Think of setting up multiple Braintree account configurations, like having different cash registers for different parts of your business.

You might have one for your online store, another for your mobile app, and maybe a third for your wholesale operations.

Each serves the same purpose, processing payments – but they’re organized to keep your business channels neat and tidy.

Let me break down exactly what we mean by ‘multiple Braintree accounts‘ and how this structure actually works.

What are multiple Braintree accounts?

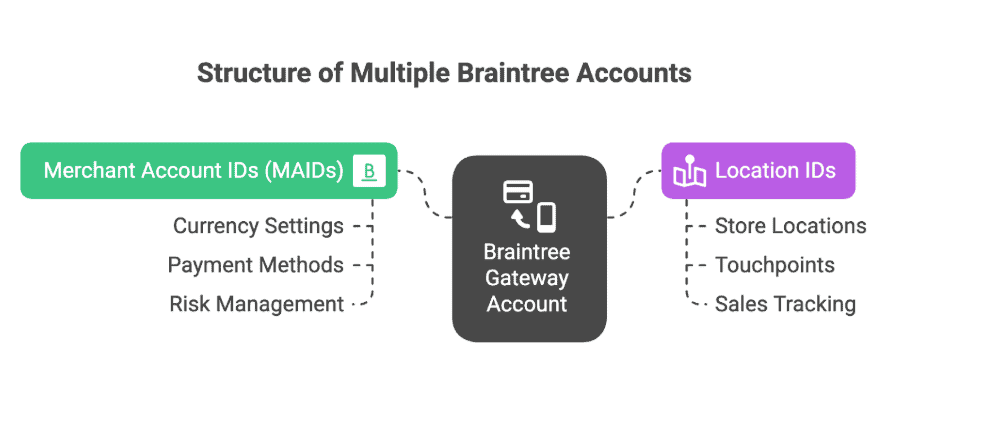

At its core, a multiple Braintree merchant accounts setup refers to having more than one merchant account within your Braintree gateway ecosystem.

The Braintree Gateway Account can house multiple merchant accounts, creating what I like to call a “payment umbrella” over your entire business operation.

Here’s how the structure breaks down:

Account hierarchy overview

- Gateway account (Merchant ID): Your main account umbrella that holds everything together

- Merchant account IDs (MAIDs): Individual payment channels under that umbrella

- Location IDs: Virtual layers for specific store locations or touchpoints

I’ve seen businesses get confused about this hierarchy, but once you understand it’s easy – each layer serves a specific purpose while fitting inside the larger structure.

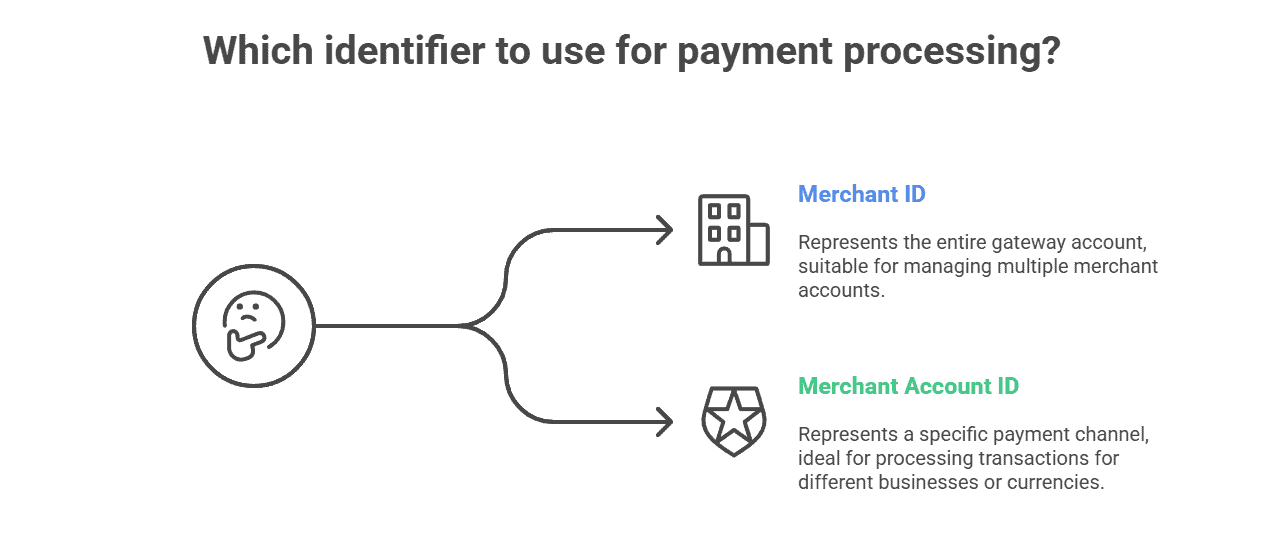

Before we go further, it’s crucial to understand the difference between your gateway and merchant account IDs, this trips up a lot of people.

Braintree gateway vs merchant account ID

Your merchant ID is the unique identifier for your entire gateway account, including the multiple merchant accounts that may be in your gateway, while each merchant account ID represents a specific payment channel.

Think of it this way:

- Merchant ID: Your business’s main address (the whole building)

- Merchant account ID: Individual apartment numbers within that building

A single Braintree gateway can have multiple merchant accounts to process transactions for different businesses or currencies.

This flexibility is what makes multiple account setups so powerful for growing businesses.

Now that you understand the basic structure, let’s explore the different ways you can configure multiple Braintree accounts for your business.

What types of multiple Braintree account setups are available?

When I first started working with Braintree configurations, I was amazed by how many ways you can structure your payment setup.

Let me walk you through the main types of multiple Braintree account setups I’ve seen work brilliantly for different businesses.

