Imagine you are piloting your SaaS business, navigating through a maze of metrics in search of the one that will guide you to success.

You encounter two powerful abbreviations – MRR and ARR – that promise to be your compass in this journey.

But which one holds the key to unlocking your SaaS business’s full potential? – if this question has been bugging you, you are in the right place!

Join us as we go into the depths of MRR vs ARR to figure out which metric will pave the way for SaaS triumph.

Ready to embark on this journey? Let’s get started with the basics.

What is Recurring Revenue?

Recurring revenue is the lifeblood of SaaS business, signifying the steady income from ongoing subscriptions or contracts.

It’s the steady flow of revenue that sustains your business over time.

What is Monthly Recurring Revenue (MRR) in SaaS?

Monthly Recurring Revenue is the total revenue generated from monthly subscriptions within a specific month.

It’s a versatile metric influenced by various factors like new sign-ups, cancellations, upgrades, and downgrades.

MRR serves multiple purposes, including financial reporting, forecasting, and evaluating marketing and sales performance.

It’s a valuable tool for optimizing pricing strategies and maximizing profits.

What is Annual Recurring Revenue (ARR) in SaaS?

Annual Recurring Revenue is a crucial metric for subscription-based businesses, measuring the total revenue expected from recurring subscriptions over 12 months.

It offers a forward-looking perspective on your company’s revenue projections based on existing subscriptions.

Monitoring ARR and its trends provides valuable insights into your business’s growth trajectory and financial performance.

It’s commonly used alongside other metrics like customer acquisition cost (CAC), customer lifetime value (CLTV), and churn rate to gauge overall business health and success.

You can read more about ARR, here.

Now to grasp MRR vs ARR better, let’s delve deeper into each metric.

What are the key differences between MRR and ARR?

Understanding the nuances between Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) is vital.

Let’s uncover their distinct characteristics and implications for your business.

Time frame

Monthly Recurring Revenue focuses on monthly revenue generated from subscriptions or contracts.

ARR, however, looks at the total revenue generated from annual subscriptions or contracts.

Predictability

Monthly subscription income helps assess short-term revenue predictability, reflecting monthly fluctuations.

Annual Recurring Revenue provides a more stable and long-term view of revenue predictability, smoothing out fluctuations over the course of a year.

Usage

MRR is commonly used to analyze the health of a SaaS business every month and to track growth trends.

Annual revenue run rate is often used for annual financial planning, forecasting, and reporting purposes.

Customer behavior

Monthly ongoing revenue allows for a more immediate monthly understanding of customer churn and acquisition rates.

ARR provides insights into customer retention and expansion over longer periods.

Decoding MRR vs ARR is crucial for selecting the most appropriate metric to assess your SaaS business’s performance.

But, why do these two metrics hold such importance? Let’s find out.

Why are MRR and ARR important SaaS metrics?

The ability to accurately gauge and predict revenue is crucial for sustaining and growing your SaaS business.

This is where Monthly Recurring Revenue and Annual Recurring Revenue come into play.

Let’s understand this further.

Revenue predictability

MRR and ARR give you a clear picture of the revenue you can count on every month or year.

They help you plan your budget and resources more effectively by predicting your income stream.

Customer retention and Expansion

Monitoring subscription revenue, be it monthly or annually, lets you see how well you’re keeping customers and if you’re successfully upselling.

You can spot trends in customer behavior, like who’s sticking around and who might be thinking of leaving.

Business performance evaluation

These two metrics are like a report card for your SaaS business.

They show you how well you are doing in attracting and keeping customers, and how fast you’re growing compared to your goals and competitors.

In short, MRR and ARR help you understand your revenue, customer loyalty, and overall performance, so you can make smarter decisions and stay ahead of the game.

Now let’s understand how to calculate them accurately.

How to calculate ARR and MRR?

Here’s how you can calculate ARR and MRR:

- Calculating ARR:

ARR is determined by adding up the total value of all annual subscription contracts, excluding one-time or non-recurring fees.

ARR = Annual recurring revenue from existing customers + Annual recurring revenue from new customers

For example, if you have 50 existing customers paying $1,000 annually and acquire 20 new customers with annual subscriptions of $800 each, your ARR would be $70,000.

ARR = ($1,000 × 50 customers) + ($800 × 20 customers) = $70,000

- Calculating MRR:

MRR is computed by summing up the monthly subscription revenue from all active customers during a specific month, excluding one-time or non-recurring fees.

