Sweet as sugar…but bitter as gourd too!

The monthly recurring revenue (MRR) is the most critical metric SaaS businesses need to keep an eye on for survival. It helps you constantly improve and depict your business’s true potential.

MRR definition, MRR calculations, MRR formula, MRR tool…everything important related to monthly recurring revenue you should know is covered here.

What is MRR?

Monthly Recurring Revenue or MRR is a normalized earning per month from all active subscriptions. In other words, MRR is the recurring income a company can anticipate every month.

Normalizing means finding the accurate MRR value after taking into account various components, pricing plans, and time intervals.

These components make it difficult to calculate the accurate MRR. We will discuss all the components in depth as we move ahead.

But before that, let’s just try to calculate monthly recurring revenue without any components attached to it.

Assume, you have 100 customers, each paying you $50 per month.

So, your MRR will be 100 x 50 = $5000

Super simple. Isn’t it?

But wait. It’s not as straightforward as it seems. It all changes when components come into the picture which changes your MRR to a great extent.

Read on to understand how we can simplify the complexities for you.

Why is tracking MRR important for your business?

So far, we have discussed various components of MRR calculation and their effects. We have also emphasized the need for SaaS businesses to understand their true MRR.

Now, let’s summarize the importance of MRR.

- To track growth – MRR shows momentum, showcasing whether your revenue is picking up or slowing down.

- To forecast – Knowing your exact MRR helps the business to forecast future sales month by month.

- To plan a budget – Like monthly recurring revenue, there are certain recurring expenses in every business, especially marketing and sales expenses. Knowing your MRR can help you create a solid budget for the upcoming months.

- To boost the sales team – For any reason, if your MRR is showing a downward trend each month, you can incentivize your sales team to close more deals. It will not only boost their confidence but also increase MRR.

How to calculate MRR?

Net MRR = Current MRR + New MRR + Expansion MRR – Churned MRR

New MRR

New customers contribute directly to MRR growth. In the above example,

- 12 new customers purchased a $100 monthly plan.

- 3 new customers purchased a $1500 annual plan, and

- 20 new customers took the discounted plan.

So the sum of all these three is ‘New MRR’.

New MRR = $1200 + $375 + $1700 = $3275

Expansion MRR

The revenue earned through upselling will contribute to an increased MRR. In the current case, 15 customers upgraded their plan from $100 to $150. The revenue from these upsells is called ‘Expansion MRR’.

Expansion MRR = 15*(150-100) = $750

Churned MRR

If some of your customers cancel their subscription in the current month or downgrade their subscription, the sum of revenue lost from them is called ‘Churned MRR’.

In our example, 5 customers cancelled their $100 monthly plan, and 5 customers downgraded to the $75 plan from the $100 plan.

Churned MRR = $500 + $(5*(100-75) = $625

So, putting the values in the MRR formula, your net MRR is:

Net MRR = $10000 + $3275 + $750 – $625 = $13400

In either approach, the final MRR comes the same.

How true MRR is calculated?

Baseline MRR+ Gained MRR – Lost MRR = True MRR

How to analyze MRR?

You will arrive at the accurate MRR only after considering the components.

How components affect your MRR calculations (Very important)

Most SaaS businesses have multiple pricing plans for different periods (monthly/quarterly/yearly). Therefore, initially, all the customers will be segmented into these specific plans and their payment recurrence will depend on the plans they choose.

Secondly, promotional offers, customer loyalty programs, unsuccessful customer retention, free trials, refunds, and cancellations affect the MRR.

This is where calculating MRR accurately becomes more challenging and crucial, thanks to these variables. (Don’t worry, there’s a solution that handles these complexities well).

Without any further delay, let’s take all direct components and understand them with examples.

- Let us assume your MRR for 1st June 2018 is $10000 from 100 active customers paying $100/month.

- Your three pricing plans are $75/month, $100/month, and $150/month.