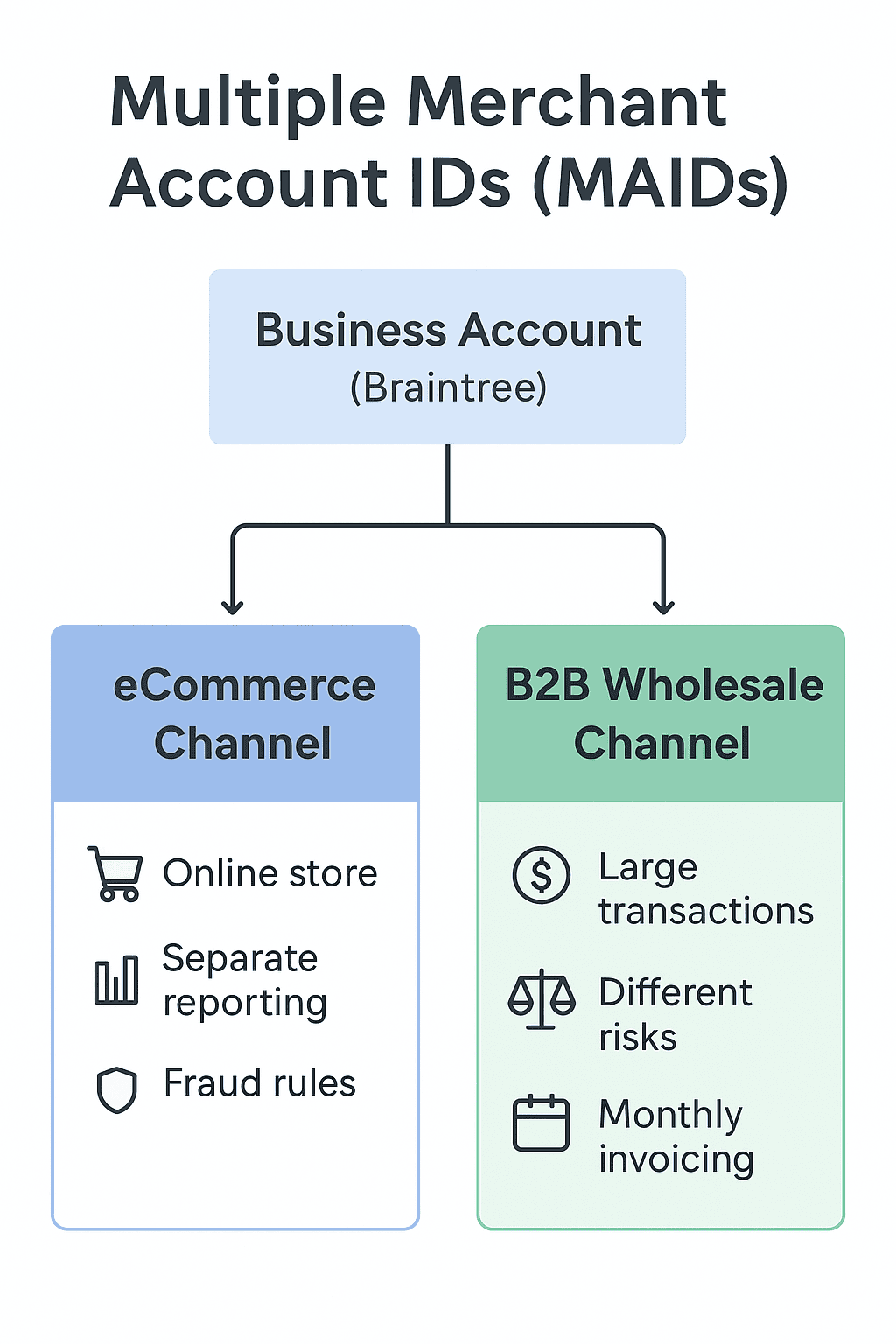

Multiple merchant account IDs (MAIDs)

This is probably the most common setup I encounter, and for good reason – it’s incredibly flexible.

The Braintree Merchant Account ID, or sometimes referred to as the “Merchant Account ID” or “MAID”, is an account tier that can be used to represent different channels of your business.

Think of MAIDs like different departments in your company, each with its own budget and purpose:

- eCommerce channel

- Your main online store transactions

- Separate reporting and settlement

- Custom fraud rules for online purchases

- B2B wholesale channel

- Larger transaction amounts and different risk profiles

- Monthly invoicing cycles

- Corporate payment methods

- Mobile app channel

- In-app purchases and subscriptions

- Different user experience requirements

- Mobile-specific payment methods

I’ve worked with clients who use this setup to keep their accounting clear – when tax season rolls around, they can instantly see which revenue came from which channel.

