Acquiring new customers is vital. However, a perspective which many of you miss is that for a business to be more successful, the most critical task is to develop long lasting customer relationships. That’s where the concept of customer lifetime value comes into play.

Customer loyalty and customer retention and generating repeat customers is of utmost important for any online business.

Hence, if you do not look at the value from customers you acquire and nurture, you are missing out on a critical piece of the success jigsaw.

What is Customer Lifetime Value / What is LTV?

Customer lifetime value (CLV) or CLTV or LTV is the estimated net profit a company can fetch from a customer’s business transactions in future before they churn. In other words, it is a predictive monetary value that can come through the customer relationship in future.

CLV is the most important metric for every ecommerce business.

Customer lifetime value assesses the financial value of each customer or his top spending power. If calculated currently, CLV can provide great insights into how much the customers spend, how much recently and how often.

Also, it provides an insight into what are some of the perks or programs that further encourage their spending and retention.

Factors contributing to LTV

Here’s what you should consider for LTV calculation:

Churn Rate

Also known as attrition rate, it shows customers who stopped purchasing from you in a given period.

Brand Loyalty

It denotes how dedicated a customer is to your brand, contributing to revenue and advocacy.

Sales & Marketing Scalability

If your revenue increases as a result of sales and marketing efforts, you need to optimize them. Track key metrics for this using Putler.

Customer Lifetime Value Calculations

CLV calculation is mostly empirical and may use complicated and analytical prediction methods Let’s look at some of the most common approaches.

This formula is the simplest way to calculate customer LTV.

But, this CLV formula is too simple, age-old and does not give correct results as different customers may have different future relationship with the company.

This is further elaborated to find out average customer value and then the CLV.

This formula is the most commonly used and probably the most correct LTV calculator.

In this customer lifetime value formula, average recurring revenue per user is the total revenue given by the customer divided by the number of months old the customer is. The churn rate implies the number of customers who leave the company or the churn can be simply referred as the “lost customers”.

Why is LTV important?

Lifetime value of a customer gives a long-term perspective of growth, especially for eCommerce businesses.

- Helps Customer Segmentation

- Improves Customer Retention

- Betters Marketing Efforts

- Impacts the Bottom Line

- Brings in Stable Cash Flow

- Aids Expansion Efforts

LTV calculation lets you segment customers based on value. For instance, by segmenting them, you can upsell to less valuable ones.

By providing targeted services, you’ll have satisfied customers. If they’re happy, they’ll stick around for more.

Understanding how to calculate LTV takes you on an in-depth journey of how your customer thinks, what they need, and more. Eventually, your marketing gets better.

If you optimize using LTV calculator, you can bring down customer acquisition cost, giving you higher profit margins.

Returning customers also guarantee a steady cash inflow. Plus, higher profit margins help with operational expenses.

With bigger profit margins, you can reinvest more into business expansion. This may include exploring new markets, new products or improving existing ones.

Why is it an Important SaaS Metric?

CLV is considered as an important metric because of the the customer-centric view provided by it. CLV guides some crucial sales and marketing strategies of your SaaS business, including some critical ones like cross-selling, retention, upselling and support.

How much to spend on acquisition is decided by it

Customer retention is the key and many SaaS industries spend 5-7 times more on acquisition of new customers rather than spending on their retention.

But what is Customer Acquisition? As the name itself tells, Customer Acquisition is the total amount of money one spend to acquire a new customer

It implies that the actual cost of acquiring a new customer should be lower than the overall revenue derived from the customers. It is very basic with null complexity but it carries a potential to reduce profit generation for lots of SaaS business

