A subscription company has to keep tabs on at least thousands of metrics in a day. But do you know which one is the most important one among them? Well, it’s ARR or annual recurring revenue.

It is a key one as it’s a mark of success and future growth. What does it mean, why one should be bothered about it, how to make sense out of it, and how it differs from other business-specific metrics? Well, we are going to discuss them in detail in this article. So stay tuned.

What is annual recurring revenue?

To begin with, ARR stands for Annual Recurring Revenue. It is a crucial metric that demonstrates annual revenue a subscription based organization generates.

In simple words, it’s the value of recurring revenue generated in a year. It’s also the annualized version of monthly recurring revenue (MRR).

Benefits of ARR for a subscription-based business

Now that you have a rough idea of what ARR is, let’s figure out the reasons behind its huge significance and importance.

From the definition, it’s clear that the ARR points out the yearly recurring revenue. Knowing this metric allows a business to:

Identify the actual standing

ARR records the company’s performance in a particular area. It lets people figure out how much recurring revenue is a sure thing.

This understanding is useful to figure out the actual market hold of a business.

Knowing ARR allows decision-makers to make data-driven decisions, create a viable operational plan, and do remedial actions to improve the company’s efficiency.

Do realistic revenue forecasting

With ARR tracking, one can easily figure out the cost of different subscriptions and predict the sales. We all know that real-times revenue forecasting lets a business take immediate actions and handle things confidently.

Increase the investment

A higher value of ARR plays a key role to woo the investors. Showing a promising, if it’s there, one can easily bring in more investment and expand that business periphery.

Take timely actions

Suppose a company has low ARR value for the upcoming year then timely actions to improve the revenue such as cross-selling and up-selling can be taken be before it’s too late.

Importance of ARR for SaaS and the Subscription Economy

The foundation of the subscription economy is based on long-term relationships. It’s not a one-time affair. The relationship between the buyer and service provider, in a subscription economy, is likely to change with time.

With continual ARR tracking, one can easily figure out what’s in favor and what’s not.

New customers, added renewal percentage, upgrades, and downgrades are some of the areas in which one can gain clarity with ARR tracking. These factors are hard to measure with traditional accounting procedures like GAAP. So, if your business is a subscription-based economy, consider ARR.

ARR Momentum

The company’s components that decide the momentum of ARR are quoted below:

ARR generated from newly added customers;

Losses of subscriptions or revenue churn in a company;

Decline in ARR due to downgrades or no renewals;

ARR generated from subscription renewals through customer retention;

Additional revenue in ARR from upgrades and add-ons.

How to calculate annual recurring revenue?

ARR calculation depends on the tone of factors/metrics such as existing pricing strategy and business model used for subscription. Here is the formula to calculate ARR.

The ARR Formula and Calculation

Calculating ARR is easy.

You will first need to figure out the MRR.

Once you have the MRR value, multiply it by 12 to get the ARR.

ARR = MRR X 12

NOTE: We use this calculation within Putler as well.

ARR example

For instance, if your customer has availed 3-year contract for a monthly plan and pays $60,000 in total for the entire contract, the ARR calculation is:

ARR= $60,000 x (12/36) = $20,000.

Practical uses of ARR (Annual Recurring Revenue)

There is no second opinion that ARR is a successful determining factor for the subscription-based organization. Here are some of the uses of these key metrics:

Learn about the future growth of the company

When used in the right manner, ARR can predict the growth, stability, and market worth a company can experience in the future.

This future growth projection is a great way to find out whether or not the current business strategy or decisions are doing any good to the company.

Weigh down the success of the business model

One company can have multiple kinds of subscription models for their businesses and it’s not necessary each one performs in the same manner. With ARR calculation, it’s easy for organizations to figure out which model is winning customers’ heart and which need a re-work.

Foretold the revenue details

This one is no secret. ARR is commonly used for revenue forecasting and acts as a common baseline for more complex calculations that can be used for predicting the future revenue of the company.

Know the trends in ASP

ASP or Average Selling Price is a key factor to keep in mind for future revenue prediction and find out how much should be the service charges. With ARR, one can figure out which are the trending ASP traits.

