Remember when we all thought grocery shopping would forever remain an in-person experience? That consumers would always want to squeeze their avocados and smell their melons before buying?

Well, the pandemic changed all that practically overnight, and now there’s no going back.

The FMCG industry has undergone a seismic shift online, and even the most traditional brands have had to adapt or risk becoming yesterday’s news.

- Procter & Gamble now earns over 14% of revenue from digital channels, double in just three years.

- PepsiCo launched two DTC platforms, Snacks.com and PantryShop.com.

- FreshDirect, an online grocer delivering fresh food directly to consumers in New York.

The list goes on.

But here’s the thing – simply having an online presence isn’t enough anymore. The difference between the FMCG brands that are thriving online and those that are merely surviving comes down to one critical factor: Analytics for FMCG Companies.

What you will find in this article

I don’t want to mislead anyone, so let me clarify what you’ll find in this article.

- This article mainly focuses on FMCG businesses that operate online or through eCommerce.

- It covers the common challenges they face, how analytics for FMCG Companies can drive business growth, and FMCG analytics that can help achieve that.

If you’re just getting started with tracking your online store’s performance, check out our eCommerce Analytics 101 guide. It answers all your questions in simple, practical terms.

That being said, let’s jump into the key pointers.

Why eCommerce-first FMCG brands need analytics

Here’s why eCommerce-based brands need FMCG analytics.

Too much data, not enough insight

When you run an online FMCG business, you’ll quickly find yourself collecting mountains of data without even trying.

Here’s what usually happens: You’ve got Shopify spitting out transaction data, Google Analytics tracking user behavior, Amazon providing seller metrics, your email platform generating engagement reports.

That’s not all, social media platforms offering their own insights, ad platforms showing campaign performance, and inventory management systems tracking stock movements.

The problem? All these systems don’t talk to each other. You end up with fragmented data living in different places, making it nearly impossible to connect cause and effect.

Like repeat customers in the Midwest, this coincided with a logistics issue that increased delivery times. That’s the difference between drowning in numbers and having actual insights.

Understanding what products are actually working

You might think you know which products in your catalog are winners, but I’ve seen countless FMCG brands get this completely wrong.

Why? Because they focus only on revenue numbers without digging deeper.

Here’s what usually happens: Your coconut water variety pack looks like your best seller based on total sales, so you double down on production and marketing.

Six months later, you’re wondering why profits are shrinking despite growing revenue.

The reality is much more complex.

That variety pack might generate high revenue, but when you factor in the higher production costs, complex fulfillment requirements, frequent customer service issues, and hefty return rates.

It might actually be losing money on every sale.

You’ll see which products bring in new customers versus which ones drive repeat purchases. You’ll understand which items frequently sell together and which ones are often returned. That’s why data analytics for FMCG Companies is crucial.

Running effective promotions (without guesswork)

Let’s be honest – most of us run promotions based on gut feeling or because our competitors are doing it.

“Let’s do 20% off for Black Friday” or “Let’s try free shipping this month” are common approaches, without any real analysis of whether these promotions actually generate profitable growth.

Here’s what usually happens: You run a promotion and see a sales spike. Everyone celebrates. But you don’t realize that you mainly sold to existing customers who would have purchased anyway (just later).

you slashed your margins unnecessarily deep, and many of these “deals” customers never come back.

You’ll see which promotions attract valuable new customers versus which ones just pull forward existing customer purchases.

For example, when you properly analyze your data, you might discover that free shipping with a minimum order threshold of $35 is more effective than a straight 15% discount.

Why? Because it preserves margins while increasing average order value. Or you might find that bundle offers outperform percentage discounts for certain product categories.

Retaining customers with smart segmentation

One of the biggest mistakes I see FMCG brands make is treating all customers the same. You send the same email to everyone. You show the same offers to everyone.

You recommend the same products to everyone. Without proper segmentation, you’re essentially trying to please everyone and ending up pleasing no one.

Here’s what usually happens: Your health-conscious customers get annoyed by your sugary product promotions.