You can have a better understanding of your customer’s behavior

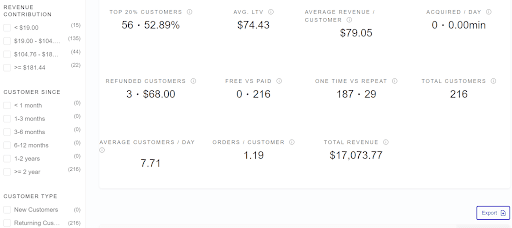

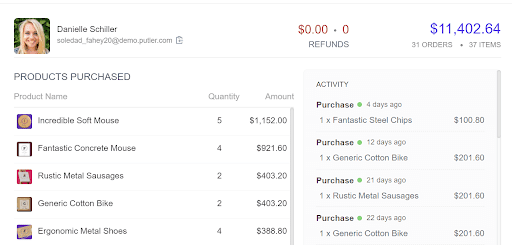

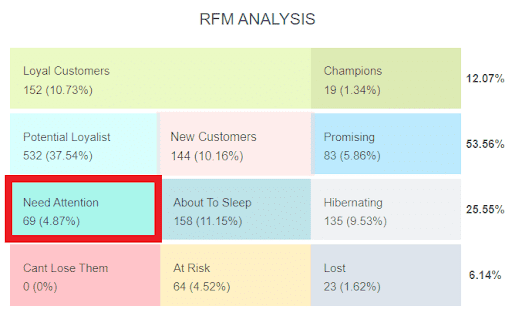

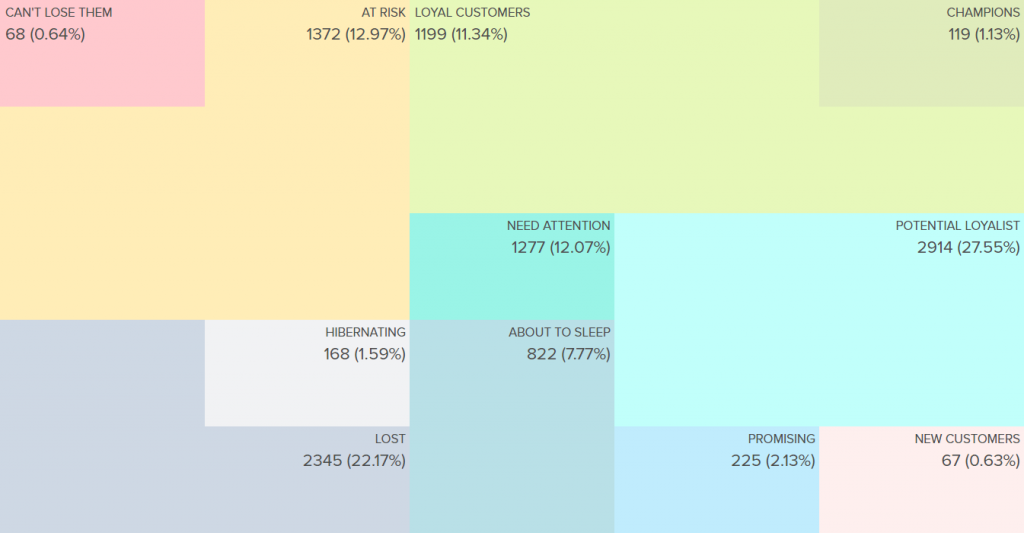

Segmenting your customers plays a predominant role here. It might become hectic to keep a track of each customer right? Putler understands you and it made this really easy for you by it’s customer segmentation (url)

And voila! It will be much easier for you to understand your customers better.

LTV dictates acceptable Customer Acquisition Cost (CAC)

CAC and LTV meaning have an inverse relationship. The more it costs to acquire customers, the lower will your LTV be. So, how can you get the best of both?

Optimize LTV vs CAC

David Slok, entrepreneur turned venture capitalist, offers insights on how to calculate LTV and suggests

- LTV should be > than CAC. For SaaS (or subscription) businesses, the LTV should be 3 x CAC.

- You should aim to recover CAC in < 12 months. If it exceeds this timeline, you’ll be using up too much capital to grow.

Determine & Track Sales Success

Check how your marketing campaigns and sales touchpoints are doing. If they’re doing good, chances are your CAC will be lower than LTV. If you can increase the LTV, you can spend more on acquiring new customers.

Understand your Best Customer Persona

Drawing up your best customer’s persona will improve marketing activities. There’s ample information available, but businesses often look at multiple channels for customer data. Putler’s customer dashboard can help with analytics from several platforms in one place.

Check Success of Features, Add-ons and Retention efforts

Let’s take HubSpot as an example. The brand prizes customer service, segments customers, provides add-ons based on value, and has a ton of features that keep customers engaged. Doing so, they increase LTV and reduce CAC.

Conduct SaaS financial planning & growth projections

You can project growth using the LTV calculator. IBM used it to increase revenue by about $20 million. It looked at customers in different value segments, allocated resources to reduce churn, and increased market productivity.

Why CLV is useful for ecommerce businesses?

An E-consultancy service surveyed more than 1,000 digital marketers and ecommerce professionals and reported that, a whopping 60% are not utilizing the amazing marketing insights that CLV data has to offer

FACT: It is undoubtedly hard to calculate LTV but it also undoubtedly helps managers decide where they need to allocate company’s resources and also forecast budgets and expenses of activities such as customer acquisition, advertising, marketing, etc.

