Oh sweet MRR! The yardstick of progress for a SaaS / subscription / membership / recurring revenue business.

Talk to the owner or marketing head of any subscription business and they will crib about how their MRR is not growing as expected, or wax eloquent about their phenomenal MRR and the hockey stick growth they witnessed.

Some may go on to describe their churn rates and quick ratios. Their action plan of dunning, recovery emails and ongoing user engagement to bring the churn down by 50 basis points.

Alright, let’s stop.

If you are in a recurring billing business, you certainly know the situation. If you are not, you most likely want to migrate to a subscription system.

So, what are these subscription metrics? What does all that jargon mean? Let’s find out.

What are Subscription Business Metrics?

Subscription business metrics are like the heartbeats of a recurring revenue business. They help you understand the pulse of your business by tracking and measuring key performance indicators (KPIs).

So, what are these subscription metrics, you may ask?

Well, there are several critical subscription business metrics that SaaS companies, membership websites, and other recurring revenue businesses need to monitor. These metrics include Monthly Recurring Revenue (MRR), Churn Rate, Annual Recurring Revenue (ARR), Average Revenue Per User (ARPU), Average Revenue Per Paying User (ARPPU), Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Gross Margins.

Don’t worry if some of these metrics sound like technical jargon. We have in-depth explanations for these metrics and we will also explain how to calculate and analyze them effectively.

So, let’s give you a quick rundown!

Top Subscription metrics for your business

If you’re running a subscription-based business, you must track and measure specific metrics to ensure your business is thriving. Let’s we’ll explore the top subscription business metrics to track and explain why they matter.

These metrics are essential for evaluating the performance of your business, identifying areas for improvement, and making data-driven decisions.

By regularly monitoring these metrics, you can optimize your revenue growth, improve customer retention, and reduce churn.

So, without further ado, let’s dive into the top subscription business metrics you should be tracking:

- Monthly Recurring Revenue (MRR) and Annual Run Rate (ARR): These metrics tell you how much money you’re making per month or year from recurring subscriptions. If you have non-monthly subscriptions, you can convert them to monthly ones for tracking purposes.

Subscriptions that do not recur at monthly intervals, are “converted” to monthly. For example, annual subscription amount is divided by 12, or weekly subscription may be multiplied by 4.33 etc.

- Churn: This is the percentage of revenue or customers you lose every month. It’s important to keep an eye on churn so you can identify and address the reasons for customer attrition.

- Switches: Tracking upgrades and downgrades is essential for understanding how changes in subscription plans affect your MRR.

- Trials: Measuring the number of trials and conversion rate to paid subscriptions gives you valuable insights into your customer acquisition funnel and the effectiveness of your trial offerings.

- Average Revenue Per User (ARPU), Average Revenue Per Paying User (ARPPU), and Average Revenue Per Account (ARPA): These metrics help you understand how much revenue each customer is generating for your business, whether they’re a free user or a paying customer. Depending on your business model, you may want to track ARPU, ARPPU, or ARPA.

- Customer Lifetime Value (CLTV), or Lifetime Value (LTV): This metric estimates the total revenue a customer will generate over their lifetime as a paying subscriber. By comparing LTV with CAC, you can see how profitable a customer is over their lifetime and make better decisions on customer acquisition and retention.

- Customer Acquisition Cost (CAC): This is the cost of acquiring a new customer and is an important metric to understand the effectiveness of your marketing and sales efforts.

- Quick Ratio: This is the cost of acquiring a new customer and is an important metric to understand the effectiveness of your marketing and sales efforts.

The formula would be (New MRR + Expansion MRR) / (Contraction MRR + Churned MRR).

You may even want to measure subscriptions by their status – New, Active, Reactivated, Churned, Canceled, Suspended etc. - Failed Charges and Dunning: Failed charges happen when credit cards expire or fail to process, and a good dunning solution can help you recover lost revenue. It’s essential to monitor failed charges and implement an effective dunning strategy.

- Refunds: Tracking refunds can help you understand the impact of customer dissatisfaction on your business and make improvements to prevent future refund requests.

- Cashflow: Keeping track of cash flow is essential for any business, and understanding your subscription metrics can help you make data-driven decisions to improve cash flow. It’s also helpful to track these metrics on a product or variant level to understand which offerings are most profitable.

