As Barack Obama once said:

‘Globalization is a fact, because of technology, because of an integrated global supply chain, because of changes in transportation. And we are not going to be able to build a wall around that’

Nothing in the world is going to stop it from making it smaller. As the world comes closer through technology, international trades and multi-currency reporting are going to be an imminent part of any business.

In this scenario it is really essential for a company to enable multi currency transactions. It doesn’t matter whether your business deals in physical goods or digital ones, creating a shopper friendly digital tool will go a long way to boost your sales.

Why your business needs multi-currency support?

Imagine finding a perfect pair of shoes online, adding them to your cart, but when you check out, your currency isn’t supported. Disappointed, you abandon the purchase and move on.

Wouldn’t that be undesirable?

Now imagine your customers being in that position. Not only will you lose on sales but you may also lose on potential customers.

Hence, it’s needless to say that creating a customer friendly payment support system will enrich your business for the long run.

To dig deep , let’s understand what multi currency support is…

A report by Forrestor Research stated that 25% of Europeans along with 30% of US consumer buy goods cross border online. However, many e-commerce companies don’t have the right tools to provide this support to customers.

For people who are not proficient with technology, it’s tricky to grasp the intricacies of the domain. Simply put, multi currency technology enables users to pay for products in the currency of their country.

People are either required to change the currency (which can be a tedious task) or look for other sites that offer the same products or services.

Many times changing the currency to euros, dollars or any other currency can discourage customers simply because of the tedious process. It may feel like a dead end to some customers.

To combat this problem there are various companies working towards creating a solution to eradicate this user experience.

Let’s talk about them in detail below.

How multi-currency support works?

Setting up multi-currency depends on your payment gateway and eCommerce platform. While most shopping carts don’t offer built-in support, there are ways to enable it.

Let’s explore how to set up multi-currency support using popular payment gateways like PayPal, Stripe, and Braintree.

PayPal multi-currency setup

Paypal has a fairly simple process to accept international currencies. The first thing you want to do is remove the blockage from your settings.

Step 1: Log in to your Paypal account

Step 2: Click the business profile icon next to log and click on profile and settings

Step 3: Click on my selling tools

Step 4: Untick the block payments from users who have non-US (UK etc) PayPal accounts”.

This will allow the currencies to be converted automatically, so every time a customer pays in a foreign currency, it will automatically get converted to the currency that you hold.

For more elaborate steps, have a look at the video below:

Stripe multi-currency setup

For Stipe, adding currencies is fairly simple, all you have to do is install the Stripe Multi Currency Addon.

Note: It is only compatible with WordPress websites. To begin with, download the plugin and follow the below steps:

Step 1: Go to the add new menu under the plugin interface

Step 2: Upload the plugin

Step 3: Click on install now button and activate the plugin

After installing the multi currency accounting software, you would need to configure the settings to enable multi currency transactions.

Step 1: Click on the settings menu under Stripe payments

Step 2: Select the multi currency tab

Step 3: Mark the enable multi currency box

Step 4: If you wish to customize the conversion fee then you can do so, or else it will stay at 2% by default.

Step 5: Mark the show currency select box on each product. This option allows customers to choose the currency they wish to pay in.

Step 6: Select the currencies that you wish to offer to the customers to pay in.

Step 7: Save changes

You’re all set to deal in international transactions!

Braintree multi-currency setup

To access multi currency in Braintree, you will have to integrate your Braintree account with your website, but before you do that, you need to configure settings in your Braintree account. Follow the steps below:

Step 1: Login to your Braintree account

Step 2: Once logged in, select the gear icon/settings icon on the top

Step 3: Select business

Step 4: Click on +new merchant account

Step 5: Enter your merchant account ID and make it the default account

Step 6: You can select or deselect accept Paypal, this is an optional step

Step 7: Choose your currency and click Save

You can follow the same steps to add multiple currencies. Integrate your account with your website’s apps and you’re all set.