MRR = Monthly recurring revenue from existing customers + Monthly recurring revenue from new customers

For instance, if you have 100 existing customers paying $50 per month and acquire 50 new customers with monthly subscriptions of $100 each, your MRR would be $7,000.

MRR = ($50 × 100 customers) + ($100 × 50 customers) = $7,000

Here’s a good read on ARR and MRR calculation.

So, now it’s quite clear that – ARR provides a longer-term view of your company’s revenue, whereas MRR offers insights into the health, growth, and stability of your subscription business.

By accurately calculating ARR and MRR, you can gain valuable insights into your recurring income stream and track growth trends, effortlessly.

Also, this makes it even easier to pick one from MRR vs ARR.

However, besides tracking recurring revenue, you also need to figure out strategies to increase your recurring subscription revenue.

Yet to give it a thought? Let us give you a head start.

Strategies to Grow Recurring Subscription Revenue

To ensure your SaaS business is up and thriving, you need to nurture and grow your recurring subscription revenue.

Here are some effective strategies to achieve this:

Customer Retention Techniques

Focus on providing excellent customer service and personalized experiences to keep existing customers happy and loyal.

You can also implement proactive retention strategies, such as targeted re-engagement campaigns and loyalty programs.

These will help you reduce churn and retain more customers over time.

Upselling and Cross-selling Opportunities

Identify opportunities to upsell existing customers to higher-tier subscription plans.

You can also cross-sell additional products or features that complement their current subscriptions.

Leverage data analytics and customer insights to tailor upselling and cross-selling offers to individual customer needs and preferences.

By implementing these strategies, you can effectively grow your recurring subscription revenue and drive sustainable growth.

Main struggle of SaaS businesses – Calculating MRR, ARR

The key to running a successful business lies in consistency.

Businesses should consistently calculate their MRR and ARR, and apply the above strategies to ensure nothing falls through the cracks.

And, manually tracking all these aspects for your entire SaaS business can be overwhelming.

Feels exhausting already, doesn’t it?

Well, here’s where Putler steps. It’s an easier alternative that can help you streamline and automate your revenue-tracking processes.

This gives you more time and energy to focus on implementing growth strategies and nurturing your business.

So, let’s find out how you can track MRR and ARR with Putler.

How to Track Recurring Revenue with Putler

Tracking recurring revenue with Putler is a breeze.

Here’s a closer look at how you can effectively track and manage your revenue with Putler:

- Connect your data sources

Begin by seamlessly integrating your data sources – shopping carts and payment gateways, like Stripe, WooCommerce, EDD, Braintree, and Authorize.Net data with Putler.

This simple setup allows Putler to access and aggregate your transaction data from multiple sources.

- Sync your data in real-time

Putler automatically syncs your transaction data in real time, ensuring you have access to the most up-to-date information about your recurring revenue.

With this, you can stay informed about your revenue streams without any manual effort or delays.