MRR vs ARR- Factors to Keep In Mind

Businesses that are using MRR for revenue forecasting and various other purposes are now switching to ARR. While it’s the need of the hour, the process is not streamlined.

One of the key issues, acting as a stumbling block in the adoption process, is the tiresome nature of ARR and its difficult usability as the calculation is done on yearly basis.

In a year, tons of things and contract terms can get changed. So, during the calculation of ARR, it’s obvious to face few errors or one has to keep the applicable changes in mind.

If a company is using AAR as a standing and common vernacular for revenue forecasting, changing MRR can be challenging in the case of new shorter-term contracts.

Not to forget that one has to make added efforts in communication change, culture, reporting processes, and measurement used while shifting from MRR to ARR.

Tons of these hassles and hurdles can be trim down when an ideal ARR service provider is hired. Their high-end expertise simplifies the job up to great extent.

Key Difference Between ARR and MRR

It’s not wrong to say that ARR and MRR are the pillars of a subscription-based economy as both these two metrics are useful to track the recurring revenue value. Though these represent the same thing, they are not identical.

ARR, as quoted above is the value of annual recurring revenue while MRR represents the value of monthly recurring revenue.

ARR gives the macro picture of the company’s recurring revenue. On the other hand, MRR represents it on a micro-scale.

Mostly ARR is adopted in the B2B subscription business where the minimum term of service is for one year. MRR is used in B2C subscription businesses wherein the minimum term of service is monthly charged.

Using ARR has an added advantage over MRR as it gets along well with GAAP revenue. MRR and GAAP revenue are two worlds apart. But, ARR is more or less equal to the GAAP revenue. So, if you know ARR, you can predict GAAP revenue as well.

Simplest tool to calculate ARR – Putler

It is evident that just like MRR, ARR is also an important SaaS metric that need to be tracked by business.

While you can always use the formula mentioned above and calculate ARR manually, some help is always welcome. There are tons of tools which can help you measure ARR but Putler is one of the simplest tools out there.

What is Putler?

In a nutshell;

- Putler is a multichannel analytics and insights tool that provides in-depth reports and insights on sales, products, customers, orders and website visitors.

- Along with reports, Putler also provides marketing features like infinite segmentation, filtering, forecasting, goal tracking sales heat etc.

- Putler can also help you perform routine tasks like processing refunds, managing subscriptions, monitoring multiple stores/businesses from a single place.

All this is impressive but how does Putler help calculate ARR?