Your price-sensitive customers ignore your premium line messaging. Your busy professionals get frustrated by your complex DIY recipes.

If you’re like most FMCG brands today, you’re selling across multiple channels – your own website, Amazon, Shopify, grocery delivery apps, and maybe even brick-and-mortar stores. Each channel shows you different data in different formats with different metrics.

Here’s what typically happens: You see strong sales on Amazon but can’t connect those customers to your direct website visitors.

You notice inventory disappearing faster than expected, but struggle to forecast demand across platforms. Your marketing team can’t tell which channels new customers discover you on versus where they actually purchase.

You’ll see how customers move between channels throughout their journey. You’ll know which products perform best on specific platforms.

Putler: A simple tool to manage analytics for FMCG Companies

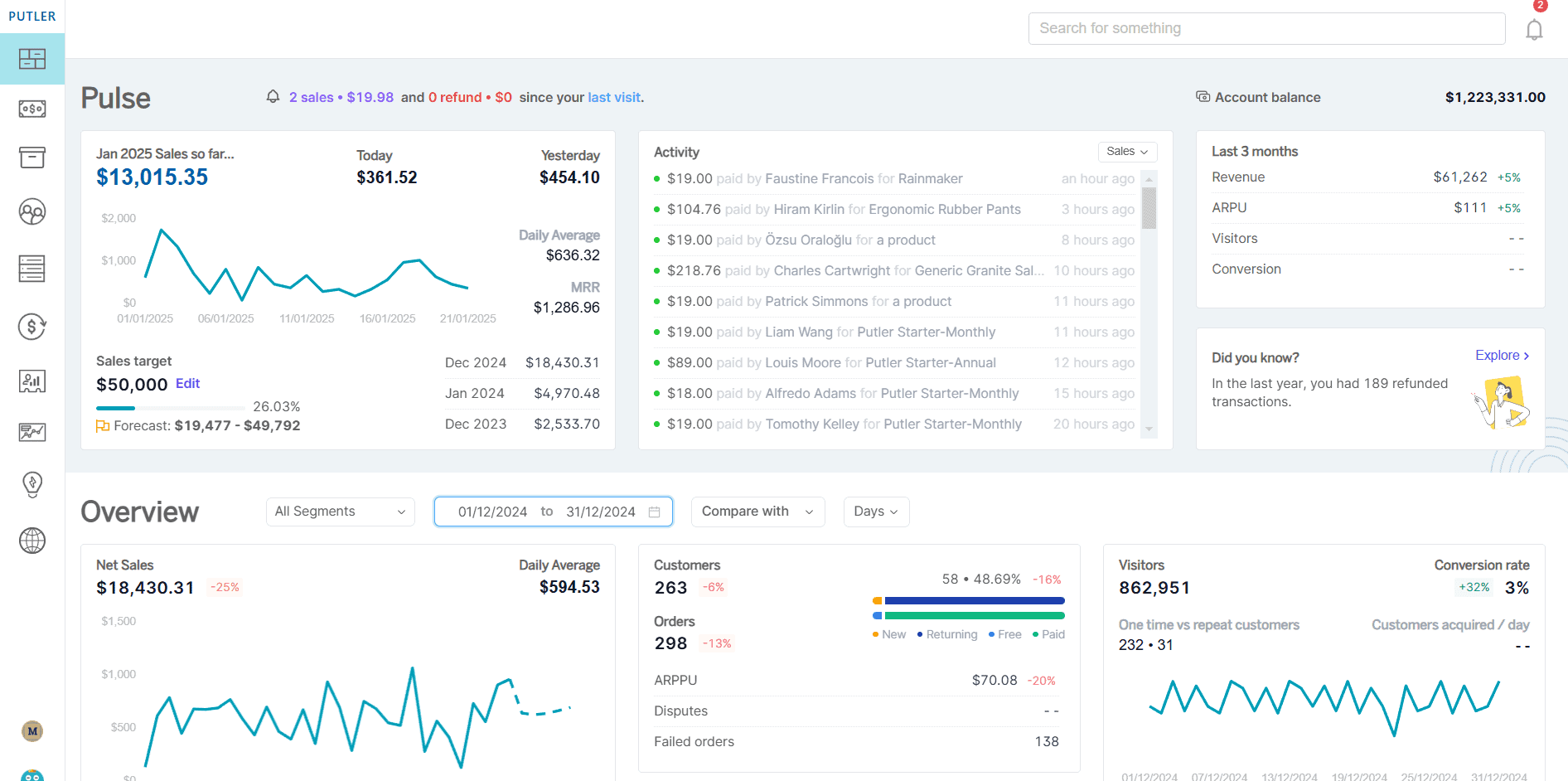

As someone who’s seen countless eCommerce businesses struggle with data overload, I’ve found Putler to be that “just right” solution for many brands that need insights without drowning in complexity.

But since every business has different needs, let’s take a look at what Putler can help with and where it may not be the right fit.

Multi-channel sales and product tracking

Remember that multi-channel chaos I mentioned earlier? Putler tackles this head-on with its impressive integration capabilities.

With 17+ direct integrations, including all the places you’re likely selling (Shopify, WooCommerce, Amazon), collecting payments (Stripe, PayPal), tracking visitors (Google Analytics), and managing email campaigns (Mailchimp, Icegram), Putler creates a unified data ecosystem.

