like Braintree and 2Checkout also offer tailored solutions, so it’s essential to evaluate factors such as pricing, features, and integration capabilities before deciding.

Who is Stripe’s biggest competitor?

Stripe faces competition from several prominent players in the payment processing industry, but one of its biggest competitors is PayPal. Both platforms offer similar services, including online payment processing and developer-friendly APIs. Other notable Stripe alternatives include Square, Braintree, and Authorize.net.

Who is better Stripe or PayPal?

The choice between Stripe and PayPal depends on your business requirements. Stripe offers customizable checkout experiences and transparent pricing, while PayPal provides a wide range of payment methods and global reach. Consider factors such as transaction fees and integration options when making your decision.