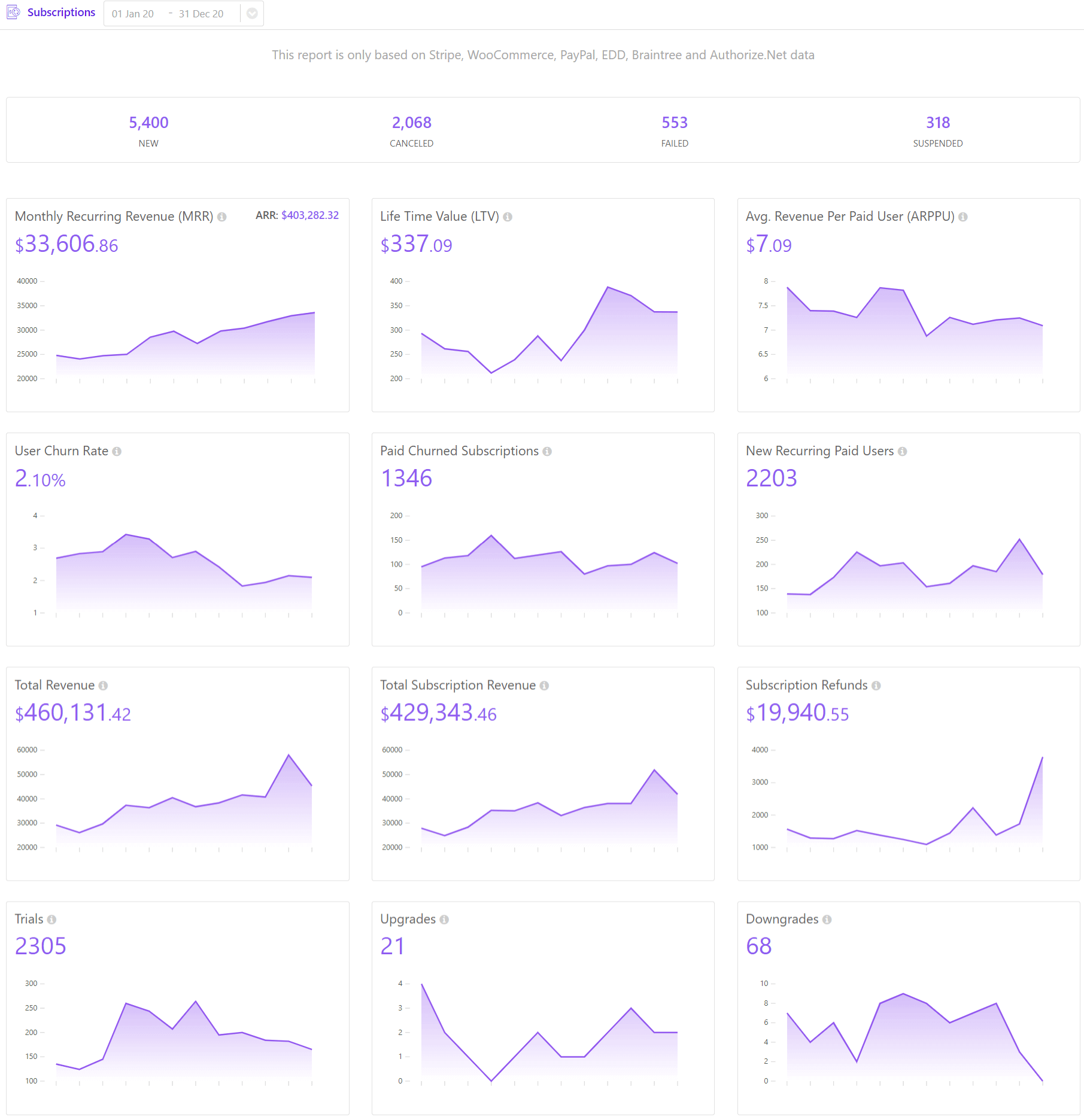

Once you connect your store (s) to Putler, it will automatically pull in all the data, process it and provide you SaaS and other reports in dedicated dashboards. Take a look at Putler’s Subscription Dashboard.’

Subscription Dashboard – Putler

Subscription Dashboard – PutlerAll the SaaS metrics are automatically calculated and displayed on the Subscription dashboard. You don’t have to work out anything manually or worry about the accuracy.

Easy right?

So don’t wait any longer, I recommend you to try out Putler and get metrics like ARR at your fingertips.

The Final Say

Any business, which is based on a subscription model, is going to get highly benefited from real-time tracking of ARR metrics as this gives a bigger and clear picture of the company’s future.

Additionally, it gives companies a chance to get things right and increase the growth momentum.

So, if a subscription-based payment model is what most of your customers follow, don’t overlook ARR metrics. Track it regularly and accurately and get to see the best path forward that one sets for the business growth.

Annual recurring revenue (ARR) FAQs

Let have better clarity about ARR with these common FAQs.

Is ARR important for SaaS?

Yes, for SaaS businesses, ARR is a key metric to forecast revenue and fabricate business growth strategy.

What is ARR v/s revenue?

ARR denotes the annual recurring revenue from the subscription. On the other hand, annual revenue refers to all kinds of business incoming.

How to optimize ARR?

One can easily optimize the ARR by increasing net customer acquisition, leveraging the expansionary revenue using upgraded and value metrics, and reducing customer acquisition costs.

Which elements are not the part of ARR calculation?

One-time fees, set-up fees, and non-recurring add-ons have no role to play in the calculation of ARR.

What is Annual Run Rate? How is it different from ARR?

It is a method of projecting the revenue-related forecasts for a long duration, for example – 1 year, or more. This calculation of revenue or sales run rate is carried out using the previous revenue trends. ARR, on the other hand, is the annual revenue for subscriptions purchased by your customers. So, it helps in calculating the annual run rate but is different from it.