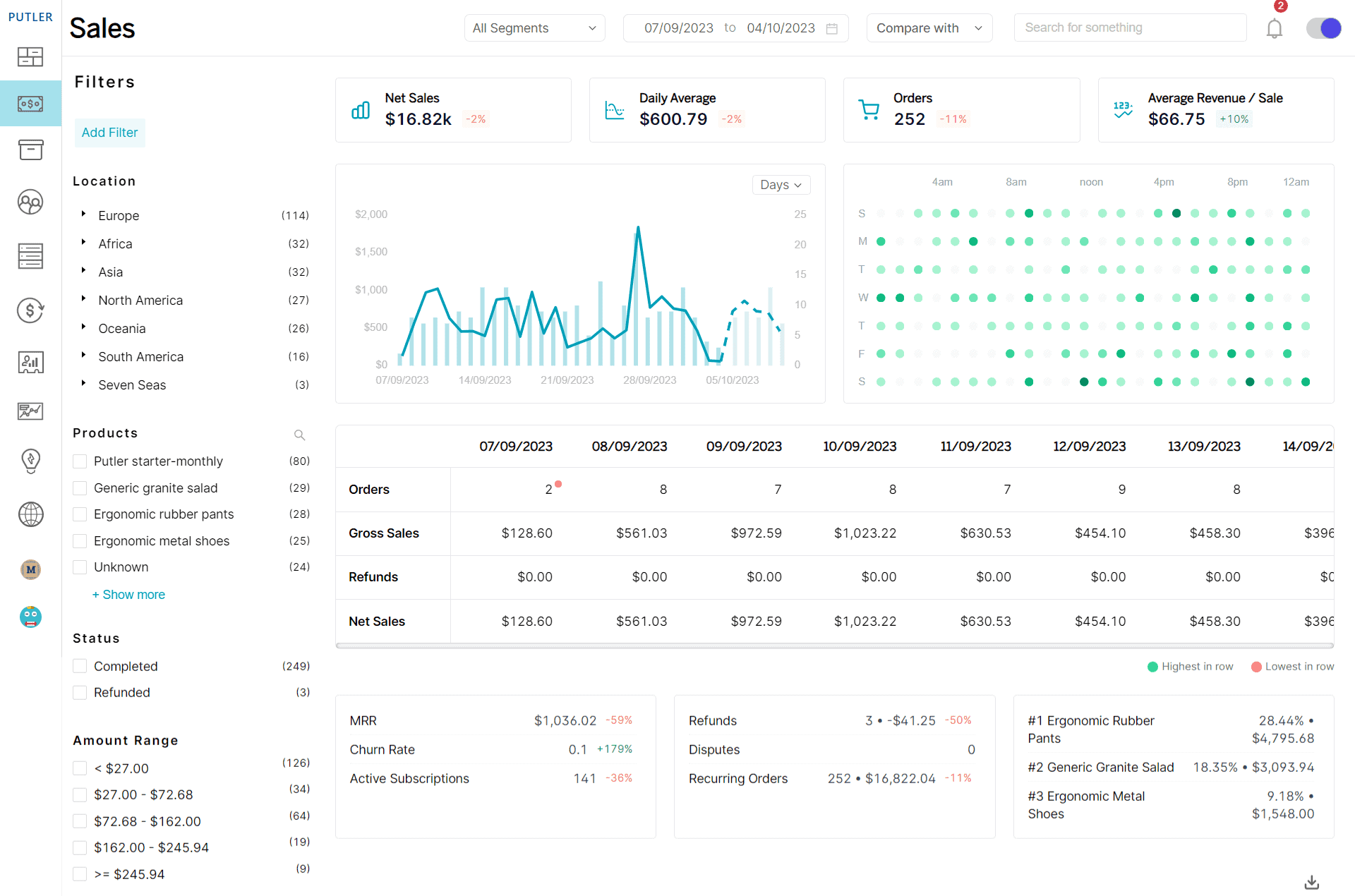

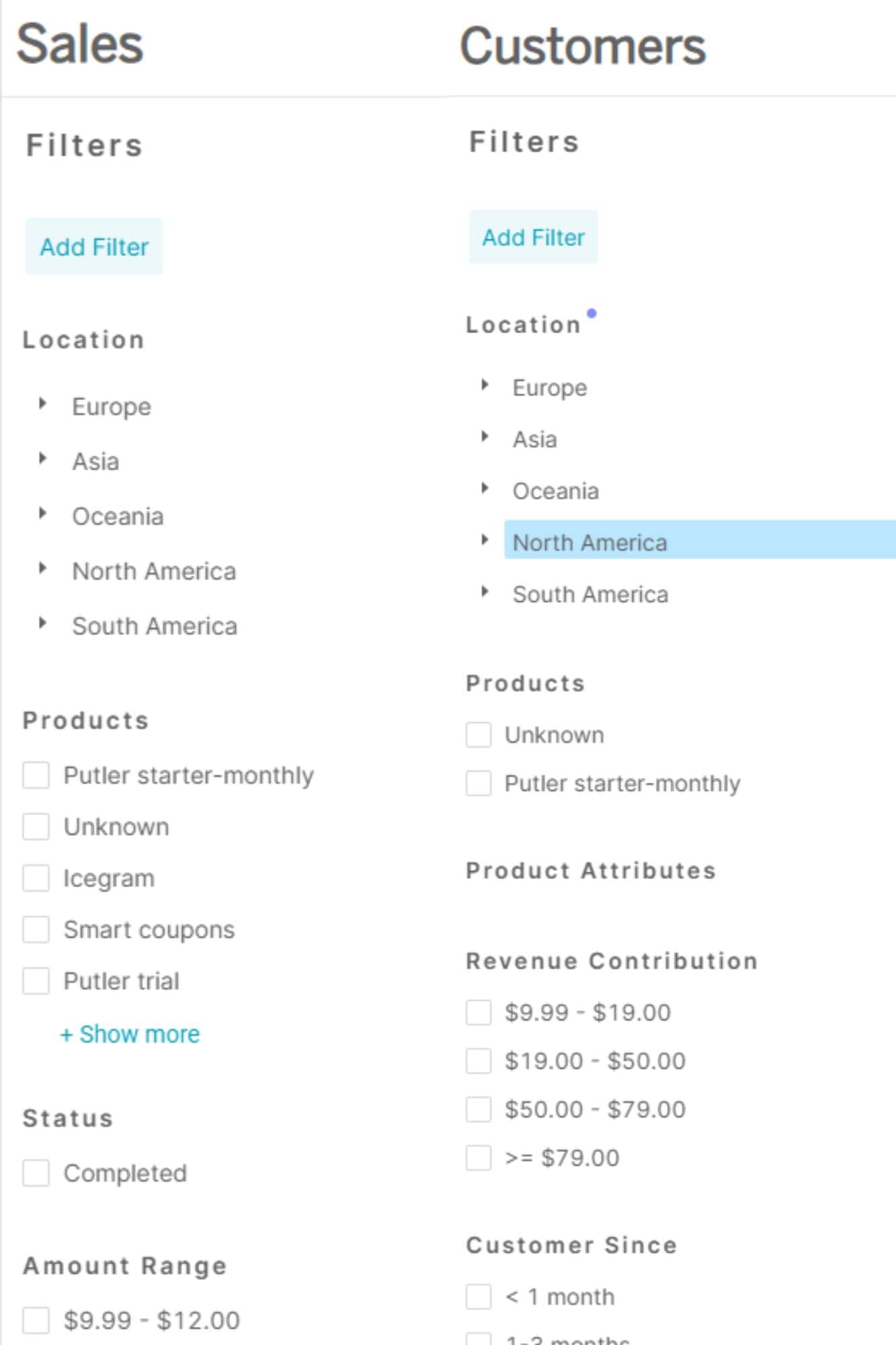

Easy filters for deeper campaign analysis

Perhaps the most underrated feature of Putler is its flexible filtering system. While many FMCG analytics tools offer basic filtering, Putler takes it to another level with what they call “infinite filters.”

The filters span every dimension of your business:

- Location-based filters

- Product-specific filters

- Revenue-based filters

- Order status filters

- Custom filters and much more

What’s truly powerful is the ability to combine these filters and save your favorite combinations. This means you can quickly check the same slice of data week after week to track progress.