- You also offer annual plans of $750, $1000, and $1500.

Now, let’s see, what will be your MRR after 30 days due to the behavior of these same 100 customers and a few more.

| Components | Number of customers | Pricing Plan | MRR per component |

|---|---|---|---|

| Upgrades | 15 | $150/month | $2250 |

| Downgrades | 5 | $75/month | $375 |

| Cancellations | 5 | $100/month | 0 |

| No-plan change Active | 75 | $100/month | $7500 |

| Coupouns/Discount | 20 | $85/month [15% OFF on $100 plan] |

$1700 |

| New customers on $100 monthly plan | 12 | $100/month | $1200 |

| New customers on $1500 annual plan | 3 | $1500 year ($125/month) | $375 |

| Free Trials | 15 (considered 0) | 0 | 0 |

| Total | Active customers = 130 | Final MRR = $13400 |

Let’s analyze each table component now.

Upgrades

A satisfied customer is always loyal and interested in advancing his thirst for more features. In this scenario, you realize 15 out of your current 100 subscriptions have upgraded their $100 monthly plan to a $150 monthly plan.

We will now calculate MRR with this impact:

Number of customers = 15

Pricing plan = $150

MRR = 15 x 150 = $2250

If we had overlooked the upgrades, our calculation could have impacted the overall MRR and it would have been a disaster on a business front.

Downgrades

Downgrades signify that your business may have failed to retain the customer at a higher plan. Or, the customer may feel satisfied with the lower plan. 5 out of 100 subscriptions downgraded their monthly plan from $100 to $75.

Number of customers = 5

Pricing plan = $75

MRR = 5 x 75 = $375

Now, if we had continued taking $100 for these 5 subscriptions, your MRR would have come as $500 which isn’t correct.

Cancellations

Apart from downgrades, another negative impact on MRR is the cancellation of subscriptions. Here, you need not pay the customer anything back from the next billing cycle but the customer will stop paying you.

So, if 5 customers cancel their $100 monthly plan, from next month you will not take $500 (5×100) into the MRR calculations. It will be counted as 0.

No plan change active

These are the remaining active subscriptions that neither upgrade, downgrade, cancel, or refund. They stick to their current plan.

So MRR from these active subscriptions will be 75*100 = $7500.

Coupons

Let’s say you ran a 15% OFF coupon on a $100 monthly plan and got 20 new active subscriptions in these 30 days. The MRR of these 20 subscriptions who availed a special discount will be –

Number of customers = 20

Pricing = 85 (100 – 15)

MRR = 20 x 85 = $1700

If we had not considered the discount, the MRR could have come to $2000 (20×100) and it would have impacted the net MRR.

New customers

These are also new customers who joined this month but without availing any discount.

New customers on the monthly plan

Let’s assume you got 12 new customers at $100 monthly plan. So the MRR from these new customers will be $1200.

New customers on annual plan

Let’s assume you got 3 new customers at $1500 annual plan. So the MRR from these new customers will be (1500/12*3) = $375.

Free Trials

Free trials should not be taken under active subscriptions. Their number will only be taken into MRR calculations when they become paid subscribers and hence, they must be excluded from MRR.

So, your final MRR comes to $13400 from 130 active subscriptions.

Now, this MRR we calculated was after 30 days.

But, due to the complex behavior of customers – switch-over, churn; the MRR gets affected frequently or daily and hence method 1 explained above is the standard approach to calculate MRR.

How to increase MRR?

Now let’s try to figure out how to improve MRR.

- Increase customer retention rate

Every business constantly needs to check the customer lifetime value (CLV) to know if they are targeting the right audience and if their product meets the market demand or not? Increased customer retention rate would help in upselling/upgrading the existing customers and hence it will increase MRR.

- Refine messaging

Sales and marketing team must work together to refine the product message which targets a specific group and not all sorts of audience. It must be customized and target specific which can help in generating more revenue.