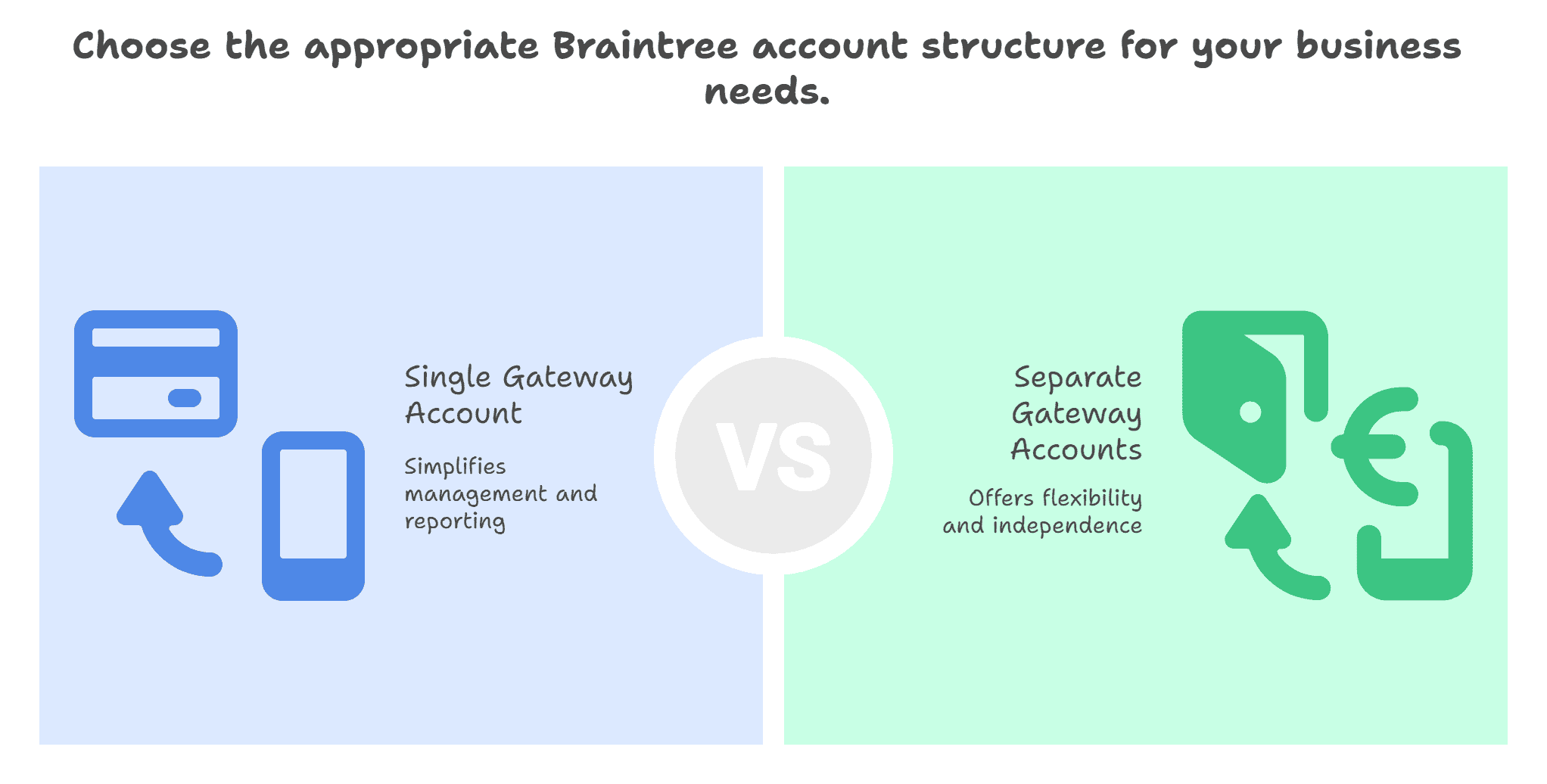

Separate Braintree gateway accounts

Now, this is where things get more complex, but sometimes it’s exactly what you need.

Instead of multiple merchant accounts under one gateway, you’re looking at completely separate gateway accounts.

It’s like having separate businesses entirely, each with its own payment infrastructure.

When this makes sense:

- Completely different legal entities

- Distinct brands with separate operations

- Geographic compliance requirements

- Independent accounting and reporting needs

The trade-off here is that you lose some of the integrated benefits like shared customer vaults and unified reporting, but you gain complete separation and control.