It may seem surprising, but tracking these metrics and comparing them with historical data can provide valuable insights into your business’s performance and help with future planning.

Additionally, it’s important to monitor these metrics on a product or variant level to identify which offerings are most profitable.

Don’t forget to consider failed charges and refunds, as they can impact your metrics differently.

By regularly reviewing these metrics, you can ensure the success of your subscription-based business.

Measuring and Calculating Subscription Metrics

We are going to talk about databases and queries here. If you are not into programming or databases, don’t worry. We will keep it as simple as possible.

But it’s useful if you understand these. It’s math at the end of the day, and that too simple math.

This is the most comprehensive, yet easy approach we’ve found. You will soon see the elegance in the solution.

Alright, let’s dive in.

Part 1: Storing important information

First, We are assuming you are storing subscription transaction information in MySQL tables – or similar. So every time you receive a new subscription, get a payment on it, or something changes in its status – cancellation, expiry, failure to charge etc – we will have an entry in that table.

Since you are logging all events to the subscription, this table will get bigger as time passes.

Calculating MRR from this table is not a good idea.

How to calculate MRR?

Let’s create a new table to store only “significant” events. Things that materially change the subscription. Signing up, upgrading or downgrading, expiry, moving from trial to paid etc.

We should also store product and variation identifiers in the table so we can calculate MRR (and other metrics) down to the variation level.

We also need to store the customer’s ID so we can calculate metrics even at the customer level – remember, they may have multiple active subscriptions!

Here’s an excerpt from this table.

2018-07-25123john@domainputlergrowthupdated10079USD

| timestamp | subs_id | product_id | variation_id | event_type | is_trial | is_new_customer | old_mrr | new_mrr | currency | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2018-07-10 | 123 | john@domain | putler | growth | created | 1 | 1 | 0 | 0 | USD |

| 2018-08-15 | 123 | john@domain | putler | scale | updated | 0 | 0 | 79 | 249 | USD |

| 2018-12-10 | 123 | john@domain | putler | scale | held | 0 | 0 | 249 | 249 | USD |

| 2018-12-15 | 123 | john@domain | putler | scale | canceled | 0 | 0 | 249 | 0 | USD |

In simple English,

- John signed up for a trial on 10th July. Converted to a paid plan of $79/month on the 25th.

- Upgraded to a higher plan of $249/m on 15th August.

- Somehow he did not want to continue, so he canceled on 10th December.

- But since his monthly subscription was paid till the 14th of the month, he used the product till the 14th, and on the 15th it expired.

- Tumbling our MRR from $249 to 0.

Let’s add a few more entries to this table for some other users, and then start calculating our metrics.

| timestamp | subs_id | product_id | variation_id | event_type | is_trial | is_new_customer | old_mrr | new_mrr | currency | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2018-07-10 | 123 | john@domain | putler | growth | created | 1 | 1 | 0 | 0 | USD |

| 2018-07-12 | 124 | annie@domain | putler | starter | created | 1 | 1 | 0 | 0 | USD |

| 2018-07-13 | 124 | annie@domain | putler | starter | updated | 1 | 0 | 0 | 29 | USD |

| 2018-07-25 | 123 | john@domain | putler | growth | updated | 0 | 0 | 0 | 79 | USD |

| 2018-08-02 | 125 | mark@domain | putler | growth | created | 1 | 1 | 0 | 0 | USD |

| 2018-08-15 | 123 | john@domain | putler | scale | updated | 0 | 0 | 79 | 249 | USD |

| 2018-08-22 | 125 | mark@domain | putler | growth | updated | 0 | 0 | 0 | 79 | USD |

| 2018-09-07 | 126 | annie@domain | 10x formula | starter | created | 0 | 0 | 0 | 99 | USD |

| 2018-11-12 | 125 | mark@domain | putler | starter | updated | 0 | 0 | 79 | 24.17 | USD |

| 2018-12-10 | 123 | john@domain | putler | scale | held | 0, | 0 | 249 | 249 | USD |

| 2018-12-15 | 123 | john@domain | putler | scale | canceled | 0 | 0 | 249 | 0 | USD |

- We won two more customers here – Annie and Mark.