Challenges in multi-currency reporting and accounting

Nothing comes without problems. You may have a good multicurrency support tool but how effective is it in terms of multi currency reporting?

While enabling multi-currency payments is crucial, managing accounting and reporting across multiple currencies can be challenging. Here are some common issues businesses face:

- Exchange Rate Fluctuations

Currency values change daily, which complicates accounting and requires careful tracking. - Complex Calculations

Manually calculating exchange rates can result in errors, leading to inaccurate financial reports. - Time-Consuming Processes

Managing transactions in various currencies is a time-intensive task for businesses without automated tools.

The end result of manually doing multicurrency accounting looks something like this..

However fortunately, to tackle these problems various companies have come up with tools that effectively provide solution and ease in business.

Top multi-currency reporting tools for 2024

The good news is that there are several tools available to simplify multi-currency reporting and accounting.

Let’s check them out!

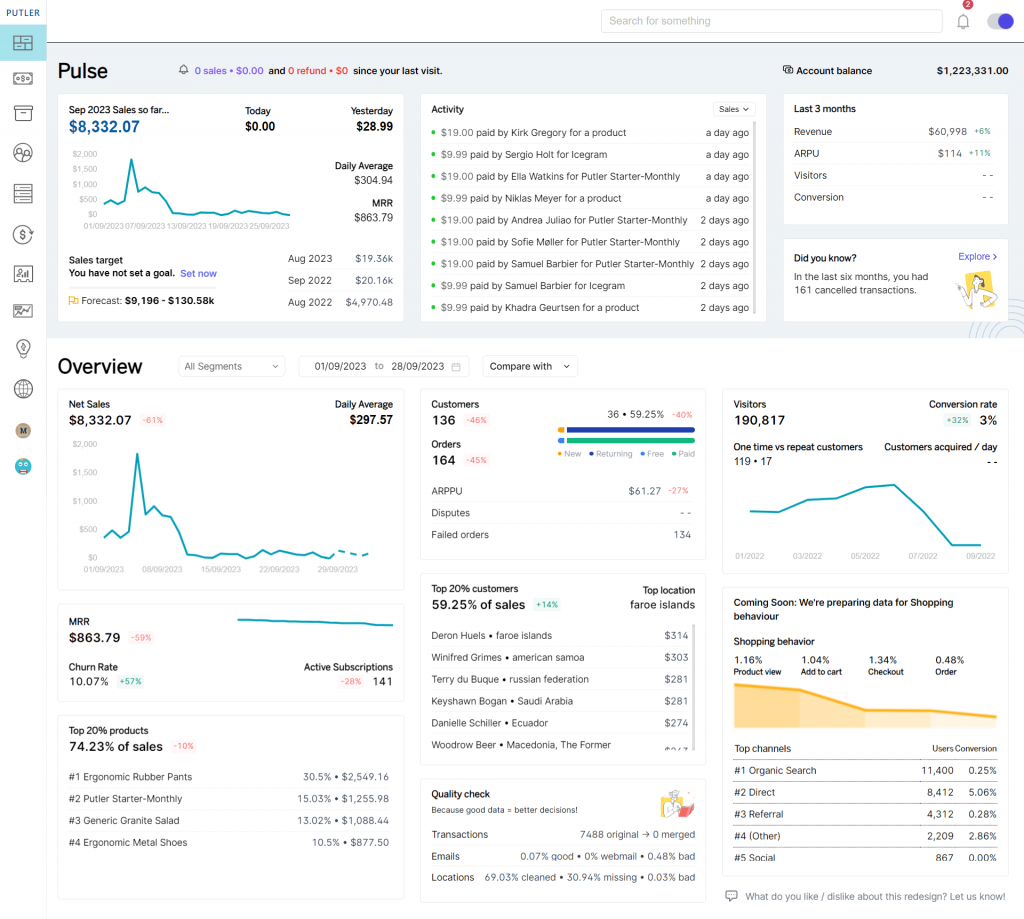

Putler

A powerful analytics tool that integrates with multiple payment gateways like PayPal, Stripe, and Braintree. Putler supports 36 currencies, offers real-time reporting, and allows easy base currency switching.