- Reduce customer acquisition cost

Customer acquisition cost is not taken in the MRR calculation but it indirectly helps you optimize your business. If you try to reduce the customer acquisition cost, you can use those savings in expanding your business which will inherently increase your revenue.

5 mistakes to avoid when calculating your MRR

Calculating MRR is an easy job but the mistakes here cannot be ignored. Let’s have a look at the major mistakes that you should avoid making:

Mistake 1: In a single month, annual, semi-annual, or quarterly contracts are included at full value.

It happens that someone pays you the total money upfront, but the MRR value, as intended, gets divided by the subscription length. The reason is a simple yet predominant one: momentum measurement. As you are measuring the growth, not the cash flow, this mistake should be avoided as it might throw off your other metrics including customer count, etc.

Mistake 2: Subtraction of delinquent charges and transaction fees.

It might be a bit pleasing to subtract the delinquent charges and transaction fees but the main catch lies here itself. It’s not about the intentions but it’s about the problem that might be created further. That means the results turn out to be misleading and incorrect.

Mistake 3: When one-time payments are included.

As the name says they happen just one time, so there’s no logic in including them in Monthly “Recurring” Revenue. Including them could be troublesome for your calculations.

Mistake 4: Counting trialers as inclusions.

Trialers are not customers, as their trial status doesn’t guarantee conversion into paying customers. Therefore, they should be excluded from the calculations.

Mistake 5: Not including discounts.

It happens sometimes that the discounts aren’t included but that is not the right practice. For instance, consider that you have given someone a discount on a $200/month plan and you get the discounted value of $100/month. Your Monthly Recurring Revenue isn’t $200/month, it’s $100/month. If the discount is taken away eventually, the top-level MRR would increase by $100/month.

Now, if these issues are not sorted, it impacts your true MRR to a great extent and shows a different picture completely.

But if you are using Putler, you need not worry about it.

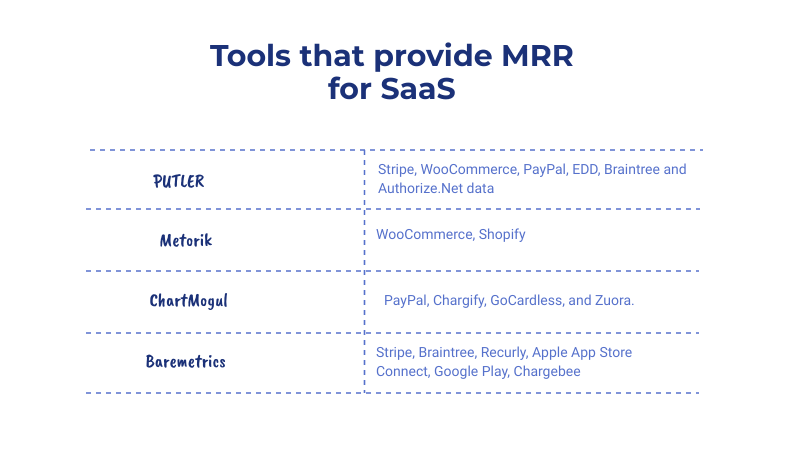

Best MRR & Churn Tracking tools

Above are the tools that help calculate MRR. But as you must have noticed, most of them only cater to Stripe. Thus leaving businesses that have multiple payment gateways or other shopping platforms in a fix.

So we have designed a tool – Putler. It caters to most businesses and it helps calculate MRR as accurately as possible. Read more to check how:

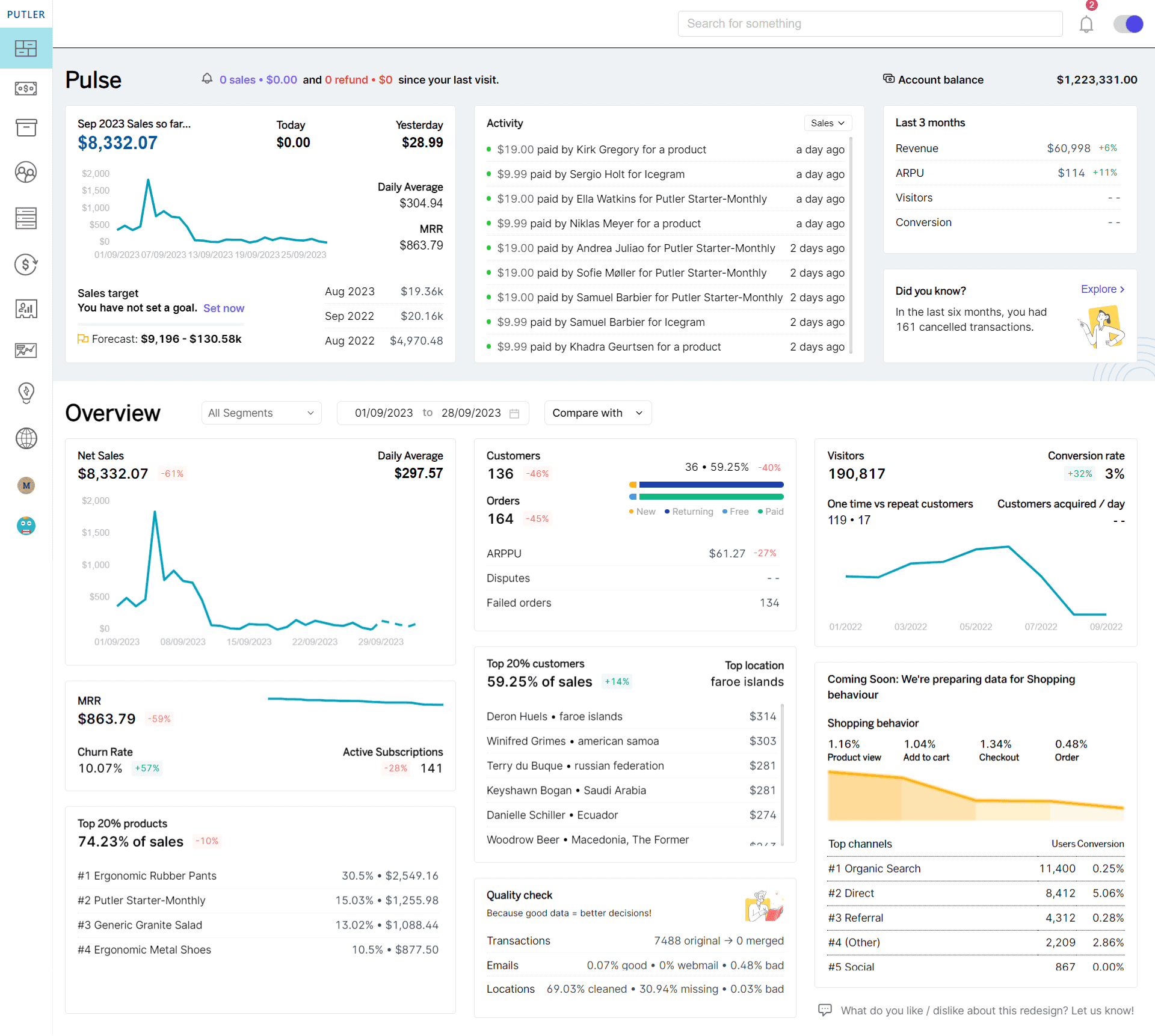

The best tool for tracking monthly recurring revenue (MRR) growth

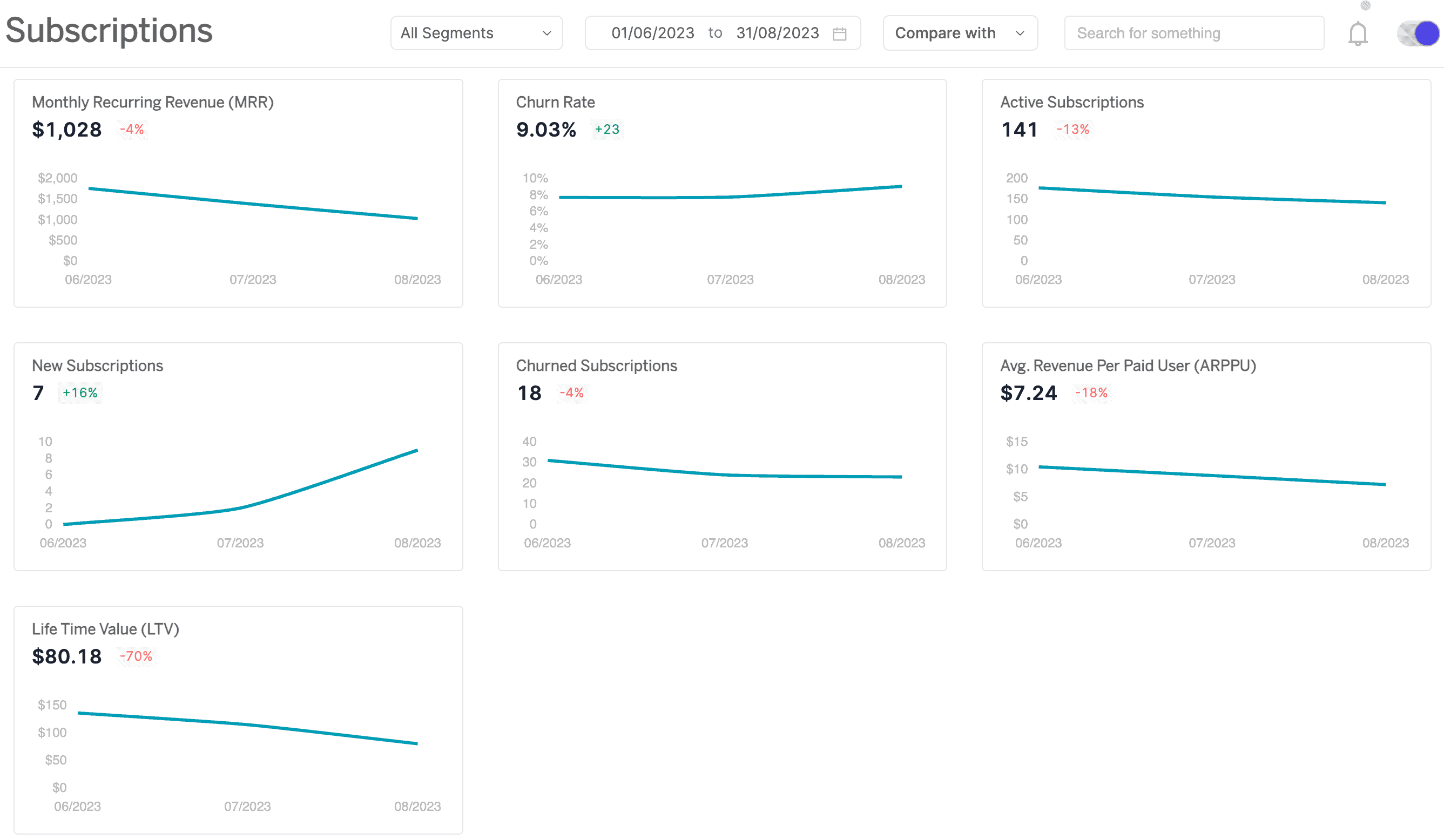

Putler automatically takes care of all the above-mentioned MRR components and the tedious calculations.

No matter how many complexities and pricing plans are associated with your business, Putler will handle all and present accurate MRR in a neat dashboard.

If you’ve joined us recently, know that Putler stands as the preferred analytics solution for thousands of e-commerce businesses, supporting them in tracking and boosting their growth.