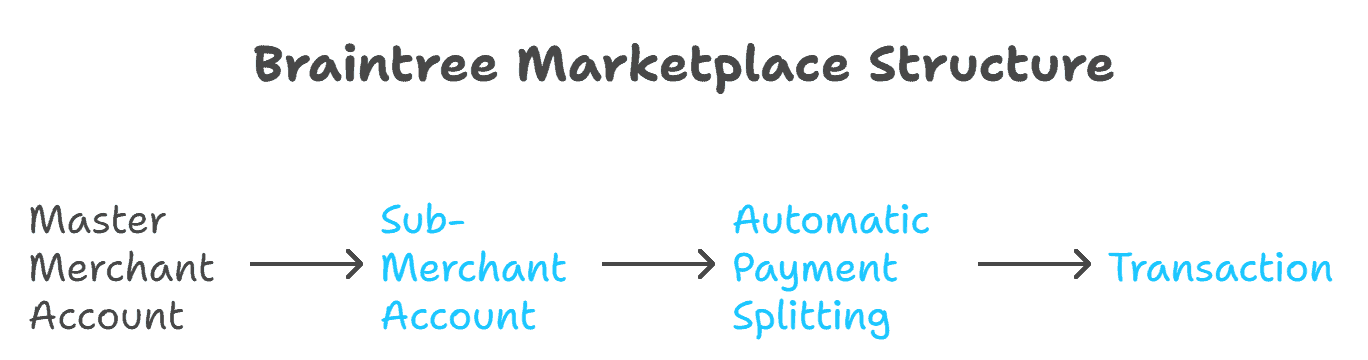

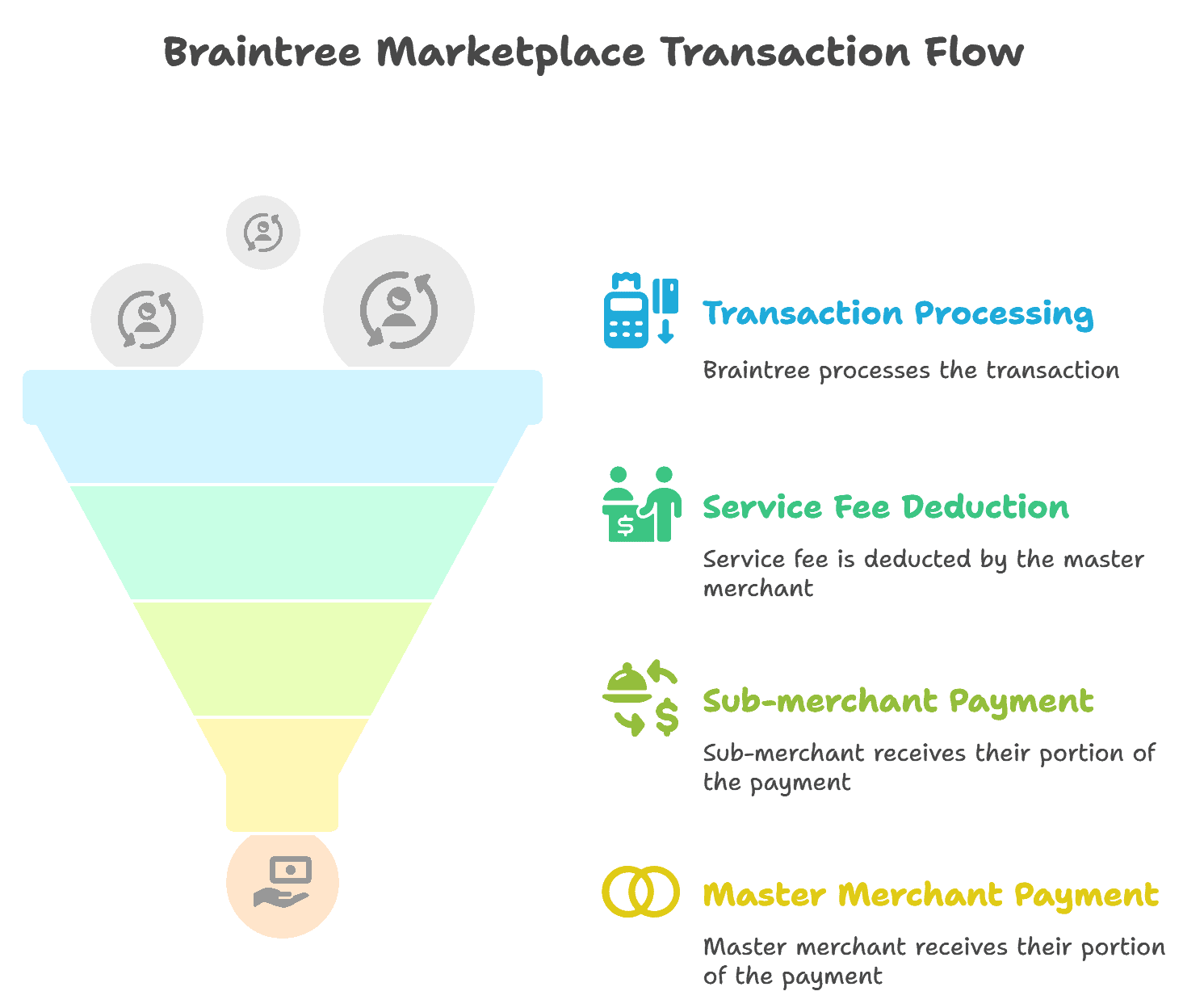

Braintree marketplace structure

Braintree Marketplace allows you to split transactions and pay your providers through Braintree’s gateway.

How the marketplace works:

- Master merchant account: You (the platform owner)

- Sub-merchant accounts: Your sellers or service providers

- Automatic payment splitting: Braintree handles distribution

With Braintree Marketplace transactions, you can only split funds between two parties – yourself as the master merchant, and a single sub-merchant account per transaction.

You cannot split between multiple sub-merchants in one go.

Perfect for:

- Online marketplaces (think Etsy or Shopify)

- Service platforms with multiple providers

- Commission-based business models

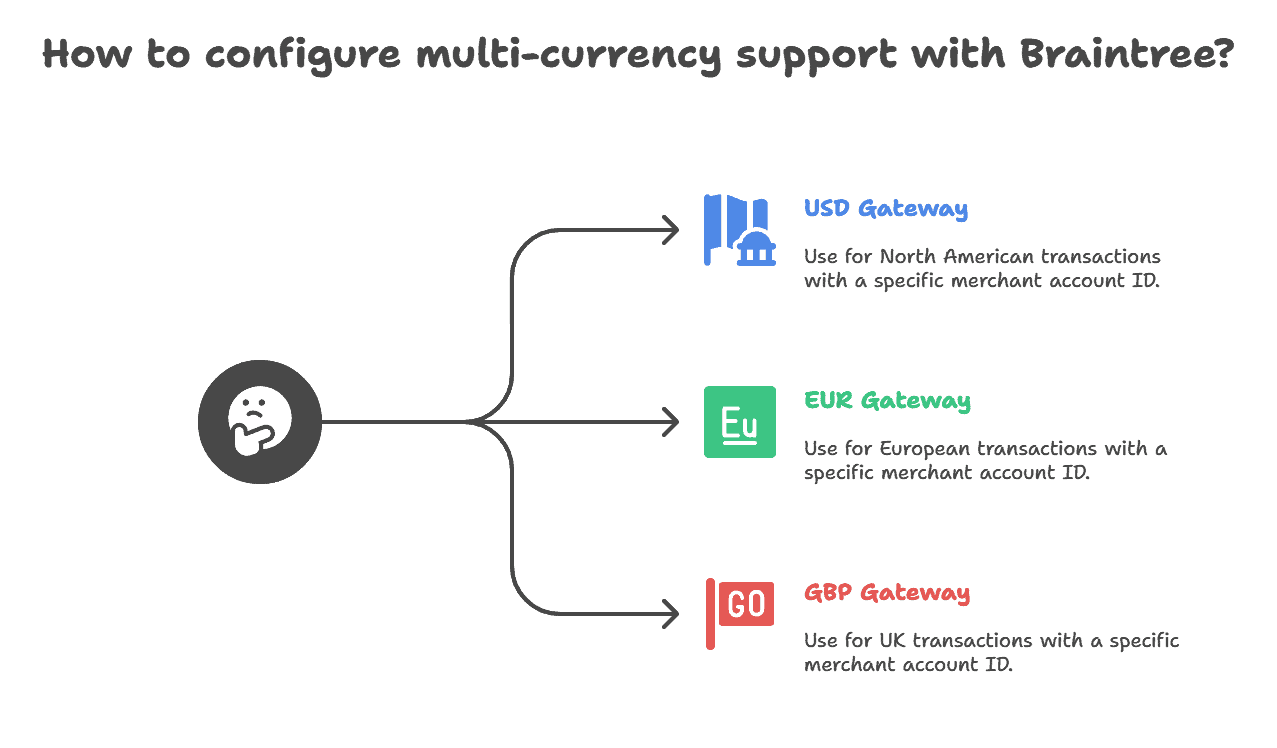

Multi-currency account configuration

Merchants wishing to use Braintree multi currency must configure multiple Braintree gateways – one for each currency.

It sounds more complicated than it is, but there’s a good reason for this approach.

The setup:

- USD gateway for North American customers

- EUR gateway for European transactions

- GBP gateway for the UK market

- Each gateway has its own merchant account ID

The Merchant Account ID identifies the available currency, so you’re essentially creating currency-specific payment channels.

It keeps everything clean from an accounting perspective and ensures proper settlement in local currencies.