Pros:

- Has 6 different payment gateway integrations including Stripe, Paypal, Braintree and more.

- Also very compatible with shopping carts and eCommerce systems.

- Provides multi currency support for 36 currencies.

- Base currency can be changed in a single click, such ease is not provided by other tools.

- Generates detailed report on product, sales, subscription, visitors etc.

- Provides 153+ key business metrics.

- Has key features like – RFM, segmentation, forecasting, goal setting, team sharing etc.

Cons:

- No mobile support.

Price:

Putler provides a 14 day free trial. No credit required while signing up. Once you try the trial version and decide which plan to opt for, you can pick any of its 3 offerings.

Base plan starts at $20/month. View Putler’s Plans

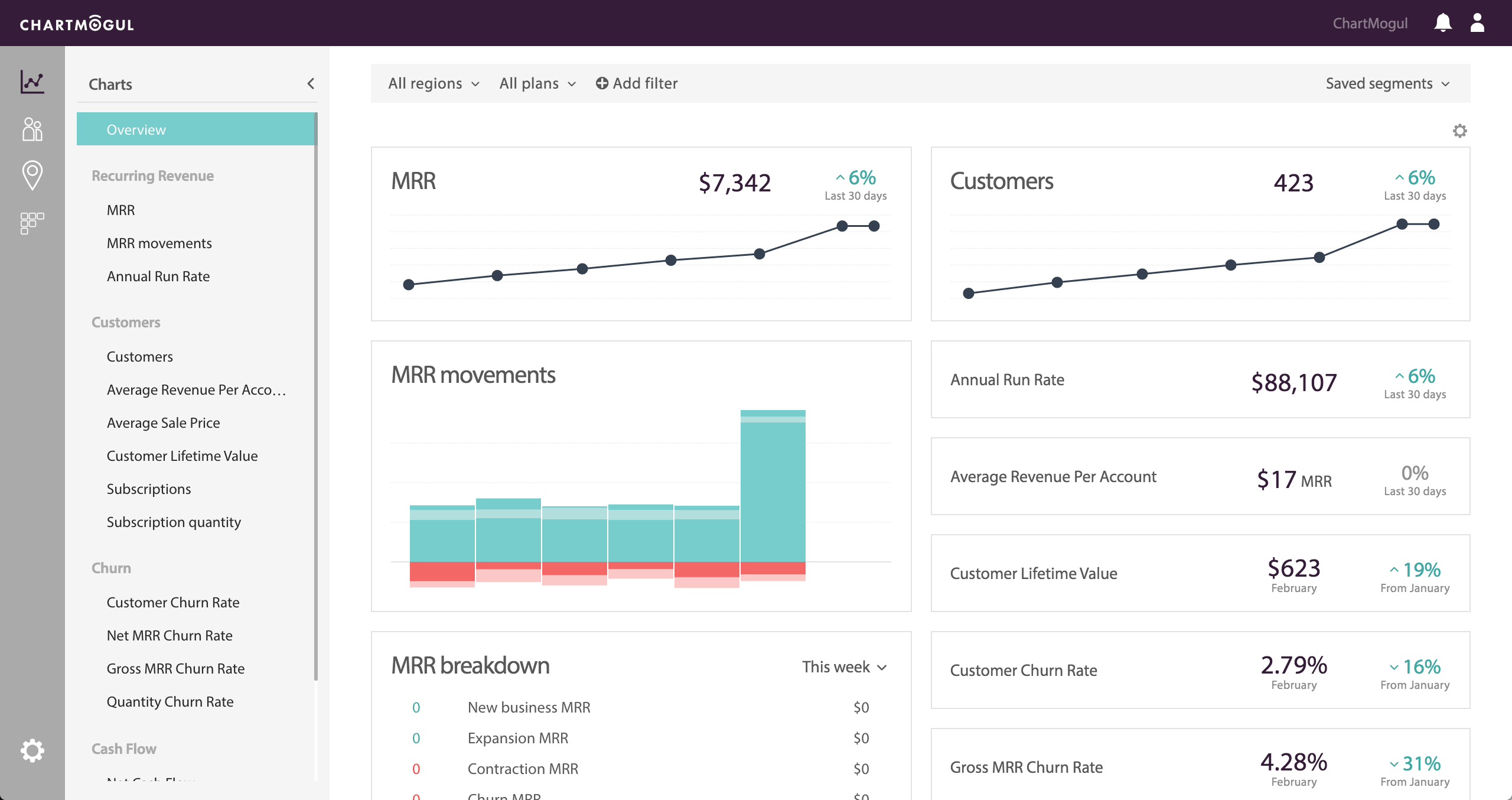

Chartmogul

Chartmogul is a subscription reporting and analytics tool that provides a detailed report on consumer data. It is one of the best tools that businesses can use to get a detailed analysis about their subscriptions

Pros:

- Provides a detailed overview of your revenue

- Supports 169 currencies

- Mobile analytics support

- Various segments and helpful overview of customer behaviour and lifetime value

- Provides trends and graphs of your business

- Customizable

Cons:

- Complicated interface might take users time to get used to

- Lack of additional data integrations which can hamper correlation with MRR and other user metrics

- No currency data support for currency fluctuations

- Tedious data configuration required to change base currency

Price:

Freemium model, base plan from $99/month.