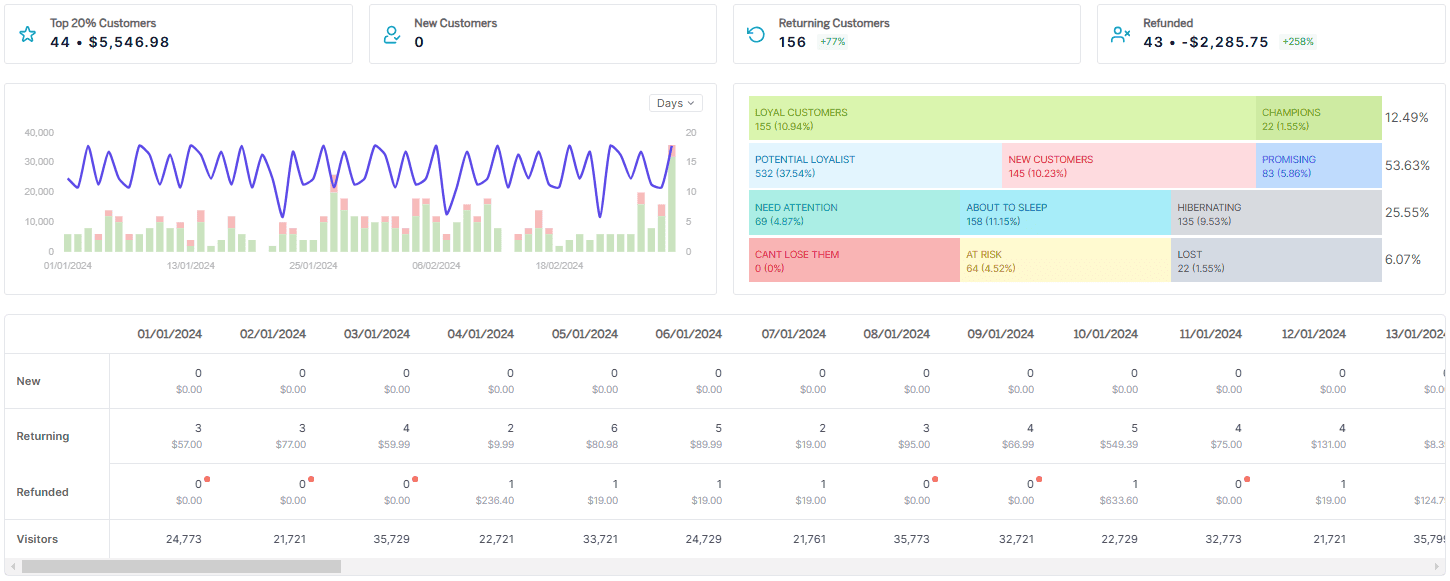

Advanced customer segmentation

If you’ve been in eCommerce for more than five minutes, you’ve probably heard about the importance of segmentation. But most brands I work with find it incredibly time-consuming to actually implement. This is where Putler’s one-click RFM segmentation becomes a game-changer.

RFM stands for Recency, Frequency, and Monetary value. The three key dimensions of customer behavior. With literally one click, Putler analyzes your entire customer base and sorts them into actionable segments:

- Champions – Your loyal, high-value customers who need VIP treatment

- At Risk – Previously good customers showing signs of slipping away

- Need Attention – Regular customers who haven’t purchased recently