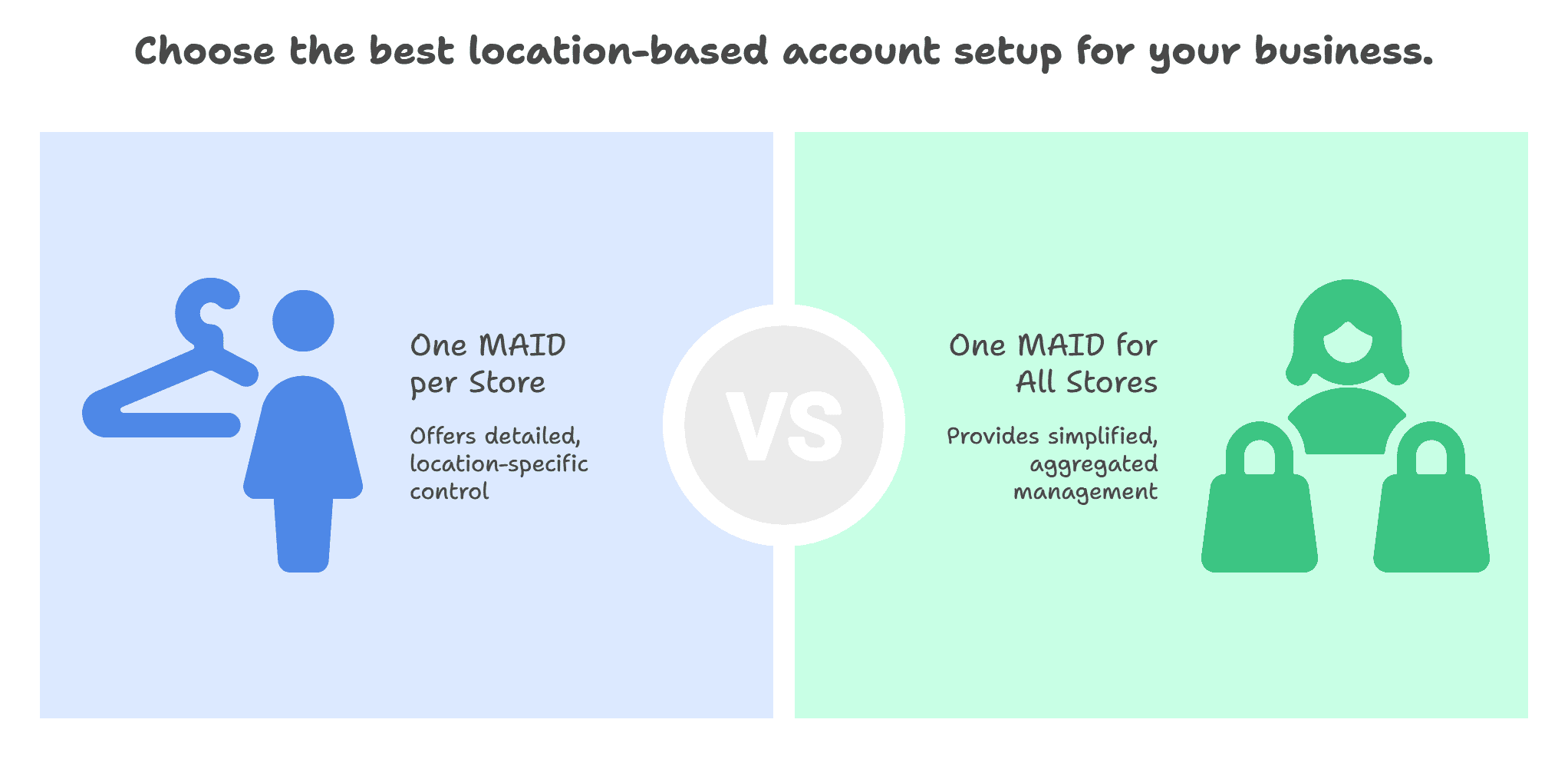

Location-based account setup

Last but not least, we have location-based setups.

This is particularly useful for businesses with physical presence in multiple locations.

The Location ID is a layer in the account structure that is really a flexible “virtual-only” account layer.

Two main approaches:

- One MAID per store:

- Individual settlement per location

- Location-specific reporting

- Separate user permissions per store

- One MAID for all stores:

- Aggregated settlement and reporting

- Simplified management

- Shared customer data across locations

The location ID does NOT appear in any Braintree reporting, so if you need location-level insights, you’ll want to go with the multiple MAID approach.

Ready to build your own setup? Here’s your step-by-step guide to creating multiple Braintree accounts.

How to set up multiple Braintree accounts

Alright, let’s roll up our sleeves and get into the nitty-gritty of actually setting up your structure.

I’ll be honest – this is where things can get a bit technical, but I promise to walk you through it step by step. Think of me as your friendly guide through what might seem like a maze at first glance.

Creating multiple merchant account IDs

Creating multiple MAIDs within your existing gateway is like adding new departments — they share the same infrastructure but have their own identity.

Here’s the step-by-step process.