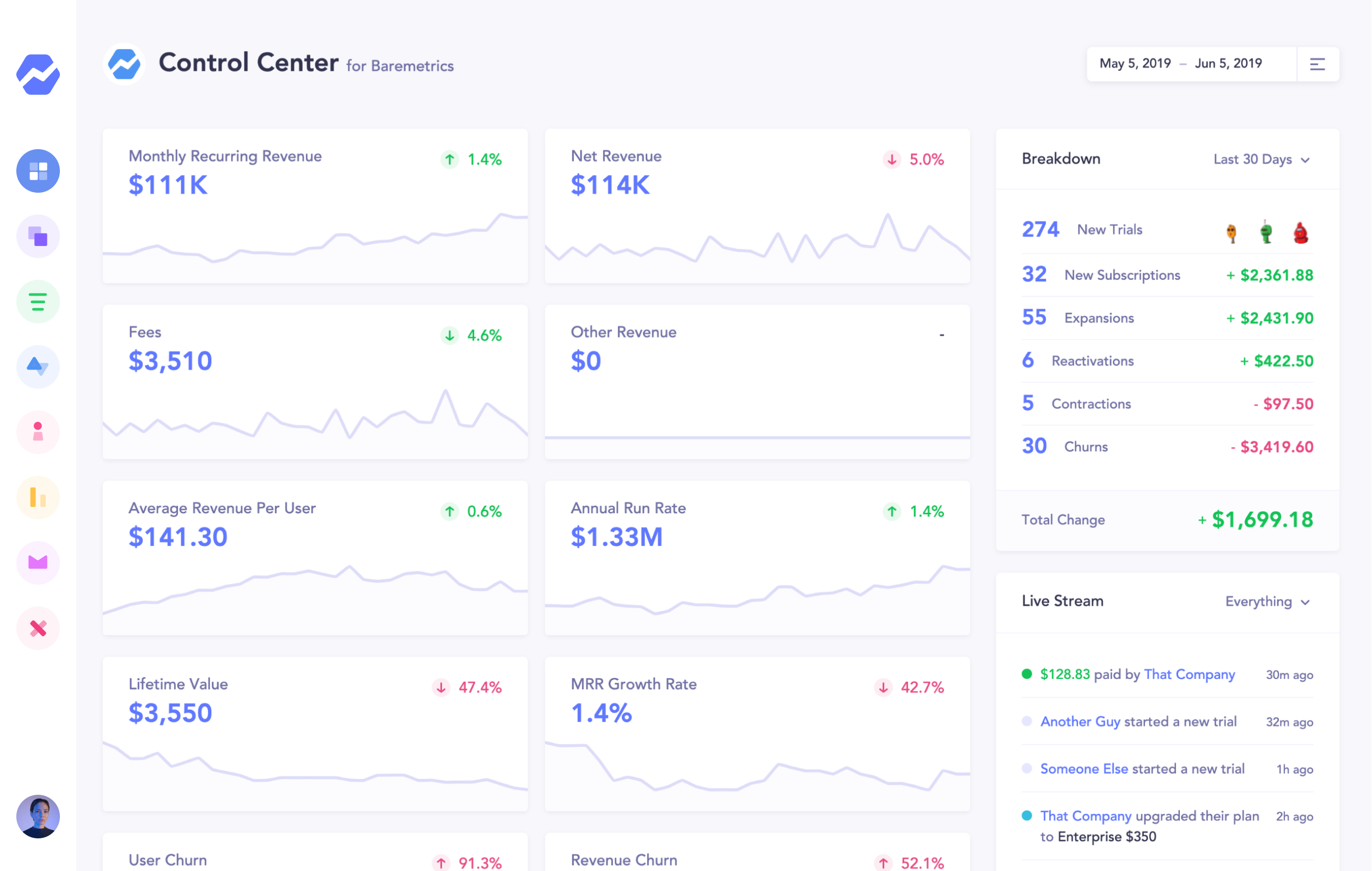

Baremetrics

Baremetrics is one of the well-known subscription analytics tools. This tool is well known to provide insights, forecasts, engagement metrics for businesses.

Pros:

- Integrates with 6 payment providers including Stripe, Google Play, Recurly etc.

- Has one of the most user friendly interfaces

- Provides segmented insights like Cancellation insights, MRR, LTV, Revenue Churn, Trial Conversion Rate, Benchmarking etc

Cons:

- Requires dropping an email to customer support to change base currency

- Lacks wide scope of companies for comparison of data

- Although they provide full analytics service, multicurrency change isn’t one of their core services, finding your way around those metrics may be tricky.

Price:

The pricing of your plan is estimated basis your MRR

However, if your MRR is 0 then your base plan starts from $108/m.

Summing it up

What makes Putler the best multi currency accounting software?

- Putler supports all the major currencies globally – 32 to be exact

- Unlike other multi-accounting tools which apply the ongoing exchange rate, Putler stores the currency exchange rate as and when the transaction was done. Thus giving you the most accurate result with zero errors

- As mentioned, you can easily change the base currency rate within Settings and Putler will automatically calibrate all the reports to the base currency that’s selected.

- No need to waste time contacting support as in the case of other multi-accounting tools

By leveraging the right multi currency reporting software, like Putler, businesses can streamline multi-currency accounting and management, optimize global sales, and enhance customer satisfaction.

Do let us know your views and opinions in the comment section below.

FAQ

Is multi-currency right for my business?

If you’re expanding globally, offering multi-currency support is essential. Without it, you risk losing out on sales from international customers.

What is multi currency reporting/accounting, and why is it important?

Multi-currency accounting refers to the process of tracking and managing transactions in different currencies. It’s crucial for businesses operating globally because it provides a consolidated view of financial performance across various markets. This practice ensures accuracy in financial reporting, helps with strategic decision-making, and keeps you aware of how exchange rates impact your business.

For businesses engaging in international trade, multi-currency reporting is equally important. It offers insights into revenues, costs, and profitability in local currencies, giving you a clearer picture of your business performance across different regions.

What are the tax implications of selling in multiple currencies?

Tax rules vary by country, so consult with an accountant familiar with international tax laws to ensure compliance.

How do I handle refunds and returns in different currencies?

Refunds should be processed using the same exchange rate applied during the initial purchase, to avoid discrepancies. Make sure your refund policy is clear to customers.

What are the best practices for multi-currency invoicing?

Always clearly state the currency and exchange rates used in your invoices. Ensure your invoicing software supports multi-currency billing for streamlined accounting.