Not just MRR, Putler shows 15 subscription metrics like Lifetime Value, Average Revenue Paid Per User (ARPPU), Annual Run Rate (ARR), user churn rate, user growth rate, and other 110+ e-commerce metrics which can help you in strategic growth.

Monthly Recurring Revenue FAQs

How to calculate ARR and MRR for SaaS?

Calculating Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR) is crucial for SaaS (Software as a Service) businesses to measure their financial performance and growth.

Here’s how you can calculate both metrics:

- ARR (Annual Recurring Revenue):

To calculate ARR for SaaS, multiply the average monthly revenue per customer by 12. If your monthly revenue is $10,000 with 100 customers, ARR = $100 (average revenue per customer) * 12 = $1,200. - MRR (Monthly Recurring Revenue):

To calculate MRR for SaaS, use the average monthly revenue per customer without multiplying by 12. Using the same example, MRR = $100 (average revenue per customer).

Example: Let’s say you have 100 customers, and your total monthly revenue is $10,000.

Average Revenue per Customer = $10,000/100 = $100

ARR = $100×12 = $1,200

MRR = $100

These calculations paint a picture of your recurring revenue and help in assessing the financial health and growth trajectory of your SaaS business.

Do custom enterprise deals count towards MRR?

Absolutely, custom enterprise deals count towards your MRR, just like regular customer subscriptions. The payments are spread out over the deal’s duration and contribute to your MRR.

However, remember that setup and consulting fees aren’t part of this. So, include those custom deals in your MRR calculations for a complete picture of how your company is doing.

MRR vs. Cashflow: How are they different?

There are some major differences between MRR and cash flow, yet some SaaS companies struggle between both. So, we have unraveled it for you.

To have a practical understanding, let’s look into the example here:

Customer P signs an annual contract at $12,000 with a one-time implementation charge of $1,000 with full upfront payment. They also wire the fee to your bank account when you invoice them.

In MRR, you have to split the charge over 12 months. After that, the monthly charge is added to your MRR. In this case, your MRR grows by $1,000 for the next 12 months (excluding one-time charges, as discussed in the common mistakes section)

Here the point arises that in terms of cash flow, your bank account already has the money including one-time charges. With this, the services provided to them for the upcoming 12 months.

The above example concludes that cash flow reporting is the actual cash one has in your bank. This is then compared against the expenditures and the services to be provided even before becoming earned revenue.

The above example showed how MRR and Cash Flow differ yet how important both of them are.

What effect does reducing churn have on MRR?

Reducing churn generates a cumulative effect, the customers who do not churn generate revenue continuously every month after that.

One of the commonly discussed ways to grow MRR is managing churn.

Reducing churn also has some positive effects on MRR such as: the account of a churned customer cannot be upgraded. Also, they cannot buy an add-on which limits the expansion of MRR. Also, they won’t refer your product to their peer or friend.

Why is MRR the mother of all metrics?

MRR reflects everything related to your company such as your mentorship, your decisive nature, and everything related to it.

The company is like a tree. At the niche stage, it is a sapling that requires constant nurturing. For that, you have to make good decisions, and also hire the people who will help you grow your company. By doing this, your MRR will grow even though it might take time.

The segmentation and analysis of MRR enable you to take up actionable insights. This can be done with your MRR number today itself!

What is Net New MRR and how to calculate Net New MRR?

New MRR is monthly recurring revenue that comes from new customers.

How to Calculate New MRR:

If you started a month with 10 customers, and at the end of the month you’ve got 12 – then, you gained 2 new customers. Let’s say your 2 new customers brought with them a total of $100 each in MRR. Then your New MRR for the month would be $100.

Are you monitoring MRR accurately?

Making decisions based on improper MRR will land your business in unexpected and risky situations that can prove fatal.

Hence, it’s important to get the right MRR which is essential to grow and make better business decisions.

And to have that MRR value without any effort, you have Putler at your disposal.