- Promising – New customers showing potential to become regulars

- Can’t Lose – Former high-value customers who’ve gone inactive

The beauty of Putler’s approach is that it’s dynamic – customers automatically move between segments as their behavior changes, so your marketing always stays relevant. No more sending “new customer” emails to people who’ve already bought five times.

Weekly insights delivered automatically

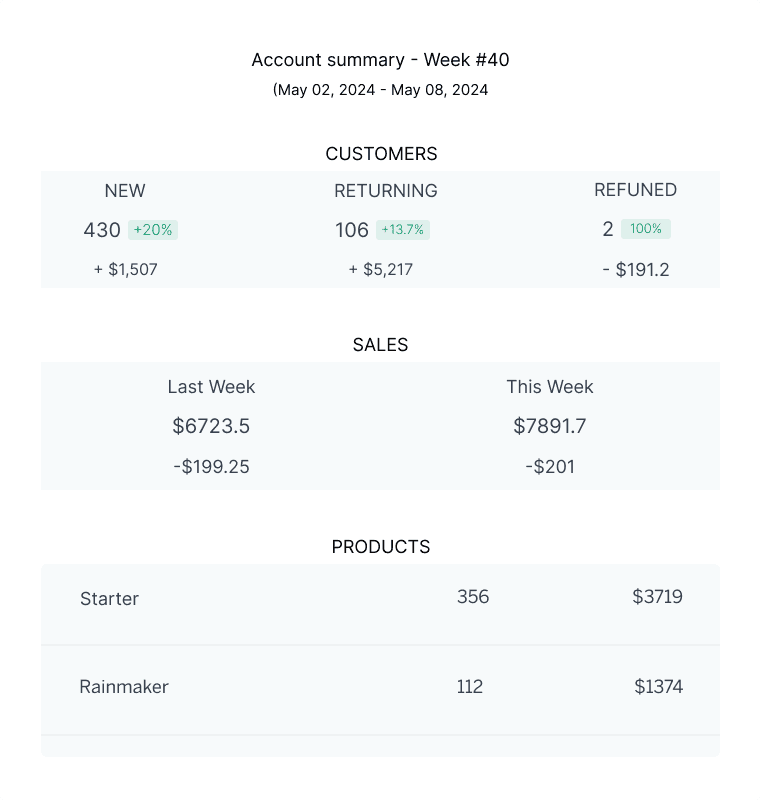

One of my favorite Putler features is something that sounds simple but delivers tremendous value: automatic weekly insight emails.

Every week, you’ll receive a digest of your key business metrics, noteworthy trends, and actionable insights.

This isn’t just a data dump – Putler actually analyzes changes and highlights what deserves your attention.