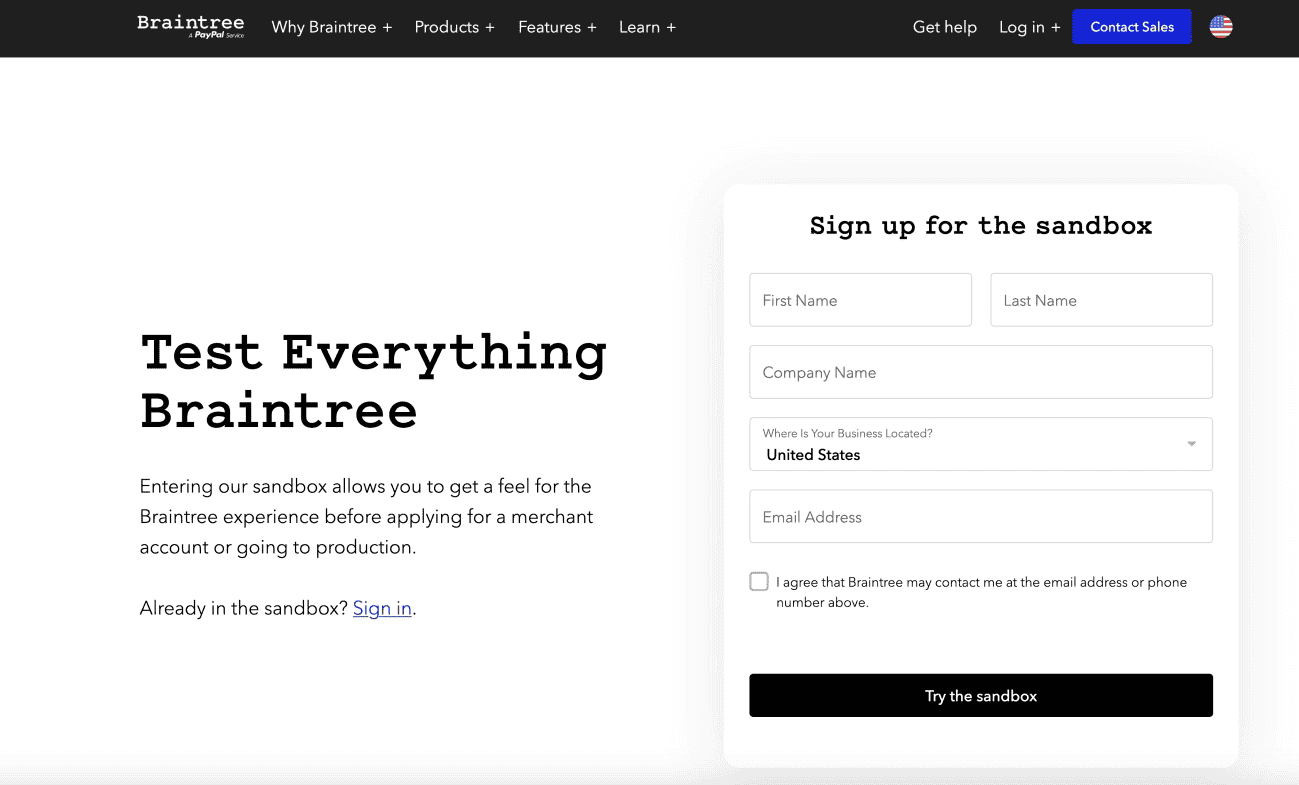

For sandbox (testing):

- Log in to your Braintree Control Panel

- Navigate to Settings → Business → Add New Merchant Account ID

- Configure currency and settlement preferences

- Test with sample transactions

For production:

You must sign up for a production Braintree account to start accepting payments, and additional merchant accounts require contacting their sales team. Here’s what that conversation typically involves:

- Your business use case

- Expected transaction volumes per account

- Currency requirements

- Settlement preferences

I always recommend starting in the sandbox first. You can add multiple merchant accounts in your sandbox to test processing in different currencies, which gives you a chance to work out any kinks before going live.

Setting up separate gateway accounts

Now, if you need completely separate gateway accounts (remember, this is like having entirely different businesses), the process is more involved.

Each gateway account requires its own application and approval process.

- When to choose this route:

- Separate legal entities

- Complete operational independence

- Different compliance requirements

- Distinct brand identities

- The process

- Submit separate Braintree applications for each entity

- Provide distinct business documentation

- Set up separate API credentials

- Configure independent settlement accounts

This approach means you’ll have completely separate control panels, reporting, and user management – which can be exactly what some businesses need.

API credentials configuration

API credentials are unique account identifiers required for processing via the API — think of them as your username and password to payment processing.

The four essential credentials:

- Merchant ID: Your gateway’s main identifier

- Public key: Like your username (safe to share)

- Private key: Your secret password (never share this)

- Merchant account ID: Specific account identifier

Finding your credentials:

- Log in to Braintree Control Panel → Account → My User → API Keys

- For Merchant Account IDs: Settings → Processing → Merchant Account ID

Each user associated with your Braintree gateway will have their own private key, which adds an extra layer of security.

I always recommend creating separate API users for different team members or applications.

Environment management: Remember, Braintree accounts fall into two categories – sandbox and production.

You must use the credential set from the sandbox account when your site is in test mode, and the production credentials when you’re live.

It’s like having separate keys for your test lab and your actual store.

Currency and settlement setup

Merchants wishing to use Braintree and multi-currency must configure multiple Braintree gateways – one for each currency.

The Merchant Account ID identifies the currency that is available.

Multi-currency configuration:

- Create separate merchant accounts for each currency

- Configure settlement in local currencies

- Set up appropriate bank accounts for each currency

- Test cross-border transaction handling

Settlement options: You’ve got flexibility here – you can receive settlement deposits individually per merchant account, or prefer a single bulk deposit for multiple accounts. This decision impacts your cash flow management and accounting processes, so choose wisely based on your business needs.

Pro tips from experience:

- Always test your credential setup in sandbox first

- Keep your API keys secure and rotate them regularly

- Document your account structure clearly for your team

- Set up proper monitoring for each account

The key thing to remember is that if you have multiple merchant accounts and don’t specify the merchant account ID in your API requests, the system will use your default account.

All requests will then process through that default merchant account.

So make sure your integration properly routes transactions to the right accounts.

Now let’s dive deep into one of the most powerful features of Braintree’s multiple account system – the marketplace model.

How does the Braintree marketplace model work?

Alright, let’s dive into one of the most fascinating aspects of multiple Braintree accounts setups – the marketplace model.

Master merchant and sub-merchant structure

The marketplace model is built around a beautifully simple concept: you’re the master merchant (think mall owner), and your sellers are sub-merchants (the individual stores).

In general, a marketplace structure allows customers to purchase goods and services from multiple providers under the umbrella of a marketplace owner.

- Master merchant: You — the platform owner

- Sub-merchants: Your sellers, service providers, or vendors

- Customers: End users buying from sub-merchants through your platform

Braintree Marketplace allows you to split transactions and pay your providers through Braintree’s gateway.

You can designate a service fee with each transaction, and we will disburse the appropriate funds to you and your sub-merchant.

Key requirements (This is important!):

Braintree Marketplace is only available for business models in which the master merchant and sub-merchants are all domiciled in the US.

Both the master merchant and sub-merchants must be domiciled in the US and receive funding in USD. I know this might be limiting for some international businesses, but it’s a hard requirement.