This lifetime value formula helps e-commerce businesses to identify the most profitable customers. Hence businesses must focus on creating value for the customer and also devise customer retention strategies rather than just selling products to customers.

The Guide to Customer Lifetime Value (CLV) in eCommerce

Case Study: How Tea Forte’s CLTV was increased by 25%

How CLTV can turn around the tables is practically told in this case study.

Tea forte which is popularly known for its classy handcrafted teas along with luxurious packaging is liked among many tea drinkers. But that wasn’t enough as it was lacking consistent marketing strategy.

By smartly using customer segmentation and campaigns, it saw more than 20X return on spend and that too in just a year or less! With this their customer lifetime value was also increased by 25%. They simply pinpointed the right customers and messaged them at the right time.

It helped Tea Forte to gain a much deeper understanding of order, product data and their customer.

According to Tea Forte’s VP of Ecommerce and Digital, Jurgen Nebelung, customer-centric marketing data and analysis is more important than campaign-centric one.

It simply proves that taking crucial steps in understanding your customers can bring your business to a boom.

Customer Lifetime Value Maximizing Campaigns

We keep the main aim to increase repeat purchase rate and to retain the customer. It’s obviously easier said than done yet if the correct measures are taken, you will surely see the desired changes:

Here are four example campaigns incorporating each and everything that matters about Customer Lifetime Value into targeting, messaging, design and smart copy.

Repeat Purchase Campaigns

From classic email for cart abandonment to post-purchase messages saying thank you counts in increasing the chances for a second purchase, hence increasing the CLTV too. The first-time purchasers won’t be as valuable as repeat purchasers. Encouraging repeat purchases might imply in offering free shipping for first-time customers and a discount when they place their second order. Just a comprehensive understanding of CLTV is needed.

Replenishment Campaigns

The smart way to put new customers on a road to become loyal ones is Replenishment Campaigns. If you sell consumable or replaceable products then it will definitely help to up your CLTV. The reason lies here that it drives much more predictable revenue with gain I’m profit from your customers and this implies well on your repeat customers.

Cross-Selling Campaigns

Not every customer has the same requirement, in that case, you just have to keep a track of the customer’s needs and act accordingly, it will increase CLTV.

Loyalty Campaigns

You can conduct various loyalty campaigns like offering them rewards for purchases, giving incentives in case of frequent purchases, will boost up your CLTV

Three ways to extend LTV

Cross-sell or Upsell

Cross-sell a similar product to customers. For instance, someone building a website may also look for content services. Offer them that.

Upsell an upgraded version of your product. For example, if a customer uses a basic level subscription, get them upgraded to the premium one.

Expand the Product Line

Expand your line and include more products for your customers. This way, they don’t move to businesses with a more wholesome offering.

Scale Pricing using a Value Metric

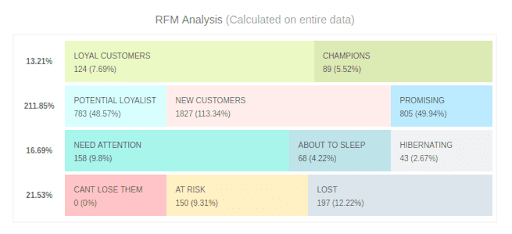

You need to scale when demand increases. Putler helps scale pricing with its location- and seasonal trend-based features plus RFM analysis. Use these value metrics to determine the right time to scale pricing.

Starbucks CLV Case Study Summary

One real life business that pays attention to CLV is Starbucks. They have outlets almost everywhere. Also they offer nice interiors, free Wi-Fi, exposure to premium products, etc. Starbucks provides all these facilities with an intention to provide value for their clientele and not just sell a cup of coffee.

Difficulties with Customer Lifetime Value Calculations

An E-consultancy survey revealed that more than 58% of businesses were not able to calculate lifetime value or correct CLV.

Some major LTV calculation limitations are:

- It takes a lot of effort and time to manually calculate CLV for the large data sets

- Calculating correct CLV is a tedious task with a high degree of difficulty. The formulas are often confusing and it may take serious efforts to effectively or accurately calculate CLV.

- Since there are a number of ways to calculate CLV, there are varied opinions. While some would like to subtract the cost of acquisition before calculating CLV, some may not.

- Some may also give due diligence to the theory of profit margin in calculating CLV, while for others this idea won’t work. This often causes disputes and results in a deadlock.