- Annie started with a trial of Putler Starter, and upgraded to paid plan the very next day.

- Eventually, she also bought another product, the 10x Formula, at $99/m, which had no trial.

- Mark signed up for a trial, and started paying $79/m after 20 days.

- Eventually, he downgraded to a lower plan, with an annual payment ($29/m, but $290/year), pulling down the MRR to $290/12 = $24.17.

Part 2: Calculating MRR, Trials to Paid, Churn and more…

Let’s calculate different metrics as on 20th December 2018.

Finding MRR is the simplest!

You may question why to deduct old_mrr from new_mrr? And if you are not familiar with SQL queries, the SUM bit there may confuse you.

Think about this for a bit. Take a pen and paper, calculate the differences and total them up.

Then calculate MRR on different dates with that logic.

Really, take some time and think through that. Once you fully grasp this, everything else will be simple.

…

Done?

Ok.

How to calculate churn?

That tells you loss in MRR due to churn, and the count of subscriptions that churned.

Not too difficult right?

How to calculate trials to be paid?

Let’s look at something a bit more involved.

Wow! You’ve accomplished a lot so far!

Let me quickly tell you possible ways of finding some other KPIs.

- Switches: When the event type is ‘updated’, and the new MRR is more than the old MRR, it’s an upgrade. Downgrade otherwise.

Similarly, all new MRR + upgrades = expansion in MRR. All churn + downgrades = contraction in MRR. - Active Subscriptions: Unique Subscriptions IDs, excluding canceled or non-converted trials.

- Average Revenue Per Paid User: MRR divided by Active Subscriptions count. (If you want “users” and not “subscriptions”, you can pick the count of unique customers with active subscriptions.)

You get the picture!

So why in the world I’m calling this Pandora’s box???

Who’s Pandora? And what’s in her box?

Pandora is a character from Greek mythology.

Prometheus stole fire from heaven, and as a punishment, Zeus (the king of the gods) presented Pandora to Prometheus’ brother Epimetheus.

A jar was left in Pandora’s care, and she opened it – only to release sickness, death, and many other evils into the world. She quickly closed the container, and Hope was left behind.

Today, the idiom “to open Pandora’s box” means to do or start something that causes many great and unexpected troubles. It’s similar in meaning to “opening a can of worms”.

Calculating subscription business metrics becomes harder and harder as you try to make it more and more accurate.

Metrics are a measurement of progress. People plan their future actions based on what metrics report. So it’s highly important to have correct metrics.

If your calculation shows a $12000 MRR, but you forgot to deduct cancellations from it, then that’s not going to work.

If you made any mistake in calculating the metrics, you will end up taking the wrong decisions.

Alright, so we agree that accurate metrics are essential. But how does it get more and more complex??

The Complexity of Subscription Revenue Reporting

To tell you the truth, we avoided building Subscription reports in Putler – our eCommerce analytics solution – for a long long time. Our first few attempts failed quickly.

Finally, we built a solution that handled all complications and edge cases.

Eventually that proved to be insufficient too. Which is when we rebuilt everything again based on the approach I outlined above.

I will tell you a bit more about Putler later on, but here is a list of major problems we’ve observed building SaaS analytics/metrics solutions.

- No universally accepted method of calculating all these metrics:Different reporting solutions have different methods for calculation. So if you are comparing your data with someone else, you may see mismatches.

- Garbage In, Garbage Out: If the log of all transactions is incomplete or inconsistent, our subscription events table will have insufficient entries. For example, if you build subscription events data from the last two years’ transactions, you may miss critical events that happened before this period. Or if your payment gateway/eCommerce system is setting the same date for creation and first payment – or any other inconsistencies – metrics will be wrong.

- E-commerce systems and payment gateway APIs change: they may change the kind of data they provide. This means two things: one, you need to constantly update your logic – which is still ok; but the second is that old data may be in the old format and new data in the new standard. In such a case, you will need to normalize and bring everything in the same format!

- New subscription events: Every time a new subscription event occurs, you need to check and update the table if needed. Most gateways do not indicate upgrades/downgrades. Many do not indicate trial information. So we need to smartly identify these patterns.

- Multiple currencies: If you accept payments in different currencies, you’d need to look up exchange rates, and convert everything into a “base” currency. This can be a challenge on its own.