What you can’t use with marketplace:

- PayPal integration

- Braintree’s recurring billing

- Most third-party shopping carts

Transaction splitting capabilities

Every transaction can be automatically split between you and your sub-merchant. Let me break down how this works with a real example.

Transaction flow example: Say a customer buys a $100 item from one of your marketplace sellers:

- Customer pays $100 total

- You set a $10 service fee (your commission)

- Sub-merchant receives $90 (minus processing fees)

- You receive $10 (minus your portion of processing fees)

You cannot split between multiple sub-merchants in one transaction. If you need to pay multiple vendors, you’ll need separate transactions for each.

Payment distribution and fees:

Here’s where things get interesting from a financial management perspective.

The payment distribution happens automatically, but understanding the fee structure is crucial for your business model.

- Standard Braintree payments processing fees apply to the full transaction amount

- Your service fee comes out of the sub-merchant’s portion

- If processing fees exceed your service fee, you’re responsible for the difference

Example fee calculation:

- $100 transaction with $10 service fee

- Braintree charges 2.9% + $0.30 = $3.20 in processing fees

- Sub-merchant receives: $90 – $3.20 = $86.80

- You receive: $10 (your service fee)

Escrow capabilities: Although Braintree does not escrow funds, as a master merchant, you have an option within Braintree Marketplace to hold a sub-merchant’s transaction funds until you make an additional call to release them.

This is perfect for service-based marketplaces where you want to ensure delivery before releasing payment.

Marketplace limitations and responsibilities:

Let me be straight with you about the limitations – they’re important to understand upfront.

Geographic restrictions

- US-only for both master and sub-merchants

- USD funding only

- No international sub-merchants allowed

Integration limitations

- No PayPal compatibility

- No recurring billing support

- Limited shopping cart integrations

- Not compatible with most third-party platforms

Financial responsibilities: Here’s something that catches many people off guard: as the master merchant, you’re jointly and severally liable for all fees, fines, chargebacks, refunds, and other expenses caused by or related to the acts or omissions of your sub-merchants.

What this means:

- Chargebacks come out of your account, not the sub-merchant’s

- You need strategies to recoup costs from problematic sub-merchants

- You’re responsible for vetting sub-merchants thoroughly

Refund complexities: If funds are in escrow, only full refunds are supported until you release the funds. If funds are not in escrow, you can issue both full and partial refunds, but the money comes from your master merchant account.

However, if you just need to route payments to different business units within your own company, standard multiple merchant accounts are probably a better fit.

What are the key challenges of managing Braintree multiple accounts?

Multiple Braintree account setups are powerful, but they come with real headaches. Here’s what you’re actually signing up for:

Platform integration restrictions

- Many eCommerce platforms don’t support merchant account routing

- You need custom logic for transaction routing

- Webhook management becomes complex quickly

- User permissions multiply across accounts

- Platform compatibility testing is essential before development

Currency and settlement complexity

Multi-Currency Requirements:

- Each currency needs its own merchant account

- Multiple bank accounts are often required for different settlements

- Perfect configuration required or transactions fail

- Settlement timing varies by currency and card type

Currency conversion issues:

- You lose control over exchange rates

- Conversion timing affects cash flow

- One misconfigured account can process thousands in the wrong currency

- Thorough sandbox testing is critical

Reporting and analytics fragmentation

- Each account reports separately

- No unified dashboard available out of the box

- Third-party analytics tools struggle with multiple data sources

- Month-end reconciliation becomes complex

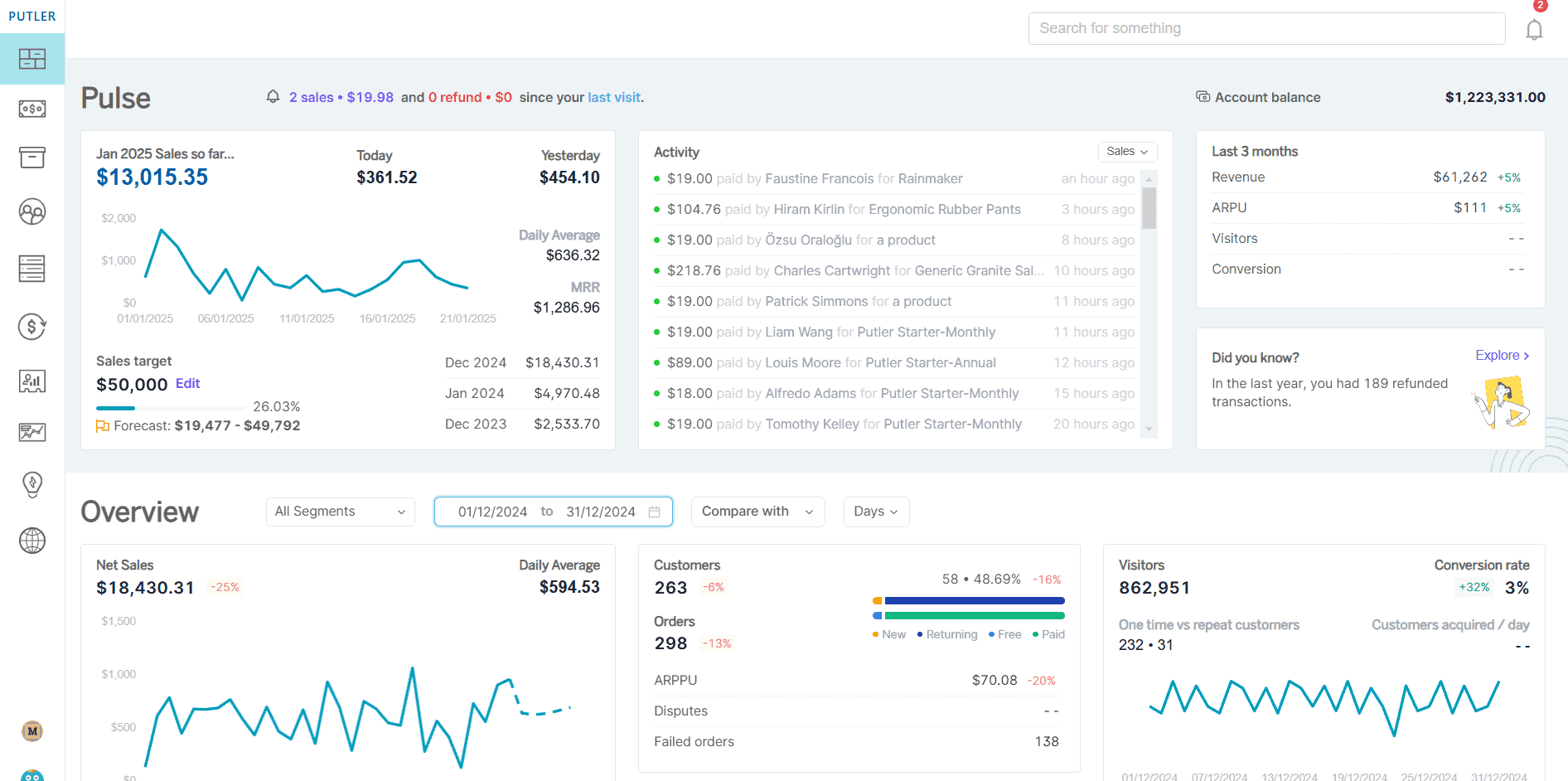

Now, reporting across multiple Braintree accounts can get chaotic with separate dashboards, mismatched currencies, duplicate customer data…

That’s where a unified analytics tool like Putler comes in.

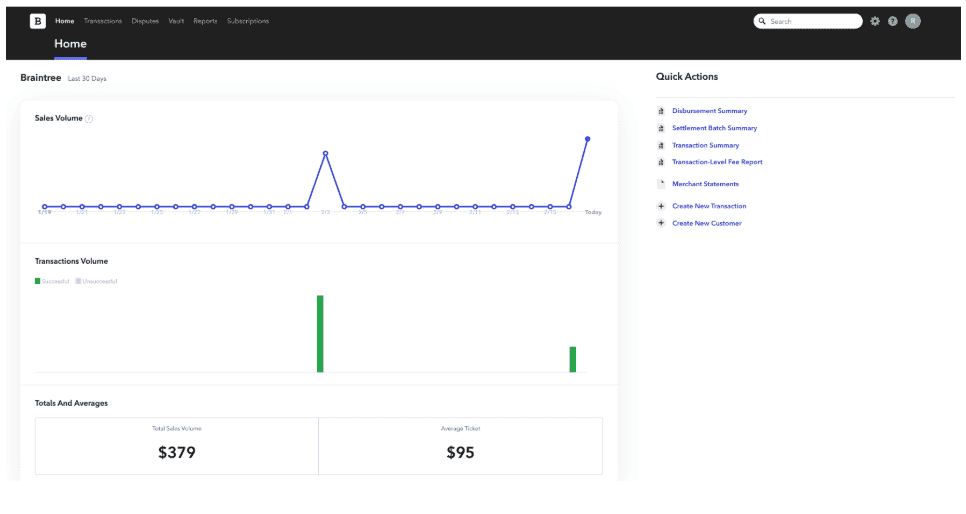

Putler: Analytics solution for multiple Braintree accounts

Remember those reporting headaches I mentioned with multiple Braintree accounts? Putler is the solution for all these problems.

One dashboard for everything

- Multiple Braintree accounts in one place

- Connect all your merchant accounts in minutes

- See unified reports across every account

- No more juggling different dashboards

Beyond just Braintree

- Add Stripe, PayPal, Razorpay, and more

- Connect Shopify, WooCommerce, Etsy (17+ integrations)

- Pull in Google Analytics data too

Smart features that actually help

Process refunds directly

- Handle refunds across all accounts from one screen

- Track refund patterns business-wide

- Save hours of admin work

Automatic currency conversion

- Handles 36+ currencies automatically

- Pick your base currency, Putler does the math

- Real exchange rates, updated daily

Data deduplication

- Finds duplicate customers across different accounts

- Eliminates double-counting sales

Advanced analytics made simple

Customer insights

- RFM analysis (who your VIP customers really are)

- Detailed customer profiles

- Infinite filter and direct mailing service

Business intelligence

- Revenue forecasting across all channels

- Product performance analysis

- Real-time reporting with 200+ metrics

- 12x faster search than PayPal

Why does it solve your problems

- Instead of scattered reports from different Braintree accounts, you get one clear view of your entire business.

- Set up: Connect accounts, pick base currency, done.

- Price: $20/month, 14-day free trial

- Result: Clear insights instead of reporting headaches

Conclusion

Multiple Braintree accounts can absolutely transform your business – but only if you go in prepared.

The setup complexity, reporting fragmentation, and administrative overhead are real challenges that’ll test your patience.

But for businesses that need clean separation between channels, currencies, or legal entities, it’s often the best path forward.

Start simple, plan for complexity, and invest in proper analytics tools from day one. Your future self will thank you.

FAQs

Can I create multiple merchant accounts under one Braintree gateway?

Yes, one gateway supports multiple merchant accounts for different business channels or currencies. Production accounts require sales team approval, while sandbox allows manual creation.

What are the geographic restrictions for Braintree Marketplace?

Both master merchants and sub-merchants must be US-based and receive USD funding only. International sub-merchants are not permitted.

Can I split payments between multiple sub-merchants in one transaction?

No, each transaction can only split funds between the master merchant and one sub-merchant. Multiple vendors require separate transactions.

Do I need separate merchant accounts for different currencies?

Yes, each currency requires its own merchant account and gateway configuration. The merchant account ID determines available currency.

What happens if I don’t specify a merchant account ID in API requests?

All transactions default to your primary merchant account, potentially processing in wrong currencies or business channels.

- Manage Multiple PayPal Accounts Easily – Best Methods & Tools (Updated Guide 2025)

- Multiple Stripe Accounts: Ultimate Guide to Managing Stripe for Multiple Businesses

- Multiple Shopify Stores: Step-by-Step Guide for Managing Multiple Shopify Shops from One Place

- BigCommerce Multiple Stores: Setup, Tools & Pro Tips

- How to Manage Multiple WooCommerce Stores Like a Pro