- Many customers are mostly one-time purchasers

How to overcome difficulties & improve your CLV?

Here’s an example: One ecommerce giant named Flipkart started an online venture by offering books at a discount rate. Gradually, they expanded in many segments and they started offering most of their products at discounted rates.

This became their USP and they acquired many new customers. Due to product diversification, the frequency of purchase by the customers increased manifold hence improving their CLV.

You have understood and also calculated CLTV but there is still room for improvement, let’s have a look at these points below for it’s better understanding.

1. Using customer data to deliver targeted content

Customer’s data is the key to level up, customer’s data directly helps you to segment them and then take steps accordingly but as I already mentioned that it is a tiresome job to segment each customer but Putler does understand that and has come up with customer segmentation to reduce your load. If you do take steps accordingly, you will also see an increase in conversion rate.

2. Personalizing your messages for each customer and it’s lifecycle

Tracking and observing every interaction of customers in real- time is a good way to send them personalized messages. The message will be according to their need or query, this way they will know that you care about giving them attention individually and hence will respond to you accordingly.

How can you increase LTV?

Understand the LTV meaning and influence customers:

Improve Customer Onboarding

The buck doesn’t stop with selling to a customer. How the customer experiences your brand extends to care after purchase, too. Putler’s dashboard offers insights on customers’ needs. Using this information, you can educate them about the product, and personalize communication.

Provide Value

Consider sharing valuable content with customers alongside promotional emails. Make them feel a part of your business. For example, share new updates about your product, or improvements in business processes that serve them better.

Invest in Customer Service

- Over 30% consumers considered switching brands after just one instance of bad customer service.

- 47% consumers made the switch in 2020.

Those numbers are pretty steep. But they show how important customer service is. Putler’s RFM analysis can show which customers you’re losing out. You can then take corrective action through superior customer service.

Don’t forget about Omnichannel Support

Customers today get in touch with a brand through multiple channels. Your Google Analytics dashboard is integrated with Putler’s. Using this feature, you can research and determine how customers connect with you, and increase presence on those channels.

Listen to Customers

Customers provide valuable feedback. Having an in-depth understanding of their needs lets you prioritize activities that contribute to satisfaction and eventually, higher revenue. Some ways to do this are customer satisfaction surveys or social media comments.

Re-engage with Customers

Re-engaging with customers who interacted with you before can extend LTV. Through retargeting, you can increase brand recognition. For instance, use Putler’s RFM analysis and reach out to customers who need attention, reminding them of your offerings.

Increase Brand Loyalty

With all your efforts to engage with and retain customers, you’re getting them to stick. You can increase this further by rewarding repeat customers. Implement a loyalty program that makes them feel happy about coming back to you. And in the process, increase LTV.

Here’s how you can improve your CLV (Effortlessly)

Now it’s the time to dig deeper to become a pro in the understanding of CLTV:

Mapping Your Ecommerce Marketing according to the Customer Lifecycle

Finding Out how you should plan each stage of the buying process will have its own personalized focus and uniqueness.

Behavioral Marketing: Maximizer of Customer Lifetime Value

Behavioral marketing is a really effective strategy. You can maximize CLV and also promote long term engagement.

Customer Retention should be at the apex

I already explained why customer retention is much better and economical than acquiring new customers. So, your primary focus should be on customer retention.

One of the best ways to increase CLV is to measure it and understand it.

And what if it’s readily available to you without you dealing with large customer database and calculating wrong clv using the formulas every now and then?

Seems great, isn’t it?

Thus, smart insights and readily available growth metrics provided by Putler can be your arsenals for success.