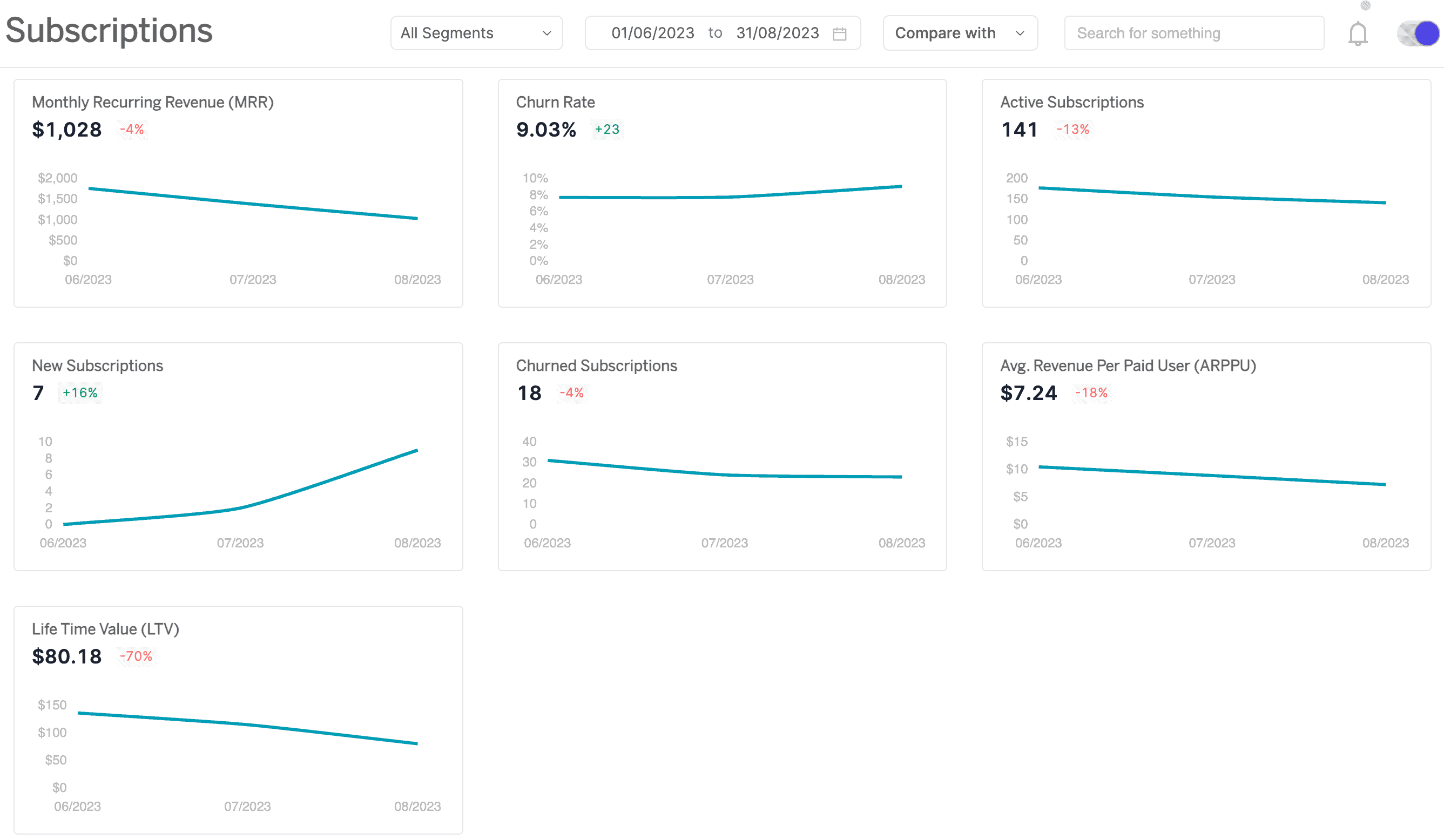

- Gain subscription insights

Dive into Putler’s comprehensive analytics and reporting tools to gain valuable insights into your revenue trends, customer behavior, and performance metrics.

Whether you’re tracking MRR, ARR, churn rates, or customer lifetime value, Putler provides you with the data you need to make informed decisions and drive your business forward.

- Automate reporting and alerts

Set up custom reports and automated alerts to monitor key metrics and trends relevant to your business.

With Putler’s reporting capabilities, you can create tailored reports that provide you with the specific insights you need to track your recurring revenue effectively.

Plus, automated alerts ensure that you never miss important changes or anomalies in your revenue data.

By leveraging Putler’s intuitive platform, you can streamline your revenue-tracking processes and gain actionable insights.

These further help make data-driven decisions to optimize your SaaS business’s financial performance.

Say goodbye to manual tracking and hello to efficient revenue management with Putler.

MRR vs ARR: Which One Should You Use?

So, as you already know, when tracking recurring revenue in your SaaS business, the choice of MRR vs ARR can be pivotal.

Conclusion

The choice between MRR and ARR can take time and effort. But fear not!

Understanding their strengths and aligning them with your goals is key to growth.

Whether diving into MRR insights or seeking ARR stability, informed decisions pave the way.

So, embrace recurring revenue tracking, harness insights, and steer your SaaS business toward success.

With the right strategies and top-notch tools like Putler, the sky’s the limit!

- What is MRR? – The ultimate guide for calculating Monthly Recurring Revenue for your SaaS Business

- What is ARR (Annual Recurring Revenue) – How to Calculate and Optimize?

- Subscription metrics analytics: How to calculate MRR, churn rate, ARPPU and more

- SaaS Reporting: Importance of SaaS Reports and the 6 Key Metrics You Must Measure for Success