For example, it might flag that your conversion rate dropped, or that a particular product is selling unusually well in a specific region.

The real value here is that you don’t need to remember to log in and check dashboards. The insights come to you, becoming a natural part of your weekly business rhythm.

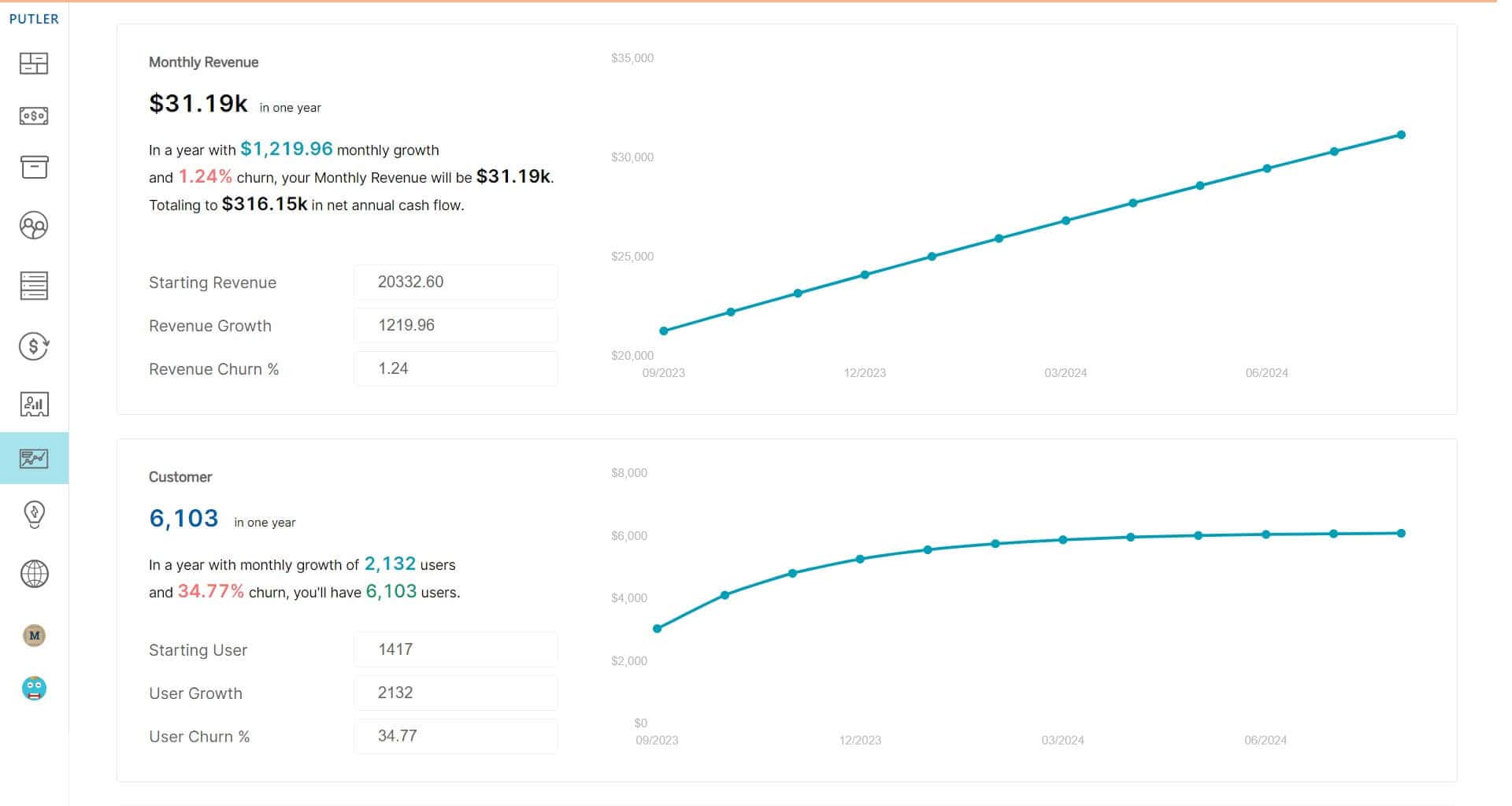

Built-in forecasting

If you’ve ever launched a new product only to run out of stock in days (or worse, been stuck with excess inventory), you’ll appreciate Putler’s forecasting capabilities.