- Multiple payment gateways/eCommerce systems: If you accept both Stripe and PayPal for payments, the kind of information they provide about a transaction later on, is different. For example, PayPal API does not provide subscription intervals and end dates. In such cases, we have to build a “fuzzy” method of detecting subscriptions and their details. Consolidating such differences across gateways and unifying data is extremely hard.

We’ve already provisioned for product and variation level metrics. But product / plan names change all the time. For higher accuracy, we need to build a system to merge / group products. - Data inaccuracy e-commerce systems: When you use an e-commerce system, it may not have the most accurate data. You need to correlate with payment gateways to confirm. This process of deduping is intensive.

Exploring Your Options for Recurring Revenue Metrics Tracking

That’s an apt analogy. If you’re not tracking your key performance indicators, you don’t know where you are going. (And BTW, if you have not read Crossing the Chasm, read it when you get a chance.)

Every serious business person knows the importance of tracking key measurements. And there is no shortage of analytics and reporting tools.

But first: don’t make the mistake of using an Excel (or Google!) spreadsheet to track your SaaS subscription metrics and KPIs. It won’t scale.

So what are your options?

Every e-commerce system has a built-in reporting system of sorts. So does every payment gateway. You can start with them.

Even general-purpose analytics solutions like Google Analytics and Mixpanel allow tracking e-commerce revenue. You can use them, but won’t get subscription KPIs we’ve been discussing – MRR / Churn etc…

Given the growth of SaaS and the recurring business model, dozens of startups have launched solutions specializing in SaaS metrics. There are plenty of options especially when you use Stripe. ChartMogul, Control, ProfitWell, Compass, Statsbot, Supermetrics… – the list goes on. Many of these solutions also work with other payment gateways.

Then there is Baremetrics – the poster boy of subscription business analytics. It’s a great product, has been there for many years, and has made lots of improvements lately. And everyone else copied them.

Even we copied Baremetrics when we built subscription revenue analytics in Putler.

Yes, Putler gives you the full gamut of recurring business reporting.

Still confused? To make things simpler, here’s an article that compares different subscriptions billing software.

Our Experience in Offering eCommerce and Subscription Business Revenue Analytics

Putler started as a simple PayPal sales tracking tool back in 2010. It stayed a desktop app for many years and gained thousands of users. We revamped the whole system and ported it to the Web in 2016.