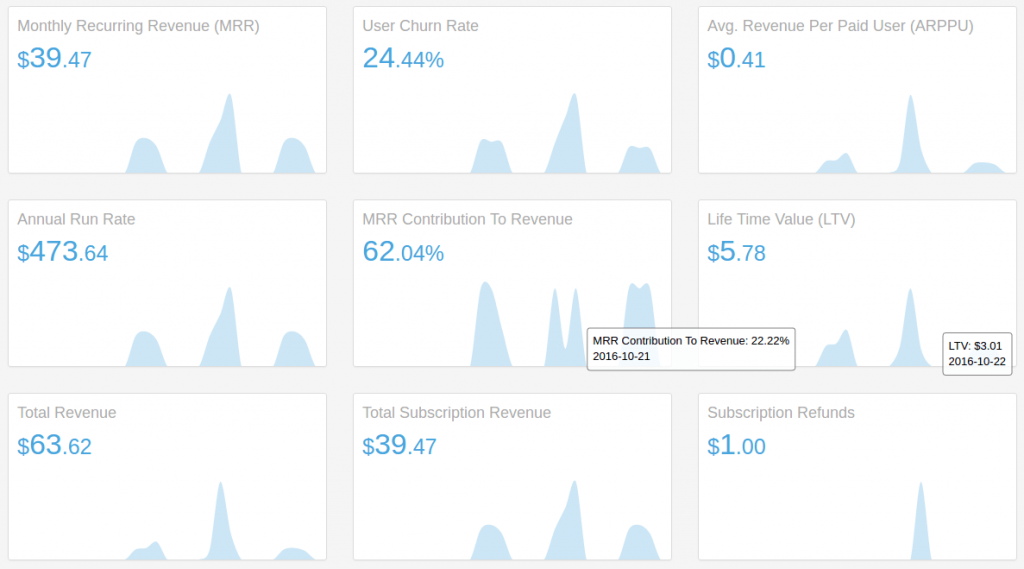

Putler’s subscriptions dashboard brings up the customer lifetime value along with other subscription metrics which you need to grow your business.

Moreover, Putler’s Recency Frequency Monetary (RFM) analysis is an ideal model for perfect customer segmentation.

This auto generated customer segments help ecommerce businesses find their best customers. Also it’s proven that targeting marketing promotions to such segments result in higher conversions.

Putler’s RFM can help understand most of the significant aspects and improving the CLV by:

- Increasing retention

- Identifying the customers who do not mind cross selling

- Recognizing customers that might respond positively

- Increasing customer’s delight

- Building referrals

- Enhancing ROI

and much more.

CLV Optimizations

When you look at the CLV formula, you can observe that Gross Margin values and ARPU should grow. Also, the churn should reduce resulting in increased customer lifetime value.

- For ARPU improvement, keep focusing on upselling your service. It directly means the usage of efficient strategies to make your present customers purchase more, be it through upgrades or discounts or coupons.

- For lowering of COGS, you should have efficient as well as effective service operations.

- For lowering of churn rate, you should shift your primary focus on customer retention.

Benefits of CLV

When calculated correctly, the business has a better idea of exactly how much the customer is likely to spend in the coming times.

CLV also inspires you to find new ways of formulating different programs and perks that may please the buyers even more to create customer delight. A delighted customer is a loyal customer and he will have a better and a longer future relationship. Thus making a profitable proposition for an ecommerce business.

This helps in increasing sales and results in customer profitability. A happy and satisfied customer also creates a favorable word of mouth generating the possibility of more customer acquisitions.

Also, knowing customers having lower CLV helps businesses alter their strategies and give a shot to extract more money from these customers. CLV also helps to identify churn rate and increase customer retention.

Leveraging Putler Metrics for Business Success

Once a company recognizes its most profitable customers using CLV, it can optimize the allocation of resources to maximize profits.

Businesses can take help from Putler to automatically calculate RFM scores and discover complete details of each customer segment.

Using these insights, companies can devise strategies like:

- Frequently rewarding their recently bought or most frequent buyers

- Targeted companies top-end products to customers paying high amount

- Offering loyalty program to frequent buyers

- Give free trials to the recent buyers.

- Send a tailor-made email with a personal touch to several buyers to build a better relationship with them.

Ready to Increase Your Business LTV?

Putler is a great tool for all the ecommerce businesses. It helps the ecommerce businesses to have a detailed insight on many variants like sales, customer hits, products etc.

Putler’s RFM combines the three most important business attributes to correctly target the customers. RFM analysis tells companies whether the customers are on the verge to churn, which segment must be retained, who are the loyal customers, and which segment of the customers must be targeted for a better CLV and hence a better revenue.

FAQs

Q1. Does Putler offer LTV insights?

Yes, Putler’s Customer dashboard offers in-depth LTV insights – information on customers, products purchased, RFM analysis, and more.

Q2. What are some common LTV mistakes to avoid?

Some mistakes you can avoid are – understanding LTV calculator, misaligning LTV with business goals, inaccurately segmenting customers, setting unrealistic LTV numbers, and neglecting business scalability.

Q3. Will an Annual Billing Cycle improve LTV?

An annual billing cycle certainly helps. You can offer better value and service to customers who stay invested for a longer time. This also ensures predictable revenue.

Amazon, Zappos…9 customer lifetime value case studies summary