Using your historical data, Putler can predict future customer growth, and revenue trends with surprising accuracy.

What Putler doesn’t do (and when to upgrade to something else)

While Putler is a great choice for analytics for FMCG companies, I’m a big believer in using the right tool for the right job. Let’s talk honestly about where Putler might not be the perfect fit for your needs.

Need deep POS data or ERP integrations?

If your business has a significant brick-and-mortar presence alongside your eCommerce operations, Putler might not give you the complete picture you need.

While it excels at pulling together online sales channels, it doesn’t offer integrations with major Point of Sale (POS) systems or Enterprise Resource Planning (ERP) platforms .

For brands with complex multi-location retail operations or sophisticated supply chain management needs, you might need to look at more enterprise-focused solutions like Domo or Tableau.

Subscription-first business? (Caution flag)

Here’s where things get a bit nuanced. Putler does offer solid subscription analytics with built-in SaaS dashboards covering critical metrics like churn rate, MRR (Monthly Recurring Revenue), LTV, and more. For many FMCG brands with a subscription component, this is perfectly adequate.

However, if your business model is primarily subscription-based with complex subscription tiers, variable billing cycles, or if you need cohort analysis at a very granular level, you might eventually want something more specialized like ProfitWell, Baremetrics, or ChartMogul.

That said, if subscriptions are just one part of your overall FMCG business, Putler’s subscription analytics will likely serve you well without needing a separate tool.

Should you still consider Putler? (Yes — if…)

Here’s my honest assessment of when Putler is the right choice.

You sell online via Shopify / WooCommerce / Amazon

If your business primarily sells through major eCommerce platforms, Putler is designed specifically for you. Its integrations with these platforms are rock-solid, and it solves the exact problems that multichannel online sellers face.

Putler particularly shines if you sell across multiple platforms – for instance, maintaining your own Shopify store while also selling on Amazon and maybe even running a WooCommerce site for wholesale orders.

The ability to unify data across these channels provides insights you simply can’t get from the native analytics of each platform.

You want quick, business-ready insights — not dashboards to manage

Here’s an unpopular opinion: many FMCG analytics tools create more work than they solve. They give you powerful dashboard builders and visualization tools, but then leave you to figure out what matters and how to interpret it.

If you don’t have a dedicated analytics person on your team (and most growing FMCG brands don’t), Putler’s approach will likely feel refreshing. Instead of giving you tools to build your own analytics, it gives you pre-built dashboards and insights that are ready to use for eCommerce businesses.

This “business-ready” approach means you’ll spend time acting on insights rather than configuring dashboards. You don’t need to know SQL or data modeling – Putler has already done that work for you.

You need clarity, not complexity

The final and perhaps most important consideration is your team’s relationship with data. If you’re a founder or marketer who gets overwhelmed by complex FMCG data analytics platforms, Putler offers that rare combination of depth without overwhelming complexity.

Putler strikes that balance of providing genuinely useful insights without requiring you to become a data scientist. Its interface is approachable, its reports are understandable, and its insights are actionable.

Conclusion

When you connect all your FMCG data in one place, you stop guessing and start growing.

You don’t just spot problems—you fix them before they get worse. And when your team has real-time visibility, every decision gets sharper.

That’s how you stay ahead in a fast-moving market.

- Best eCommerce Analytics Software for Business Success in 2025

- Analytics Dashboard – Importance, Types, and Best Tools in 2025

- The Best Web Analytics Tools for Your Website (2025)

- A Beginners Guide to Use Data Analytics for Marketing in 2025

- Subscription Analytics Tools: The Details You Need to Know About (2025)