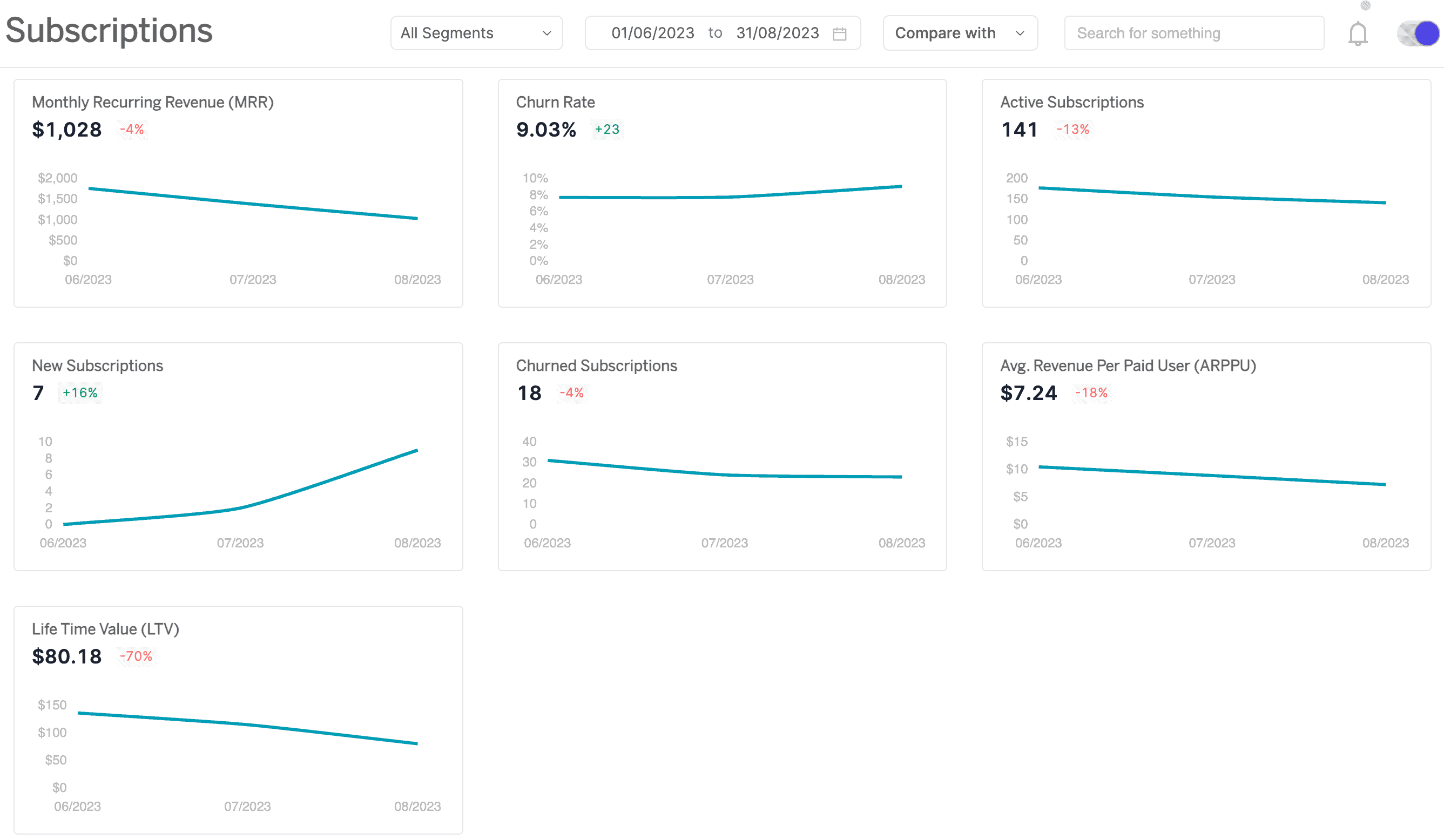

A Closer Look at Putler’s Subscription Dashboard

Putler is a meaningful e-commerce analytics platform, and one of the best out there.

Why?

Mainly because of our awesome customers. We built Putler with continuous feedback from customers. We’ve solved real problems for people.

Putler does what most other analytics solutions don’t.

Comparing Putler with Competitors

| Features | Putler | ChartMogul | Baremetrics | Metorik | GetControl (Out of business) |

Compass (Out of business) |

|---|---|---|---|---|---|---|

| SaaS Metrics | ||||||

| Non SaaS Metrics | ||||||

| Website metrics | ||||||

| Number of Integrations | 17 | 7 | 4 | 4 | ||

| Integrates with PayPal | ||||||

| Team sharing available | ||||||

| Realtime updates | ||||||

| Multi-currency support | ||||||

| Aggregated reports | ||||||

| Individual reports | ||||||

| Customer Segmentation (RFM) | ||||||

| Send money functionality | ||||||

| Subscription Management | ||||||

| Process refunds | ||||||

| Desktop App | ||||||

| Chrome extension | ||||||

| Intuitive Search | ||||||

| Pricing | $20 | $100 | $50 | $50 | – | – |

Which is the best solution for SaaS?

There are many good solutions. A few popular ones as well. There are some free, some charge hefty fees.

Here are some questions you can ask to discover the best solution for your needs.

- Does it work only with Stripe? Or a specific gateway or e-commerce system? If so, this could limit you in the future.

Even if you are using the gateway the system is built for, will it work in your case? For instance, some solutions need plans/products defined at Stripe / gateway level. If you use an e-commerce system – like WooCommerce – and use Stripe only for payments, most of the solutions will not work. - Can the solution handle non-recurring payments? Even for SaaS, not every dollar is recurring. You need something that can handle everything.

- Does the platform have a ready integration with your payment/eCommerce system? Everyone has an API, but using an API to populate your data can be a big task.

- Does it give you most (if not all) metrics you want to track? Can it pull data from other systems – like Google Analytics – to give you a better understanding of your business?

- How does the system handle the complexities we outlined earlier? Changes in the system, plan switches, refunds, multiple currencies etc?

- Do you have multiple payment gateways/businesses/websites? If so, can the solution accurately consolidate them all in one place?

- Can you give restricted access to your team members? To the marketing or customer support team?

- Is it just a reporting tool or goes beyond? Does it enrich customer profiles? Can it email reports? Can it handle dunning/failed charges?

- What’s the price? Even if it’s free, how much time and effort will you have to spend to get it to work? How are premium upsells offered?

- Is it easy to use? Do you get the information you need without a lot of jumping here and there?

- Will the platform survive? Or will it get lost over the next few years?

Wow, that was a lot of questions, wasn’t it?

But trust me, it’s important to consider all those aspects when choosing the right subscription metrics tool.

But before you leave, let’s just remind you of the most important subscription business metrics you need to track.

Finally, which subscription business metrics should you track?

As a subscription-based business owner, it’s important to keep a close eye on metrics to track the performance and growth of your business.

But with so many metrics to choose from, which ones should you prioritize?

Here are the top subscription business metrics you should be tracking to make informed decisions and drive growth:

- Monthly recurring revenue (MRR): This is the amount of revenue you receive each month from your subscribers. MRR helps you track the growth or decline of your business, and it’s an important metric to monitor over time.

- Churn rate: This measures the rate at which your customers are leaving your subscription service. High churn rates can indicate a problem with your pricing or product offerings, and it’s important to identify and address these issues to retain your customers.

- Customer lifetime value (CLV): This measures the total value of a customer over the duration of their relationship with your business. Tracking CLV can help you understand the ROI of your acquisition efforts and make informed decisions about where to allocate your resources.

- Average revenue per user (ARPU): This metric measures the average amount of revenue generated by each subscriber. It’s useful for identifying trends in spending and can help you optimize your pricing strategy.

- Subscriber growth rate: This metric measures the rate at which your subscriber base is growing. It’s important to monitor this metric to ensure that you’re on track to meet your business goals and to identify potential problems before they become major issues.

Remember, tracking these metrics on a regular basis will help you make informed decisions about your subscription business, and ultimately contribute to its long-term success.

In conclusion, tracking subscription business metrics is essential for the growth and success of any subscription-based business. It allows you to gain insights into your business’s performance and profitability, identify trends, and make informed decisions for future planning.

Putler offers a comprehensive solution for tracking subscription metrics, including the most crucial ones we discussed earlier.

Its user-friendly interface, integrations with multiple payment gateways and e-commerce systems, and powerful reporting capabilities make it a valuable tool for any subscription-based business looking to optimize its performance.

With Putler, you can focus on what matters most – growing your business and keeping your customers happy.

FAQs

What is the key performance metric in a subscription market?

The key performance metric in a subscription market is typically the Monthly Recurring Revenue (MRR). It is a measure of the predictable revenue generated by your subscription business on a monthly basis.

How do you calculate average revenue per subscriber?

Average revenue per subscriber (ARPS) can be calculated by dividing total revenue by the total number of subscribers. Putler’s ARPS tracking feature provides real-time insights into the performance of your subscription business and helps optimize revenue growth.

How do you measure a subscription business?

A subscription business can be measured by tracking key metrics such as customer acquisition cost (CAC), customer lifetime value (CLV), churn rate, and monthly recurring revenue (MRR). Putler provides a comprehensive set of metrics to measure the performance of your subscription business, making it easier to identify areas for improvement.

Which metrics are used to measure subscription revenue?

Metrics commonly used to measure subscription revenue are Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), and Total Contract Value (TCV). These metrics give you an idea of the revenue generated by your subscription business.

What is the most important metric in SaaS?

The most important metric in SaaS is arguably customer lifetime value (CLV). CLV measures the total revenue a customer will generate over their lifetime with your business, and it is a key indicator of the long-term profitability of your SaaS business. Putler’s CLV tracking feature allows you to calculate and optimize this critical metric.

Very impressive article!! SaaS metrics are used to calculate MRR which will help to understand the health of the company, set goals for the future. Along with this most of the organizations are using CRM software or adopting the AI tools for evaluating and improving the business performance. There are some AI-powered tools such as CSAT.AI, MaestroQA, ScorebuddyQA, and Salesforce Einstein are well known in the current market trend.